Whey Protein Market Growth and Industry Forecast

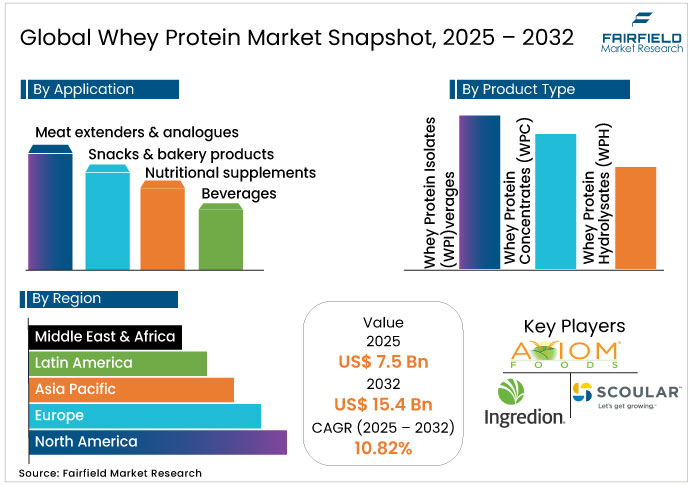

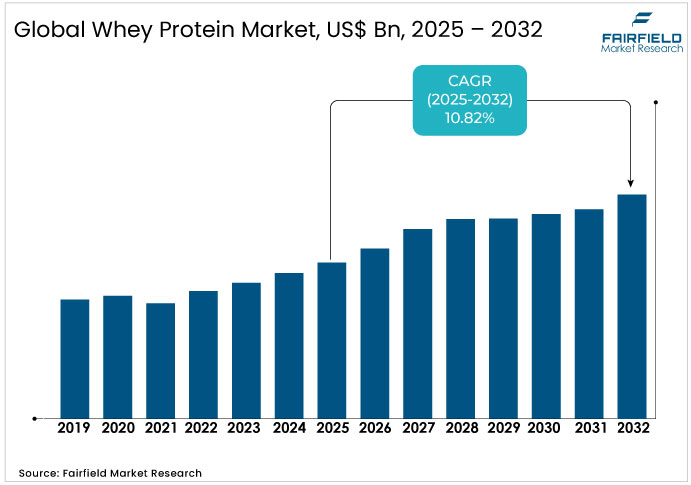

The global whey protein market is valued at USD 7.5 billion in 2025 and is projected to reach USD 15.4 billion, growing at a CAGR of 10.82% by 2032.

Whey Protein Market Summary: Key Insights & Trends

- Whey Protein Concentrates (WPC) dominate with over 58% share, widely used across supplements, snacks, and bakery products.

- Whey Protein Hydrolysates (WPH) emerge as the fastest-growing type, driven by demand for hypoallergenic and fast-absorbing nutrition solutions.

- Nutritional supplements lead applications with around 40% share, reflecting strong consumer preference for protein powders and bars.

- Beverages are the fastest-expanding segment, fueled by the popularity of RTD and RTM protein drinks.

- Dry form holds about 75% share, favored for its long shelf life and storage efficiency.

- Health-driven lifestyles and preventive nutrition trends continue to propel global whey protein consumption.

- Nutraceutical integration offers major opportunities as whey gains recognition for therapeutic and functional benefits.

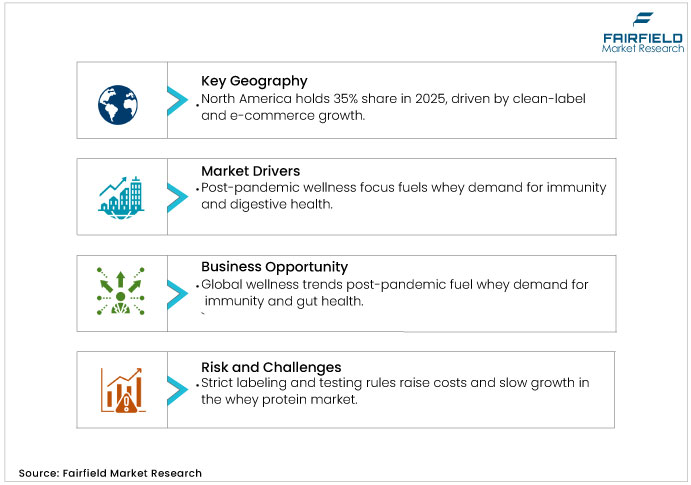

- North America leads with over 35% share, while Asia Pacific stands out as the fastest-growing regional market.

