Global Wearable Skin Adhesives Market Forecast

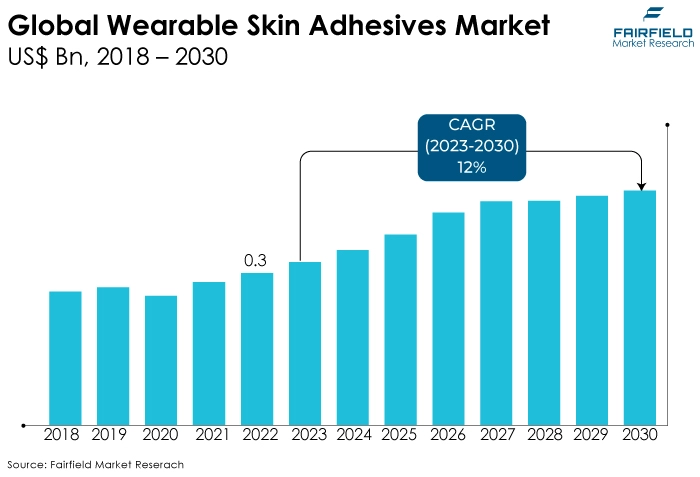

- Global wearable skin adhesives market size poised to triple between 2022 and 2030, i.e., from US$3 Bn to US$9 Bn

- Market revenue slated for a strong CAGR of 12% through 2030

Quick Report Digest

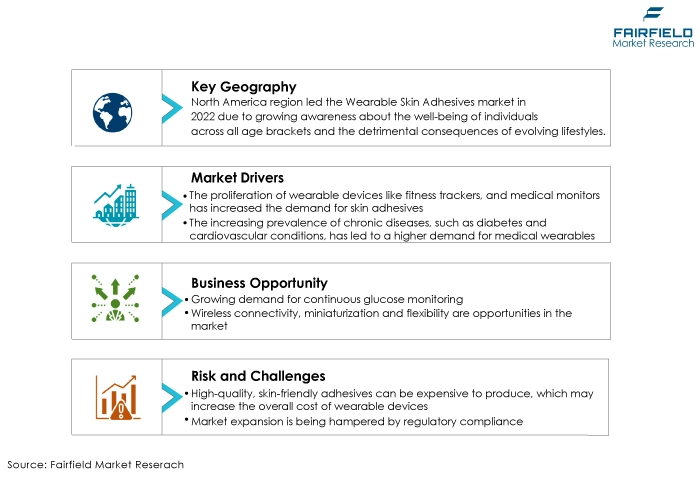

- The key trends anticipated to fuel the global wearable skin adhesives market growth are the increasing prevalence of chronic diseases and technological advancements.

- Another major market trend expected to fuel the growth is the global wearable skin adhesives market, a rapidly expanding global healthcare industry. The market is also predicted to profit from the expanding worldwide healthcare industry.

- Acrylic-based products dominate the wearable skin adhesives market due to their excellent skin adhesion, durability, and versatility. These qualities make them ideal for extended wear, ensuring reliable performance in various applications and contributing to their largest market share.

- Due to their diverse healthcare applications, diagnostic devices have the largest market share in the wearable skin adhesives market. These devices continuously monitor vital signs, glucose levels, and other physiological parameters, making them crucial tools for managing chronic conditions and enhancing healthcare outcomes.

- Hospitals hold the largest market share in the wearable skin adhesives market because of their extensive adoption of these devices for continuous patient monitoring, medication administration, and wound care. Hospitals provide a critical healthcare setting for the utilisation of wearable skin adhesives, contributing to their dominant market presence.

- North America's dominance in the wearable skin adhesives market is attributed to its advanced healthcare infrastructure, high prevalence of chronic diseases, technological advancements, presence of key industry players, and favourable reimbursement policies, creating a conducive market growth and leadership environment.

- Asia Pacific is the fastest-growing region in the wearable skin adhesives market due to its large and increasingly affluent population, rising awareness of health and wellness, growing chronic disease burden, improving healthcare infrastructure, and focus on healthcare innovation and technology adoption.

- The increasing cost of healthcare facilities challenges the wearable skin adhesives market. While these devices offer cost-effective monitoring solutions, initial investments in technology and infrastructure may deter adoption, particularly in resource-constrained healthcare settings.

A Look Back and a Look Forward - Comparative Analysis

The wearable skin adhesives market is growing due to several key factors. These include the rising prevalence of chronic diseases, increased health and fitness awareness, technological advancements in sensor technology and materials, expanding healthcare infrastructure, and the demand for non-invasive and continuous monitoring solutions.

The growing ageing population also drives the market as wearable skin adhesives help address the healthcare needs of elderly individuals. Additionally, innovations and expanding applications contribute to market growth.

The market witnessed staggered growth during the historical period 2018 - 2022. This is due to the substantial growth of the major end-use application sectors, such as diagnostic and monitoring devices.

Monitoring devices are growing in the wearable skin adhesives market due to their increasing use in healthcare and fitness applications. These devices offer real-time monitoring of vital signs and physiological parameters, meeting the demand for continuous health tracking and remote patient monitoring solutions.

The prospects of the wearable skin adhesives market are highly favourable. With ongoing technological advancements, expanding applications beyond healthcare into sports and wellness, and increasing awareness of health monitoring, the market is poised for sustained growth.

Additionally, as the ageing population grows, the demand for wearable skin adhesives to manage chronic conditions is expected to rise, providing significant growth opportunities for manufacturers and innovators.

Key Growth Determinants

- Increasing Cases of Chronic Diseases

The increasing prevalence of chronic diseases is a significant driver of the wearable skin adhesives market. Chronic conditions like diabetes, cardiovascular diseases, and neurological disorders often require continuous monitoring and drug delivery.

Wearable skin adhesives offer a non-invasive and convenient solution by providing a platform for sensors and drug delivery systems. They enable real-time monitoring of vital signs, glucose levels, and medication administration, enhancing patient management and reducing hospitalisation.

As chronic diseases continue to rise globally, the demand for these wearable technologies is growing. Moreover, advancements in materials and technology are making these adhesives more comfortable, reliable, and user-friendly, further fuelling market expansion in the healthcare sector.

- Technological Advancements

Technological advancements are a key driver of the wearable skin adhesives market. Innovations in materials, miniaturisation of sensors, and improved adhesive properties have led to the development of more comfortable, flexible, and durable wearable adhesive devices.

These advancements have enhanced the accuracy and functionality of sensors for monitoring vital signs and drug delivery, making them more appealing to healthcare providers and patients.

In addition, connectivity options and data analytics capabilities have improved, enabling better remote monitoring and healthcare management. These technological strides are driving the adoption and growth of wearable skin adhesives in various healthcare applications.

- Growing Incidence of Obesity

The growing incidence of obesity drives the wearable skin adhesives market due to the associated health monitoring needs. Obesity often leads to chronic conditions like diabetes and cardiovascular diseases that require continuous monitoring.

Wearable skin adhesives provide a non-invasive and convenient way to track vital signs, glucose levels, and medication delivery, especially for obese individuals. As obesity rates rise globally, the demand for these adhesive devices is increasing, making them crucial tools for managing and addressing the healthcare needs of this growing patient population.

Major Growth Barriers

- Increasing Healthcare Costs

The increasing cost of healthcare facilities challenges the wearable skin adhesives market. While wearable adhesives offer cost-effective solutions for continuous monitoring and drug delivery, their adoption requires initial investments in devices and infrastructure. These costs may deter healthcare facilities, particularly those with limited budgets, from integrating these technologies.

Additionally, the cost of training staff and ensuring data security can pose financial challenges. Overcoming these cost-related barriers and demonstrating the long-term benefits of wearable skin adhesives is crucial for market growth and widespread adoption in healthcare settings.

- Stringent Regulations

Stringent regulations pose a significant challenge to the wearable skin adhesives market. Regulatory bodies, such as the FDA, impose rigorous standards on these medical devices' safety, efficacy, and quality.

Compliance requires extensive testing, documentation, and adherence to evolving standards, which can increase development costs and timeframes. Variations in regulations across regions further complicate market entry and global expansion. Navigating this complex regulatory landscape and securing necessary approvals are essential but challenging for companies operating in the wearable skin adhesives market.