Key Growth Drivers

- Health-Driven Consumers Propel Global Adoption of Whey for Preventive Nutrition Benefits

A global pivot toward proactive wellness, accelerated by post-pandemic awareness, fuels demand for nutrient-dense ingredients such as whey, central to the Whey Protein Market's trajectory. Individuals prioritize immunity-boosting and digestive health solutions, with whey’s bioactive peptides offering anti-inflammatory benefits and gut microbiota support. The World Health Organization notes a 20% uptick in chronic disease prevalence since 2019, driving consumers to incorporate whey for weight management and metabolic health. Justifications stem from clinical studies by the American Journal of Clinical Nutrition, showing whey supplementation improves satiety by 18% compared to other proteins, encouraging habitual use. In theory, this behavioral shift creates a virtuous cycle: as education on protein’s role in sarcopenia prevention spreads, adoption rates climb, with industry surveys indicating 35% of millennials now view whey as essential.

- Functional Food Innovation Expands Whey Protein Applications Across Everyday Nutrition Products

Whey’s functional properties-emulsification, gelation, and solubility-enable seamless incorporation into everyday foods, broadening the Whey Protein Market beyond supplements. Food technologists leverage these attributes to fortify products such as yogurts and bars, meeting clean-label demands without compromising taste. U.S. Department of Agriculture data reveals functional food sales rose 22% from 2022-2024, with whey contributing to high-protein variants that address obesity trends affecting 42% of adults. This integration mitigates flavor challenges through microencapsulation techniques, enhancing palatability and shelf life, while regulatory endorsements from the European Food Safety Authority validate health claims on muscle health, spurring 15% annual growth in fortified categories and solidifying whey’s multifunctional appeal.

Key Restraints

- Regulatory Complexities and Safety Standards Challenge Global Whey Protein Manufacturers

Regulatory hurdles in the whey protein market, particularly around labeling and contaminant testing, pose significant challenges for manufacturers. Divergent standards across borders, such as those in emerging markets, delay product approvals and inflate compliance costs by up to 15%. This restraint limits scalability for smaller players, as non-adherence risks recalls that erode trust. Theoretically, it underscores the need for harmonized global guidelines to mitigate fragmentation.

- Dairy Price Volatility and Raw Material Shortages Disrupt Whey Protein Supply Chain

Volatility in raw milk supplies disrupts with price swings tied to feed costs and weather impacting production margins. In 2024, dairy input costs rose 12%, squeezing profitability for concentrate producers. This creates barriers to consistent supply, especially for isolates requiring advanced processing. Addressing these demands diversified sourcing strategies to stabilize the market ecosystem.

Whey Protein Market Trends and Opportunities

- Whey Protein Gains Ground in Nutraceuticals with Therapeutic and Functional Benefits

The whey protein industry holds untapped potential in nutraceuticals, where bioactive peptides from whey support gut health and anti-inflammatory responses. This opportunity arises from rising chronic disease prevalence, with projections estimating a sustainable CAGR for functional foods through 2032. Justifications include clinical evidence linking whey to enhanced bioavailability of micronutrients, appealing to aging demographics. In the Asia Pacific, policy shifts toward preventive healthcare amplify this, enabling formulations for immunity supplements. Theoretically, this pivots whey from fitness niche to mainstream therapeutics, fostering partnerships with pharma entities for compounded growth.

- AI and E-Commerce Drive Growth of Personalized Whey Protein Formulations

Digital platforms offer a gateway for the whey protein market to deliver customized blends, capitalizing on AI-driven recommendations for flavor and dosage. This is driven by a 40% uptick in online health purchases, which bypasses traditional retail constraints. Opportunities lie in data analytics for trend forecasting, enhancing inventory efficiency, and consumer engagement. For instance, subscription models could lock in recurring revenue, with emerging markets such as India showing 25% digital penetration growth.

Segment-wise Trends & Analysis

- Whey Protein Concentrates Lead While Hydrolysates Gain Momentum in Premium Nutrition

Whey Protein Concentrates (WPC) command over 58% market share in 2025, valued at approximately USD 4.35 billion, due to their cost-effectiveness and balanced nutritional profile that retains beneficial lactose and minerals. This leadership stems from widespread use in cost-sensitive applications, where WPC's 70-80% protein purity suffices for most fortification needs without advanced processing.