Key Trends and Opportunities to Look at

- Miniaturisation and Flexibility

Miniaturisation and flexibility are prominent technology trends in the wearable skin adhesives market. Devices are becoming smaller, thinner, and more flexible, offering increased comfort and wearability for users. These advancements enable unobtrusive, long-term wear, making them ideal for continuous health monitoring.

Miniaturisation also allows for discreet placement on the skin, enhancing the aesthetic appeal of wearable adhesive devices and expanding their range of applications in healthcare and beyond.

- Advanced Sensor Technology

Advanced sensor technology is a significant trend in the wearable skin adhesives market. These devices are integrating more sophisticated sensors, such as biosensors and multi-modal sensors, to accurately monitor an extensive range of physiological parameters. This trend enhances the capabilities of wearable adhesives, allowing for more comprehensive health monitoring and data collection. Users can benefit from real-time and precise information about their health, enabling better management of chronic conditions and overall well-being.

- Continuous Glucose Monitoring

Continuous glucose monitoring (CGM) is a prominent trend in the wearable skin adhesives market, especially for individuals with diabetes. These wearable adhesive devices are equipped with advanced sensors to provide continuous and real-time monitoring of glucose levels.

CGM technology has evolved to offer improved accuracy, convenience, and longer wear times, making it a valuable tool for diabetes management. The trend addresses the growing demand for non-invasive and reliable glucose monitoring solutions, enhancing the quality of life for patients.

How Does the Regulatory Scenario Shape this Industry?

The regulatory scenario plays a crucial role in shaping the wearable skin adhesives market, ensuring these medical devices' safety, efficacy, and quality. Regulatory organisations, such as the U.S. Food and Drug Administration (FDA) in the United States, and the European Medicines Agency (EMA) in Europe, impose stringent guidelines and approval processes on wearable adhesive devices.

Manufacturers must obtain regulatory approvals or clearances before marketing their wearable adhesive products. This process involves rigorous testing and documentation to demonstrate safety and performance standards compliance. Regulatory authorities set quality standards that manufacturers must adhere to while producing wearable skin adhesives. These standards ensure consistency, reliability, and effectiveness.

Regulations pertaining to data privacy and security, such as the GDPR in Europe, have an influence on wearable device design and data management since they frequently capture sensitive health data. Regulatory bodies require accurate labelling and user instructions to ensure that consumers and healthcare professionals can use the devices safely and effectively.

Continuous monitoring of device performance and adverse events is mandated, and manufacturers must report any safety concerns to regulatory authorities. Efforts to harmonise regulatory requirements globally aim to streamline market entry for manufacturers and ensure consistent standards.

Fairfield’s Ranking Board

Top Segments

- Acrylic-based Adhesives Lead in Sales

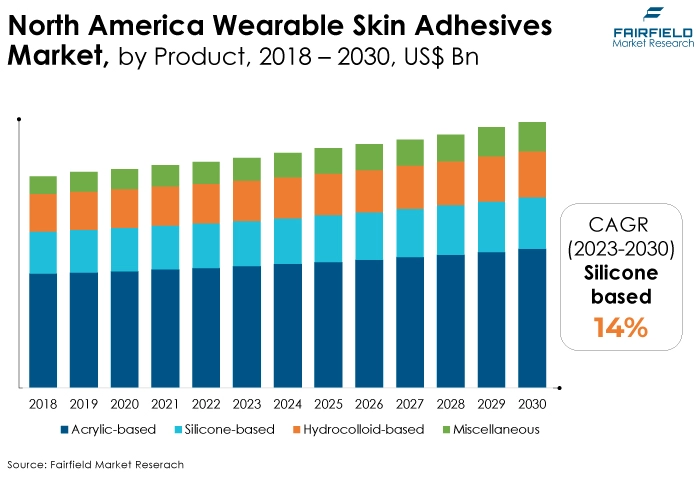

Acrylic-based products have captured the largest market share in the Wearable Skin Adhesives Market due to their versatility and suitability for various applications. They offer excellent adhesion to the skin, ensuring secure and long-lasting wear.