Whey Protein Hydrolysates (WPH), an emerging segment, exhibits rapid growth driven by demand for hypoallergenic and fast-absorbing options in clinical nutrition. Competitive positioning favors innovators such as Glanbia, who leverage hydrolysis tech for premium hydrolysates, capturing niche markets in sports recovery. This trajectory underscores strategic shifts toward personalization, where WPH's peptide structure enhances bioavailability, challenging WPC's dominance in high-end formulations.

- Nutritional Supplements Dominate as Beverages Emerge as Fastest-Growing Whey Segment

Nutritional supplements lead with about 40% share in 2025, equating to USD 3.0 billion, as consumers favor standalone powders and bars for targeted protein dosing in fitness routines. This dominance reflects theoretical advantages in direct efficacy, bypassing processing losses common in integrated foods.

Beverages emerge as a fast-growing segment, fueled by convenience trends and RTD innovations, with growth rates exceeding a sustainable CAGR amid urban lifestyles. Key drivers include flavor masking advancements, positioning leaders such as Arla Foods to expand via low-calorie mixes. In the Whey Protein Market, this fosters competitive edges through solubility enhancements, diversifying from supplements into daily hydration products.

- Dry Whey Protein Leads Global Share While Liquid Formats Drive Future Growth

The dry form holds around 75% market share in 2025, reaching USD 5.625 billion, prized for shelf stability and ease of portioning in global distribution networks. Leadership arises from logistical efficiencies, minimizing spoilage in emerging markets.

Liquid forms represent the emerging frontier, propelled by on-the-go consumption and e-commerce, anticipating a robust CAGR as formulations improve taste and texture. Drivers encompass retail shifts to ready-mixed options, with DuPont gaining traction via stabilized emulsions. The segment rewards agility in packaging, transforming whey protein market dynamics toward premium, portable solutions.

Regional Trends & Analysis

North America Leads Global Whey Protein Market with Strong Innovation and Infrastructure

North America commands over 35% global share in 2025, anchored by the U.S.'s mature sports nutrition ecosystem and Canada’s emphasis on functional dairy exports. Trends include a pivot to clean-label variants amid sustainability mandates, with e-commerce accelerating access in suburban demographics.

U.S. Whey Protein Market - 2025 Snapshot & Outlook

The U.S. market is characterized by consumer sophistication and aggressive innovation, with regulatory support for high-quality standards and product traceability. Margin advantages are reinforced by local dairy production and proactive government initiatives promoting nutritional supplementation. Recent consumer surveys by FDA indicate a 30% surge in interest for functional protein foods post-pandemic, positioning U.S. suppliers well in premium categories.

Asia Pacific Emerges as Fastest-Growing Region in Global Whey Protein Expansion

Asia Pacific’s Whey Protein Market is projected for the fastest CAGR through 2032, propelled by rising health awareness and rapid urbanization. Local manufacturers focus on product launches tailored to regional dietary preferences and expanding retail footprints.

China Whey Protein Market - 2025 Snapshot & Outlook

China’s market is defined by high-volume imports, increasing sports nutrition penetration, and emerging regulatory frameworks favoring international brands. Margins are supported by growing demand from young consumers driving specialty nutrition product launches. China’s National Food Safety Authority reported a 20% year-on-year growth in protein-based supplement sales.

India Whey Protein Market - 2025 Snapshot & Outlook

India is an evolving powerhouse, with rapid adoption supported by rising disposable income, proliferation of fitness clubs, and heightened consumer awareness. New government certification initiatives and supportive import tax incentives drive supply chain efficiencies. According to FSSAI, the Indian sports nutrition market posted a 25% annual growth in protein powder consumption in 2024.

Europe’s Whey Protein Growth Accelerates Amid Shifting Diets and Regulatory Reforms

Europe’s market is among the fastest-emerging markets, shaped by evolving dietary trends and regulatory harmonization following Brexit. Regulatory complexity creates both barriers and unique opportunities for innovative entrants.

Germany Whey Protein Market - 2025 Snapshot & Outlook

Germany leads European growth driven by strong fitness culture, supermarket adoption of protein-fortified products, and promising subsidies for functional food R&D. Consumer confidence metrics from Eurostat reveal a 15% annual uptick in whey protein product engagement.

U.K. Whey Protein Market - 2025 Snapshot & Outlook

The U.K. features a robust sports nutrition segment as manufacturers adapt to dual legal landscapes post-Brexit. Tax incentives for dairy-based innovation and tightening of nutritional safety standards foster trust and support premium product positioning. Industry Analytics UK cites a 12% increase in retail shelf presence of whey protein snacks.

Competitive Landscape Analysis

The players in the whey protein market are focusing on capacity expansions to capture emerging demand in Asia Pacific. This strategy addresses supply bottlenecks from dairy volatility, with investments exceeding USD 500 million in 2024 alone to scale hydrolysis facilities. One event, Arla Foods' USD 200 million plant upgrade in Denmark, exemplifies how vertical integration secures raw inputs, reducing costs by 15%. Another, Glanbia's partnership with tech firms for flavor analytics, accelerates product diversification, responding to 20% annual rise in RTD preferences.

Rising raw milk prices and EU sustainability mandates will impact costs, potentially hiking premiums by 8-10% for organic lines. Meanwhile, M&A activity, such as Leprino's acquisition of regional processors, bolsters distribution networks amid trade tensions. Early movers will benefit from established supply chains, while latecomers may face premium pricing pressures.

Key Companies

- Axiom Foods, Inc

- Scoular Company

- Ingredion Incorporated

- Roquette Frères

- Puris

- Emsland Group

- DuPont

- A&B Ingredients.

- Glanbia plc

- FENCHEM

- Others

Recent Developments:

- January 2025, Axiom Foods has unveiled Oryzatein® 2.0, a next-generation white, grit-free, ultra-low-heavy-metal rice protein designed for plant-based and infant nutrition. The innovation eliminates grittiness, flavor issues, and allergen concerns while meeting Prop 65 standards-marking a major advance in clean, functional plant proteins.

- September 2025, Emsland Group has introduced a Vegan Bolognese Sauce concept that replicates authentic meat-such as texture using its Empure® starches, Empro® E 86 HV pea protein isolate, and Emfibre® KF 500 potato fiber. The clean-label, 100% plant-based formulation offers excellent heat stability, making it ideal for ready meals and pasta sauces.

- October 2024, Ingredion has launched VITESSENCE® Pea 200 D, a new pea protein isolate designed for nutritional and ready-to-mix beverages, offering superior solubility, smooth texture, and neutral flavor. Developed in North America, the innovation helps manufacturers deliver cleaner, high-protein drinks with improved mouthfeel and fewer additives.

- February 2024, Roquette has expanded its NUTRALYS® plant protein range with four new multi-functional pea proteins-including isolate, hydrolysate, and textured forms-engineered to enhance taste, texture, and formulation versatility in plant-based foods and nutritional products. These innovations enable smoother, firmer, and higher-protein applications across meat alternatives, bars, beverages, and dairy substitutes.

Global Whey Protein Market Segmentation-

By Product Type

- Whey Protein Isolates (WPI)

- Whey Protein Concentrates (WPC)

- Whey Protein Hydrolysates (WPH)

By Application

- Meat extenders & analogues

- Snacks & bakery products

- Nutritional supplements

- Beverages

- Others

By Form

- Dry

- Liquid

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Whey Protein Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Analyst Recommendations

2. Market Overview

2.1. Market Definitions

2.2. Market Taxonomy

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.4. Value Chain Analysis

2.5. Porter’s Five Forces Analysis

2.6. Covid-19 Impact Analysis

2.7. Key Patents

3. Global Whey Protein Market Outlook, 2019 - 2032

3.1. Global Whey Protein Market Outlook, by Form, Value (US$ ‘000), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Dry

3.1.1.2. Liquid

3.1.2. BPS Analysis/Market Attractiveness Analysis

3.2. Global Whey Protein Market Outlook, by Type, Value (US$ ‘000), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Isolates

3.2.1.2. Concentrates

3.2.1.3. Textured

3.2.2. BPS Analysis/Market Attractiveness Analysis

3.3. Global Whey Protein Market Outlook, by Application, Value (US$ ‘000), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. Meat extenders & analogs

3.3.1.2. Snacks & bakery products

3.3.1.3. Nutritional supplements

3.3.1.4. Beverages

3.3.1.5. Others

3.3.2. BPS Analysis/Market Attractiveness Analysis

3.4. Global Whey Protein Market Outlook, by End User, Value (US$ ‘000), 2019 - 2032

3.4.1. Key Highlights

3.4.1.1. Food & Beverages

3.4.1.2. Animal Feed

3.4.1.3. Cosmetics & Personal Care

3.4.1.4. Pharmaceuticals

3.5. BPS Analysis/Market Attractiveness AnalysisGlobal Whey Protein Market Outlook, by Region, Value (US$ ‘000), 2019 - 2032