Additionally, acrylic adhesives are skin-friendly, minimising the risk of irritation or allergies. They are perfect for longer usage, which is essential for ongoing health monitoring because of their resilience and resistance to moisture. As a result, acrylic-based products have become the preferred choice for wearable skin adhesives, contributing to their dominant market position.

Silicone adhesives offer gentle, hypoallergenic adhesion, reducing the risk of skin irritation. They are highly breathable, allowing for improved comfort during long-term wear. Silicone's flexibility and ability to conform to body contours make it ideal for wearable adhesive applications.

As the demand for comfortable, non-invasive, and skin-friendly wearable devices grows, silicone-based adhesives are increasingly preferred, contributing to their rapid adoption and the highest CAGR in the market.

- Diagnostic Devices Ahead of the Curve

Because of their wide range of applications, diagnostic devices have captured the largest market share in the wearable skin adhesives market. These devices include sensors for monitoring vital signs, glucose levels, and other physiological parameters.

The need for diagnostic wearable skin adhesives has increased because of the rising incidence of chronic illnesses and the requirement for ongoing health monitoring. They offer valuable insights into a user's health, enabling early detection of issues and better management of chronic conditions, making them a primary choice in the market.

Due to their expanding use in healthcare and sports, monitoring devices are likely to witness the fastest CAGR during the period of forecast. These devices, equipped with advanced sensors, monitor various health parameters, including heart rate, temperature, and activity levels. The growing awareness of health and fitness and the need for remote patient monitoring fuel their adoption.

Additionally, innovations in sensor technology and enhanced data analytics capabilities are driving the development of more sophisticated and accurate monitoring devices, contributing to their high growth rate in the market.

- Hospitals Create the Maximum Demand

Hospitals have captured the largest market share in the wearable skin adhesives market due to their extensive use of these devices in various healthcare applications. Wearable skin adhesives are essential hospital tools for continuous patient monitoring, medication delivery, and wound care. They enhance patient management, reduce hospitalisation, and improve overall healthcare outcomes.

Additionally, hospitals have the infrastructure and trained staff to effectively implement wearable adhesive technologies, making them the primary end-users and contributors to the market's dominant share.

Ambulatory surgical centres (ASCs) are experiencing the highest CAGR in the wearable skin adhesives market due to several factors. ASCs increasingly adopt wearable skin adhesives for various applications, such as continuous patient monitoring and post-operative wound care. They fit in with the trend towards outpatient operations because of their capacity to improve patient outcomes and decrease the requirement for hospitalisation.

Moreover, wearable adhesive technology advancements make them more suitable for ASC settings, driving their rapid adoption and the highest CAGR in the market.

Regional Frontrunners

North America Leads

Due to several compelling factors, North America has secured the largest market share in the wearable skin adhesives market. First, the region has a well-established healthcare infrastructure with a high level of technology adoption, making it receptive to wearable adhesive devices.

A significant prevalence of chronic diseases, such as diabetes and cardiovascular conditions, drives the demand for continuous health monitoring and medication delivery, a primary application of these adhesives. Third, major players and robust research and development efforts in North America contribute to innovation and market growth.

Favourable reimbursement policies and healthcare reforms support adopting these devices in clinical settings. Lastly, a proactive approach to healthcare and wellness among consumers fosters market expansion. These factors collectively establish North America as a dominant force in the wearable skin adhesives market.

Asia Pacific at the Forefront with the Highest Chronic Disease Prevalence

The Asia Pacific region is experiencing the fastest growth in the wearable skin adhesives market due to several key factors. First, the region has a large and increasingly affluent population with a growing health and wellness awareness.

Chronic disease prevalence, particularly diabetes, drives demand for continuous monitoring and drug delivery solutions. Third, improving healthcare infrastructure and expanding access to healthcare services are facilitating the adoption of wearable adhesive technologies.

Moreover, emerging economies and a burgeoning middle class create a favourable market environment. Lastly, technological advancements and a focus on healthcare innovation propel the rapid growth of the wearable skin adhesives market in the Asia Pacific region.