3.5.1. Key Highlights

3.5.1.1. North America

3.5.1.2. Europe

3.5.1.3. Asia Pacific

3.5.1.4. Latin America

3.5.1.5. Middle East & Africa

3.5.2. BPS Analysis/Market Attractiveness Analysis

4. North America Whey Protein Market Outlook, 2019 - 2032

4.1. North America Whey Protein Market Outlook, by Form, Value (US$ ‘000), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Dry

4.1.1.2. Liquid

4.1.2. BPS Analysis/Market Attractiveness Analysis

4.2. North America Whey Protein Market Outlook, by Type, Value (US$ ‘000), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Isolates

4.2.1.2. Concentrates

4.2.1.3. Textured

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Whey Protein Market Outlook, by Application, Value (US$ ‘000), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. Meat extenders & analogs

4.3.1.2. Snacks & bakery products

4.3.1.3. Nutritional supplements

4.3.1.4. Beverages

4.3.1.5. Others

4.3.2. BPS Analysis/Market Attractiveness Analysis

4.4. North America Whey Protein Market Outlook, by End User, Value (US$ ‘000), 2019 - 2032

4.4.1. Key Highlights

4.4.1.1. Food & Beverages

4.4.1.2. Animal Feed

v4.4.1.3. Cosmetics & Personal Care

4.4.2. Pharmaceuticals

4.5. North America Whey Protein Market Outlook, by Country, Value (US$ ‘000), 2019 - 2032

4.5.1. Key Highlights

4.5.1.1. U.S. Whey Protein Market by Value (US$ ‘000), 2019 - 2032

4.5.1.2. Canada Whey Protein Market by Value (US$ ‘000), 2019 - 2032

4.5.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Whey Protein Market Outlook, 2019 - 2032

5.1. Europe Whey Protein Market Outlook, by Form, Value (US$ ‘000), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Dry

5.1.1.2. Liquid

5.1.2. BPS Analysis/Market Attractiveness Analysis

5.2. Europe Whey Protein Market Outlook, by Type, Value (US$ ‘000), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Isolates

5.2.1.2. Concentrates

5.2.1.3. Textured

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Whey Protein Market Outlook, by Application, Value (US$ ‘000), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Meat extenders & analogs

5.3.1.2. Snacks & bakery products

5.3.1.3. Nutritional supplements

5.3.1.4. Beverages

5.3.1.5. Others

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Whey Protein Market Outlook, by End User, Value (US$ ‘000), 2019 - 2032

5.4.1. Key Highlights

5.4.1.1. Food & Beverages

5.4.1.2. Animal Feed

5.4.1.3. Cosmetics & Personal Care

5.4.2. Pharmaceuticals

5.5. Europe Whey Protein Market Outlook, by Country, Value (US$ ‘000), 2019 - 2032

5.5.1. Key Highlights

5.5.1.1. Germany Whey Protein Market by Value (US$ ‘000), 2019 - 2032

5.5.1.2. France Whey Protein Market by Product, Value (US$ ‘000), 2019 - 2032

5.5.1.3. U.K. Whey Protein Market by Value (US$ ‘000), 2019 - 2032

5.5.1.4. Italy Whey Protein Market by Value (US$ ‘000), 2019 - 2032

5.5.1.5. Spain Whey Protein Market by Product, Value (US$ ‘000), 2019 - 2032

5.5.1.6. Rest of Europe Whey Protein Market Value (US$ ‘000), 2019 - 2032

5.5.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Whey Protein Market Outlook, 2019 - 2032

6.1. Asia Pacific Whey Protein Market Outlook, by Form, Value (US$ ‘000), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Dry

6.1.1.2. Liquid

6.1.2. BPS Analysis/Market Attractiveness Analysis

6.2. Asia Pacific Whey Protein Market Outlook, by Type, Value (US$ ‘000), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Isolates

6.2.1.2. Concentrates

6.2.1.3. Textured

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Whey Protein Market Outlook, by Application, Value (US$ ‘000), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. Meat extenders & analogs

6.3.1.2. Snacks & bakery products

6.3.1.3. Nutritional supplements

6.3.1.4. Beverages

6.3.1.5. Others

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Whey Protein Market Outlook, by End User, Value (US$ ‘000), 2019 - 2032

6.4.1. Key Highlights

6.4.1.1. Food & Beverages

6.4.1.2. Animal Feed

6.4.1.3. Cosmetics & Personal Care

6.4.2. Pharmaceuticals

6.5. Asia Pacific Whey Protein Market Outlook, by Country, Value (US$ ‘000), 2019 - 2032

6.5.1. Key Highlights

6.5.1.1. India Whey Protein Market by Value (US$ ‘000), 2019 - 2032

6.5.1.2. China Whey Protein Market by Value (US$ ‘000), 2019 - 2032

6.5.1.3. Japan Whey Protein Market by Value (US$ ‘000), 2019 - 2032

6.5.1.4. Australia & New Zealand Whey Protein Market Value (US$ ‘000), 2019 - 2032

6.5.1.5. Rest of Asia Pacific Market by Value (US$ ‘000), 2019 - 2032

6.5.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Whey Protein Market Outlook, 2019 - 2032

7.1. Latin America Whey Protein Market Outlook, by Form, Value (US$ ‘000), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Dry

7.1.1.2. Liquid

7.1.2. BPS Analysis/Market Attractiveness Analysis

7.2. Latin America Whey Protein Market Outlook, by Type, Value (US$ ‘000), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Isolates

7.2.1.2. Concentrates

7.2.1.3. Textured

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Whey Protein Market Outlook, by Application, Value (US$ ‘000), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Meat extenders & analogs

7.3.1.2. Snacks & bakery products

7.3.1.3. Nutritional supplements

7.3.1.4. Beverages

7.3.1.5. Others

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Whey Protein Market Outlook, by End User, Value (US$ ‘000), 2019 - 2032

7.4.1. Key Highlights

7.4.1.1. Food & Beverages

7.4.1.2. Animal Feed

7.4.1.3. Cosmetics & Personal Care

7.4.2. Pharmaceuticals

7.5. Latin America Whey Protein Market Outlook, by Country, Value (US$ ‘000), 2019 - 2032

7.5.1. Key Highlights

7.5.1.1. Brazil Whey Protein Market by Value (US$ ‘000), 2019 - 2032

7.5.1.2. Mexico Whey Protein Market by Value (US$ ‘000), 2019 - 2032

7.5.1.3. Rest of Latin America Whey Protein Market by Value (US$ ‘000), 2019 - 2032

7.5.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Whey Protein Market Outlook, 2019 - 2032

8.1. Middle East & Africa Whey Protein Market Outlook, by Form, Value (US$ ‘000), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Dry

8.1.1.2. Liquid

8.1.2. BPS Analysis/Market Attractiveness Analysis

8.2. Middle East & Africa Whey Protein Market Outlook, by Type, Value (US$ ‘000), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Isolates

8.2.1.2. Concentrates

8.2.1.3. Textured

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Whey Protein Market Outlook, by Application, Value (US$ ‘000), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. Meat extenders & analogs

8.3.1.2. Snacks & bakery products

8.3.1.3. Nutritional supplements

8.3.1.4. Beverages

8.3.1.5. Others

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Whey Protein Market Outlook, by End User, Value (US$ ‘000), 2019 - 2032

8.4.1. Key Highlights

8.4.1.1. Food & Beverages

8.4.1.2. Animal Feed

8.4.1.3. Cosmetics & Personal Care

8.4.2. Pharmaceuticals

8.5. Middle East & Africa Whey Protein Market Outlook, by Country, Value (US$ ‘000), 2019 - 2032

8.5.1. Key Highlights

8.5.1.1. GCC Whey Protein Market by Value (US$ ‘000), 2019 - 2032

8.5.1.2. South Africa Whey Protein Market by Value (US$ ‘000), 2019 - 2032

8.5.1.3. Rest of Middle East & Africa Whey Protein Market by Value (US$ ‘000), 2019 - 2032

8.5.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Market Share Analysis, 2021

9.2. Company Profiles

9.2.1. Axiom Foods, Inc

9.2.1.1. Company Overview

9.2.1.2. Key Retailing Partners

9.2.1.3. Business Segment Revenue

9.2.1.4. Ingredient Overview

9.2.1.5. Product Offering & its Presence

9.2.1.6. Certifications & Claims

9.2.2. Scoular Company

9.2.3. Ingredion Incorporated,

9.2.4. Roquette Frères

9.2.5. Puris

9.2.6. Emsland Group

9.2.7. DuPont

9.2.8. A&B Ingredients.

9.2.9. Glanbia plc

9.2.10. FENCHEM

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Application Coverage |

|

|

Form Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Product-, Application-, Region-, Country-wise Trends & Analysis, COVID-19 Impact Analysis, Key Trends |