Fairfield’s Competitive Landscape Analysis

The global wearable skin adhesives market is a consolidated market with fewer major players present globally. The key players are introducing new products and working on the distribution channels to enhance their worldwide presence. Moreover, Fairfield Market Research expects more consolidation over the coming years.

Who are the Leaders in the Global Wearable Skin Adhesives Market space?

- 3M Company

- Abbott Laboratories

- Medtronic

- Johnson & Johnson

- Lohmann & Rauscher

- Scapa Group plc

- Avery Dennison Corporation

- Toray Industries, Inc.

- Nitto Denko Corporation

- Dow Inc.

- Henkel AG & Co. KGaA

- Procter & Gamble

- Beiersdorf AG

- Paul Hartmann AG

- Flex Ltd.

Significant Company Developments

New Product Launches

- May 2022: The Food and Drug Administration (FDA) granted authorisation for the BioStamp point system, according to MC10 Inc., a company that specialises in developing wearable solutions for seamless healthcare data collecting.

- February 2022: 3M unveiled a new line of advanced silicone adhesives for medical devices. These innovations were specifically engineered to facilitate extended wear, provide robust support for heavier devices, and deliver enhanced adhesion performance.

Distribution Agreement

- January 2022: MC10 Inc., a company specialising in wearable solutions for healthcare data collection, and AbbVie, a global biopharmaceutical firm focused on research, have disclosed their collaboration on clinical trials. The BioStamp nPoint technology will be used in these trials to examine several outcome metrics in MS patients.

An Expert’s Eye

Demand and Future Growth

As per Fairfield’s Analysis, growth in healthcare is driving the market. The market demand for wearable skin adhesives is on an upward trajectory and is expected to continue growing. Factors driving this demand include the increasing prevalence of chronic diseases, rising health and fitness awareness, technological advancements, and expanding healthcare infrastructure.

Wearable skin adhesives offer non-invasive, real-time monitoring and drug delivery solutions, making them valuable tools in healthcare and beyond. With ongoing innovations, expanding applications, and a growing ageing population, the wearable skin adhesives market holds significant potential for future growth and development.

Supply Side of the Market

The leading suppliers in the wearable skin adhesives market vary by region and country. In the United States, 3M, and Avery Dennison are prominent players, offering innovative adhesive solutions for medical and consumer wearables.

In Europe, companies like Lohmann, and Henkel dominate the market with a wide range of skin-friendly adhesives. In Asia, Nitto Denko, and Scapa Group are key suppliers, catering to the growing demand for wearable adhesive products. These companies excel in providing advanced and biocompatible adhesive technologies tailored to specific regional needs, driving growth in the global wearable skin adhesives market.

The production of wearable skin adhesives requires several key raw materials, including medical-grade adhesives (often silicone-based), backing materials (such as films or foams), release liners, and additives for skin-friendliness.

One major supplier of raw materials for this industry is Dow Corning, a subsidiary of Dow Inc., which specialises in providing high-quality silicone-based adhesives and materials used in medical and wearable applications. Dow Corning is recognised as a major contributor to the supply chain for wearable skin adhesive manufacturers, ensuring the availability of critical materials to meet industry demand.

Global Wearable Skin Adhesives Market is Segmented as Below:

By Product:

- Acrylic-based

- Silicone-based

- Hydrocolloid-based

- Others

By Application:

- Diagnostic Devices

- Monitoring Devices

- Drug Delivery Devices

- Sports & Fitness

- Others

By End User:

- Hospitals

- Ambulatory Surgical Centres

- Home Care Settings

- Others

By Geographic Coverage:

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Wearable Skin Adhesives Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Wearable Skin Adhesives Market Outlook, 2018 - 2030

3.1. Global Wearable Skin Adhesives Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Acrylic-based

3.1.1.2. Silicone-based

3.1.1.3. Hydrocolloid-based

3.1.1.4. Miscellaneous

3.2. Global Wearable Skin Adhesives Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Diagnostic Devices

3.2.1.2. Monitoring Devices

3.2.1.3. Drug Delivery Devices

3.2.1.4. Sports and Fitness

3.2.1.5. Miscellaneous

3.3. Global Wearable Skin Adhesives Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Hospitals

3.3.1.2. Ambulatory Surgical Centers

3.3.1.3. Home Care Settings

3.3.1.4. Others

3.4. Global Wearable Skin Adhesives Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Wearable Skin Adhesives Market Outlook, 2018 - 2030

4.1. North America Wearable Skin Adhesives Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Acrylic-based

4.1.1.2. Silicone-based

4.1.1.3. Hydrocolloid-based

4.1.1.4. Miscellaneous

4.2. North America Wearable Skin Adhesives Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Diagnostic Devices

4.2.1.2. Monitoring Devices

4.2.1.3. Drug Delivery Devices

4.2.1.4. Sports and Fitness

4.2.1.5. Miscellaneous

4.3. North America Wearable Skin Adhesives Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Hospitals

4.3.1.2. Ambulatory Surgical Centers

4.3.1.3. Home Care Settings

4.3.1.4. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Wearable Skin Adhesives Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

4.4.1.4. U.S. Wearable Skin Adhesives Market End Use, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

4.4.1.7. Canada Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

4.4.1.8. Canada Wearable Skin Adhesives Market End Use, Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Wearable Skin Adhesives Market Outlook, 2018 - 2030

5.1. Europe Wearable Skin Adhesives Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Acrylic-based

5.1.1.2. Silicone-based

5.1.1.3. Hydrocolloid-based

5.1.1.4. Miscellaneous

5.2. Europe Wearable Skin Adhesives Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Diagnostic Devices

5.2.1.2. Monitoring Devices

5.2.1.3. Drug Delivery Devices

5.2.1.4. Sports and Fitness

5.2.1.5. Miscellaneous

5.3. Europe Wearable Skin Adhesives Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Hospitals

5.3.1.2. Ambulatory Surgical Centers

5.3.1.3. Home Care Settings

5.3.1.4. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Wearable Skin Adhesives Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

5.4.1.13. Turkey Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

5.4.1.14. Turkey Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.15. Turkey Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest of Europe Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest of Europe Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest of Europe Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Wearable Skin Adhesives Market Outlook, 2018 - 2030

6.1. Asia Pacific Wearable Skin Adhesives Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Acrylic-based

6.1.1.2. Silicone-based

6.1.1.3. Hydrocolloid-based

6.1.1.4. Miscellaneous

6.2. Asia Pacific Wearable Skin Adhesives Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Diagnostic Devices

6.2.1.2. Monitoring Devices

6.2.1.3. Drug Delivery Devices

6.2.1.4. Sports and Fitness

6.2.1.5. Miscellaneous

6.3. Asia Pacific Wearable Skin Adhesives Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Hospitals

6.3.1.2. Ambulatory Surgical Centers

6.3.1.3. Home Care Settings

6.3.1.4. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Wearable Skin Adhesives Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Wearable Skin Adhesives Market Outlook, 2018 - 2030

7.1. Latin America Wearable Skin Adhesives Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Acrylic-based

7.1.1.2. Silicone-based

7.1.1.3. Hydrocolloid-based

7.1.1.4. Miscellaneous

7.2. Latin America Wearable Skin Adhesives Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Diagnostic Devices

7.2.1.2. Monitoring Devices

7.2.1.3. Drug Delivery Devices

7.2.1.4. Sports and Fitness

7.2.1.5. Miscellaneous

7.3. Latin America Wearable Skin Adhesives Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Hospitals

7.3.1.2. Ambulatory Surgical Centers

7.3.1.3. Home Care Settings

7.3.1.4. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Wearable Skin Adhesives Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

7.4.1.8. Argentina Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

7.4.1.9. Argentina Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

7.4.1.11. Rest of Latin America Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

7.4.1.12. Rest of Latin America Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Wearable Skin Adhesives Market Outlook, 2018 - 2030

8.1. Middle East & Africa Wearable Skin Adhesives Market Outlook, by Product, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Acrylic-based

8.1.1.2. Silicone-based

8.1.1.3. Hydrocolloid-based

8.1.1.4. Miscellaneous

8.2. Middle East & Africa Wearable Skin Adhesives Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Diagnostic Devices

8.2.1.2. Monitoring Devices

8.2.1.3. Drug Delivery Devices

8.2.1.4. Sports and Fitness

8.2.1.5. Miscellaneous

8.3. Middle East & Africa Wearable Skin Adhesives Market Outlook, by End User, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Hospitals

8.3.1.2. Ambulatory Surgical Centers

8.3.1.3. Home Care Settings

8.3.1.4. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Wearable Skin Adhesives Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

8.4.1.7. Egypt Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

8.4.1.8. Egypt Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.9. Egypt Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

8.4.1.10. Nigeria Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

8.4.1.11. Nigeria Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.12. Nigeria Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Wearable Skin Adhesives Market by Product, Value (US$ Bn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Wearable Skin Adhesives Market Application, Value (US$ Bn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Wearable Skin Adhesives Market End User, Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. End User vs Application Heatmap

9.2. Manufacturer vs Application Heatmap

9.3. Company Market Share Analysis, 2022

9.4. Competitive Dashboard

9.5. Company Profiles

9.5.1. 3M Company

9.5.1.1. Company Overview

9.5.1.2. Product Portfolio

9.5.1.3. Financial Overview

9.5.1.4. Business Strategies and Development

9.5.2. Abbott Laboratories

9.5.2.1. Company Overview

9.5.2.2. Product Portfolio

9.5.2.3. Financial Overview

9.5.2.4. Business Strategies and Development

9.5.3. Medtronic

9.5.3.1. Company Overview

9.5.3.2. Product Portfolio

9.5.3.3. Financial Overview

9.5.3.4. Business Strategies and Development

9.5.4. Johnson & Johnson

9.5.4.1. Company Overview

9.5.4.2. Product Portfolio

9.5.4.3. Financial Overview

9.5.4.4. Business Strategies and Development

9.5.5. Lohmann & Rauscher

9.5.5.1. Company Overview

9.5.5.2. Product Portfolio

9.5.5.3. Financial Overview

9.5.5.4. Business Strategies and Development

9.5.6. Scapa Group plc

9.5.6.1. Company Overview

9.5.6.2. Product Portfolio

9.5.6.3. Financial Overview

9.5.6.4. Business Strategies and Development

9.5.7. Avery Dennison Corporation

9.5.7.1. Company Overview

9.5.7.2. Product Portfolio

9.5.7.3. Financial Overview

9.5.7.4. Business Strategies and Development

9.5.8. Toray Industries, Inc.

9.5.8.1. Company Overview

9.5.8.2. Product Portfolio

9.5.8.3. Financial Overview

9.5.8.4. Business Strategies and Development

9.5.9. Nitto Denko Corporation

9.5.9.1. Company Overview

9.5.9.2. Product Portfolio

9.5.9.3. Financial Overview

9.5.9.4. Business Strategies and Development

9.5.10. Dow Inc.

9.5.10.1. Company Overview

9.5.10.2. Product Portfolio

9.5.10.3. Financial Overview

9.5.10.4. Business Strategies and Development

9.5.11. Henkel AG & Co. KGaA

9.5.11.1. Company Overview

9.5.11.2. Product Portfolio

9.5.11.3. Financial Overview

9.5.11.4. Business Strategies and Development

9.5.12. Procter & Gamble

9.5.12.1. Company Overview

9.5.12.2. Product Portfolio

9.5.12.3. Financial Overview

9.5.12.4. Business Strategies and Development

9.5.13. Paul Hartmann AG

9.5.13.1. Company Overview

9.5.13.2. Product Portfolio

9.5.13.3. Financial Overview

9.5.13.4. Business Strategies and Development

9.5.14. Flex Ltd.

9.5.14.1. Company Overview

9.5.14.2. Product Portfolio

9.5.14.3. Financial Overview

9.5.14.4. Business Strategies and Development

9.5.15. Dupont

9.5.15.1. Company Overview

9.5.15.2. Product Portfolio

9.5.15.3. Financial Overview

9.5.15.4. Business Strategies and Development

9.5.16. Polymer Science Inc

9.5.16.1. Company Overview

9.5.16.2. Product Portfolio

9.5.16.3. Financial Overview

9.5.16.4. Business Strategies and Development

9.5.17. Adhezion Biomedical

9.5.17.1. Company Overview

9.5.17.2. Product Portfolio

9.5.17.3. Financial Overview

9.5.17.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Application Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |