Global Wiring Devices Market Forecast

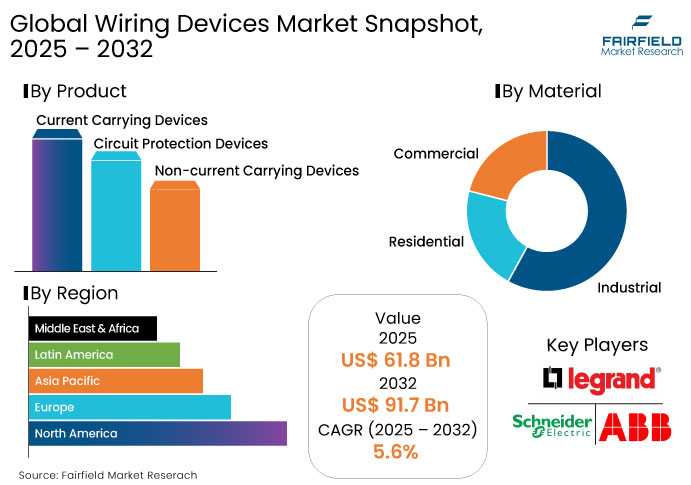

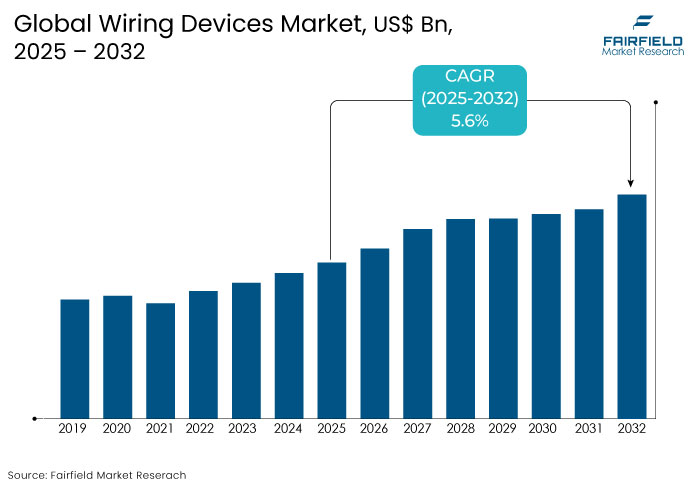

- The global wiring devices market is expected to reach a market size of US$ 91.7 Bn, up from US$ 61.8 Bn in 2025, resembling strong growth with a 5.6% CAGR by 2032.

- The wiring devices market is anticipated to benefit from strong demand due to the increasing adoption of advanced electrical systems, growing construction activities, and the rise in smart homes and infrastructure projects.

Wiring Devices Market Insights

- With growing concerns about electrical hazards, there is an increasing demand for wiring devices with safety features such as surge protection, circuit breakers, and grounding options.

- Current carrying devices are projected to hold 45.1% market share in 2025 due to their essential role in electrical systems for safely conducting electricity in various applications.

- Smart wiring devices integrated with IoT technology are gaining traction, offering energy efficiency, automation, and enhanced control over electrical systems.

- A shift towards sustainable and energy-efficient wiring devices is emerging as environmental concerns prompt the demand for energy-saving solutions, such as low-energy switches and recyclable materials.

- The residential sector is one of the largest application with homeowners seeking more advanced electrical systems and greater convenience.

- The growing adoption of electric vehicles (EVs) contributes to the demand for wiring devices, including EV charging stations, requiring specialized electrical equipment.

- The adoption of wiring devices with a reduced environmental impact is increasingly favored in green building initiatives and projects seeking LEED certification.

A Look Back and a Look Forward - Comparative Analysis

The historical growth of the Wiring Devices Market experienced steady growth, driven by advances in smart home technology, along with a focus on energy efficiency, which led to the adoption of more innovative wiring solutions. Rapid urbanization and construction activities increased demand for wiring devices in both new buildings and renovations. Safety and energy conservation regulations further boosted the market, while improvements in wiring materials made devices more durable and efficient.

Looking ahead, the market is poised for significant growth, propelled by the ongoing digital transformation in homes, businesses, and industries. The rise of smart grids, smart homes, and energy-efficient solutions will boost demand for advanced wiring devices. Innovations in eco-friendly materials and the growth of electric vehicles and renewable energy will create new opportunities for specialized wiring systems. As industries embrace automation, the market is expected to expand in both developed and developing regions.

Key Growth Determinant

- Rising Demand for Energy-Saving Electrical Solutions

The global shift toward energy conservation and sustainability is significantly influencing the wiring devices market. Governments and organizations are introducing stricter regulations and offering incentives to promote energy-efficient technologies across residential, commercial, and industrial sectors. This drives demand for wiring devices that optimize energy use and reduce electricity waste.

Smart switches, energy-saving outlets, and advanced circuit protection devices are playing a key role in modernizing electrical systems. These products support smart home and building automation by enabling real-time monitoring and control of energy consumption. According to the Bureau of Energy Efficiency's (BEE) India Energy Scenario 2024 report, the implementation of various energy efficiency schemes resulted in total energy savings of 53.60 million tonnes of oil equivalent (Mtoe) in 2023-24, accounting for approximately 6% of the country's total primary energy supply. This includes savings of 25.96 Mtoe in thermal energy and 321.39 billion units (BU) of electricity, leading to significant cost reductions of nearly US$ 20 billion.

Key Growth Barrier

- Technological Complexity and Compatibility

The technological complexity and compatibility challenges posed by advanced wiring devices, such as smart technologies, IoT capabilities, and energy-efficient features, present notable barriers to market growth. As these devices evolve, their increased design and functionality, and complexity often lead to compatibility issues with older infrastructure. Integrating modern systems like smart switches and energy-efficient outlets into pre-existing electrical setups often requires costly and time-consuming modifications.

Many consumers hesitate to adopt these advanced systems due to the potential hassle of upgrading their entire electrical infrastructure. Specialized installation requirements and retrofitting needs further limit adoption, particularly in residential and commercial sectors with older systems. The rapid pace of technological innovation results in reluctance to invest in devices that quickly become outdated, slowing market penetration, especially in regions where customers are more conservative about embracing new technologies.

Wiring Devices Market Trends and Opportunities

- Electrical Vehicle Charging Infrastructure

The expansion of the electric vehicle (EV) market has significantly increased the demand for robust and reliable charging infrastructure. From residential charging points to large-scale commercial stations, high-quality electrical wiring solutions are necessary to handle varying voltages and power loads, especially at fast-charging stations that require higher-capacity wiring. With the integration of EV chargers into smart grids and digital platforms, there is a growing demand for sophisticated wiring solutions capable of supporting features such as load management, remote monitoring, and dynamic pricing. Companies such as Tesla and ChargePoint have led the way in this integration and as this continues the market for specialized wiring solutions compatible with current and future technologies is poised to expand.

For example, in the U.S., an estimated 28 million EV charging ports will be needed by 2030 to support 33 million EVs. In China, where home charging access is limited and public charging is widespread the government continues to enhance high-quality charging infrastructure. The country accounted for 70% of global public LDV charging in 2023 and is projected to maintain this share through 2035, reflecting strong demand for reliable wiring systems. According to the U.S. Department of Energy, the US will need 28 million EV charging ports to support 33 million EVs by 2030.

- Increased Focus on Safety Standards and Compliance

Governments worldwide are tightening safety regulations, prompting manufacturers and consumers to adopt safer, compliant wiring solutions. This is evident in the enforcement of updated standards that emphasize electrical safety across residential, commercial, and industrial sectors. In the UK, the BS 7671:2018/A3:2024 (IET Wiring Regulations) reflects a strong commitment to safety and, while non-statutory, is often legally binding through its reference in statutory instruments.

In the U.S., the updated UL 2610 standard, released in January 2023, governs the safety of security alarm systems in commercial premises. Recognized by OSHA’s NRTL Program, it consolidates key safety requirements for systems such as central station burglar alarms. As a result, manufacturers are increasingly developing wiring devices with enhanced insulation, fire resistance, and durability to comply with such evolving standards, driving innovation and market growth.

Leading Segment Overview

- Current Carrying Devices Segment Leads the Wiring Devices Market

Current carrying devices are anticipated to account for 45.1% share of the wiring devices market in 2025, due to increasing demand for efficient power distribution systems across all sectors. The rise in smart homes and automation technologies is driving the adoption of advanced switches, sockets, and circuit breakers. Urbanization and infrastructure development, especially in emerging economies, are also contributing to this growth.

Circuit protection devices are expected to grow at a significant rate as the demand for safety and reliability in electrical systems increases. As the use of complex electrical installations rises across industries such as construction, automotive, and electronics, the need for circuit breakers, fuses, and surge protectors grows. These devices help prevent damage caused by overloads, short circuits, and electrical faults, thereby enhancing system longevity.

- Commercial Sector Expansion Fueled by Renovations, Safety Standards, and Smart Wiring Solutions

The commercial segment is anticipated to account for 39.2% of the market share in 2025, driven by the rise in renovation and construction projects, along with stricter regulations for safety and energy standards, which are boosting the demand for wiring devices. The need for energy-efficient wiring solutions, along with the integration of smart technologies such as IoT and automation in commercial properties, further accelerates market expansion.

The residential sector is rapidly growing due to the rising demand for smart homes and energy-efficient solutions. The shift toward home automation, IoT-enabled devices, and smart home ecosystems is driving the need for advanced wiring devices such as smart switches and sensors. As new homes are built and older ones are renovated with modern technologies, the market is experiencing significant expansion, fueled by increasing consumer awareness and affordability of smart devices.

Regional Analysis

- Smart Wiring Devices Surge as North American Consumers Prioritize Convenience, Efficiency, and Security

Consumers in North America are increasingly prioritizing convenience, energy efficiency, and security, and driving demand for smart wiring devices such as voice-controlled switches and app-enabled outlets. These devices have gained mainstream traction due to their affordability and ease of installation, particularly in tech-savvy suburban homes and upscale apartment complexes. Additionally, renovation and retrofitting of aging infrastructure, especially in the Northeastern U.S. and Central Canada, have spurred demand for modern wiring systems such as USB-integrated sockets, tamper-resistant receptacles, and GFCI devices.

The surge in data center development, driven by AI and cloud computing has significantly impacted wiring device needs with the U.S. Department of Energy reporting that data centers accounted for 4.4% of national electricity use in 2023 and may reach between 6.7% to 12% by 2028. Residential construction also plays a major role, with March 2025 housing completions rising 3.9% year-over-year to a rate of 1,549,000, according to the U.S. census for new residential construction. Furthermore, the U.S. Census Bureau reported that construction spending in the first two months of 2025 reached $311.1 billion, a 2.1% increase from 2024, supporting further growth in demand for wiring devices.

- Asia Pacific Leads the Wiring Devices Market

Asia Pacific is projected to account for more than 35% market share by 2025, driven by rapid urbanization, industrialization, and growing infrastructure development in emerging economies such as China, India, and Southeast Asia. With over 60% of the world’s urban population residing in Asia, urban expansion is fueling demand for new residential, commercial, and industrial infrastructure, each requiring extensive wiring systems. Government investments in smart city initiatives further amplify this demand.

For instance, China’s Smart City Development Plan aims to integrate advanced information technologies with urban infrastructure, while India’s Smart Cities Mission is driving the creation of 100 smart cities, necessitating modern wiring solutions. Japan’s commitment to net-zero emissions by 2050 is spurring investments in renewable energy infrastructure, and South Korea’s Green New Deal supports eco-friendly infrastructure development, contributing to increased demand for advanced wiring devices.

- Renewable Energy and Smart Grid Developments Accelerating Advanced Wiring Device Market Growth in Europe

In Europe, the growing emphasis on energy efficiency and renewable energy is driving the demand for advanced wiring devices. Countries like Germany are adopting smart switches and energy-efficient outlets to meet stringent energy standards set by the government and the EU. With renewable sources accounting for 59.0% of Germany's electricity generation in 2024, up from 56.0% in 2023, the country's relatively low levels of large-scale electricity storage (1.7 GW with 2.2 GWh in January 2025) highlight the need for improved grid management and flexibility services, further boosting demand for sophisticated wiring devices.

The UK is experiencing growth in its electricity network sector due to substantial investments, with Ofgem approving a £4 billion allocation for grid equipment. This proactive strategy aligns with the country’s green energy objectives and stimulates increased demand for advanced wiring devices. Spain's urbanization and smart city growth are significantly impacting wiring device demand. Cities like Barcelona and Madrid are adopting smart technologies to optimize energy usage and reduce environmental impacts, particularly through smart homes and renewable energy integration.

Competitive Landscape

The key players are innovating by integrating IoT technology into wiring devices, enabling remote control of lighting, outlets, and other devices for enhanced convenience and smart home integration. They also focus on eco-friendly products, using recyclable, non-toxic materials, and creating energy-efficient solutions like dimmable lighting and power-saving outlets to meet sustainability demands and attract environmentally conscious consumers.

- In March 2025, ELEGRP introduced its innovative TrapConnect technology, revolutionizing electrical installations. This tool-free, quick-wiring system uses an elastic clamp mechanism to securely connect wires in just 8 seconds, eliminating screws and tools. Compatible with AWG #10 and #12 copper-clad aluminum wire, TrapConnect ensures reliable, durable connections, making it ideal for both DIY users and electricians in residential and commercial settings.

- In August 2024, Schneider Electric has integrated Matter protocols into its X Series connected wiring devices, enhancing compatibility with major smart home ecosystems. The upgraded outlets, light switches, and dimmers offer real-time energy monitoring, giving homeowners better control over their energy usage.

Key Companies

- Legrand

- Schneider Electric

- Panasonic Corporation

- ABB

- Honeywell International, Inc.

- Eaton Corporation

- TE Connectivity

- Hubbell Incorporated

- SMK Corporation

- IPEX Electrical Inc

- Lex Products

Expert Opinion

- The rise of smart cities is pushing the adoption of smarter and more integrated wiring systems.

- Governments are encouraging the development of sustainable, energy-efficient buildings, which is fueling the demand for wiring devices that incorporate energy-saving technologies.

- The growth of industrial automation and robotics has increased the need for specialized devices capable of enduring harsh environments and managing complex electrical systems.

- Modular wiring solutions, which allow for easy upgrades and expansion, are increasingly being adopted in commercial and residential buildings.

Global Wiring Devices Market is segmented as-

By Product

- Current Carrying Devices

- Electric Switches

- Receptacles

- Connectors

- Circuit Protection Devices

- Miscellaneous

- Circuit Protection Devices

- Circuit Breakers

- Fuses

- Misc.

- Non-current Carrying Devices

- Conduit, Trunking, and Raceways

- Electric Insulator

- Faceplates

- Misc.

By Application

- Industrial

- Residential

- Commercial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East & Africa

1. Executive Summary

1.1. Global Wiring Devices Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2024

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. COVID-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Wiring Devices Market Outlook, 2019 - 2032

3.1. Global Wiring Devices Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

3.1.1. Key Highlights

3.1.1.1. Current Carrying Devices

3.1.1.1.1. Receptacles

3.1.1.1.2. Electric Switches

3.1.1.1.3. Connectors

3.1.1.1.4. Others

3.1.1.2. Non-current Carrying Devices

3.1.1.2.1. Faceplates

3.1.1.2.2. Electric Insulator

3.1.1.2.3. Conduit, Trunking, and Raceways

3.1.1.2.4. Others

3.1.1.3. Circuit Protection Devices

3.1.1.3.1. Fuses

3.1.1.3.2. Circuit Breakers

3.1.1.3.3. Others

3.2. Global Wiring Devices Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

3.2.1. Key Highlights

3.2.1.1. Commercial

3.2.1.2. Industrial

3.2.1.3. Residential

3.3. Global Wiring Devices Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Wiring Devices Market Outlook, 2019 - 2032

4.1. North America Wiring Devices Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

4.1.1. Key Highlights

4.1.1.1. Current Carrying Devices

4.1.1.1.1. Receptacles

4.1.1.1.2. Electric Switches

4.1.1.1.3. Connectors

4.1.1.1.4. Others

4.1.1.2. Non-current Carrying Devices

4.1.1.2.1. Faceplates

4.1.1.2.2. Electric Insulator

4.1.1.2.3. Conduit, Trunking, and Raceways

4.1.1.2.4. Others

4.1.1.3. Circuit Protection Devices

4.1.1.3.1. Fuses

4.1.1.3.2. Circuit Breakers

4.1.1.4. Others

4.2. North America Wiring Devices Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

4.2.1. Key Highlights

4.2.1.1. Commercial

4.2.1.2. Industrial

4.2.1.3. Residential

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Wiring Devices Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.3.1. Key Highlights

4.3.1.1. U.S. Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

4.3.1.2. U.S. Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

4.3.1.3. Canada Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

4.3.1.4. Canada Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Wiring Devices Market Outlook, 2019 - 2032

5.1. Europe Wiring Devices Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

5.1.1. Key Highlights

5.1.1.1. Current Carrying Devices

5.1.1.1.1. Receptacles

5.1.1.1.2. Electric Switches

5.1.1.1.3. Connectors

5.1.1.1.4. Others

5.1.1.2. Non-current Carrying Devices

5.1.1.2.1. Faceplates

5.1.1.2.2. Electric Insulator

5.1.1.2.3. Conduit, Trunking, and Raceways

5.1.1.2.4. Others

5.1.1.3. Circuit Protection Devices

5.1.1.3.1. Fuses

5.1.1.3.2. Circuit Breakers

5.1.1.3.3. Others

5.2. Europe Wiring Devices Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

5.2.1. Key Highlights

5.2.1.1. Commercial

5.2.1.2. Industrial

5.2.1.3. Residential

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Wiring Devices Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.3.1. Key Highlights

5.3.1.1. Germany Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

5.3.1.2. Germany Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

5.3.1.3. U.K. Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

5.3.1.4. U.K. Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

5.3.1.5. France Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

5.3.1.6. France Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

5.3.1.7. Italy Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

5.3.1.8. Italy Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

5.3.1.9. Spain Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

5.3.1.10. Spain Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

5.3.1.11. Turkiye Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

5.3.1.12. Turkiye Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

5.3.1.13. Russia Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

5.3.1.14. Russia Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

5.3.1.15. Rest of Europe Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

5.3.1.16. Rest of Europe Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Wiring Devices Market Outlook, 2019 - 2032

6.1. Asia Pacific Wiring Devices Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

6.1.1. Key Highlights

6.1.1.1. Current Carrying Devices

6.1.1.1.1. Receptacles

6.1.1.1.2. Electric Switches

6.1.1.1.3. Connectors

6.1.1.1.4. Others

6.1.1.2. Non-current Carrying Devices

6.1.1.2.1. Faceplates

6.1.1.2.2. Electric Insulator

6.1.1.2.3. Conduit, Trunking, and Raceways

6.1.1.2.4. Others

6.1.1.3. Circuit Protection Devices

6.1.1.3.1. Fuses

6.1.1.3.2. Circuit Breakers

6.1.1.3.3. Others

6.2. Asia Pacific Wiring Devices Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

6.2.1. Key Highlights

6.2.1.1. Commercial

6.2.1.2. Industrial

6.2.1.3. Residential

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Wiring Devices Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.3.1. Key Highlights

6.3.1.1. China Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

6.3.1.2. China Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

6.3.1.3. Japan Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

6.3.1.4. Japan Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

6.3.1.5. South Korea Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

6.3.1.6. South Korea Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

6.3.1.7. India Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

6.3.1.8. India Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

6.3.1.9. Southeast Asia Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

6.3.1.10. Southeast Asia Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

6.3.1.11. Rest of Asia Pacific Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

6.3.1.12. Rest of Asia Pacific Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Wiring Devices Market Outlook, 2019 - 2032

7.1. Latin America Wiring Devices Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

7.1.1. Key Highlights

7.1.1.1. Current Carrying Devices

7.1.1.1.1. Receptacles

7.1.1.1.2. Electric Switches

7.1.1.1.3. Connectors

7.1.1.1.4. Others

7.1.1.2. Non-current Carrying Devices

7.1.1.2.1. Faceplates

7.1.1.2.2. Electric Insulator

7.1.1.2.3. Conduit, Trunking, and Raceways

7.1.1.2.4. Others

7.1.1.3. Circuit Protection Devices

7.1.1.3.1. Fuses

7.1.1.3.2. Circuit Breakers

7.1.1.3.3. Others

7.2. Latin America Wiring Devices Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

7.2.1. Key Highlights

7.2.1.1. Commercial

7.2.1.2. Industrial

7.2.1.3. Residential

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Wiring Devices Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.3.1. Key Highlights

7.3.1.1. Brazil Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

7.3.1.2. Brazil Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

7.3.1.3. Mexico Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

7.3.1.4. Mexico Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

7.3.1.5. Argentina Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

7.3.1.6. Argentina Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

7.3.1.7. Rest of Latin America Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

7.3.1.8. Rest of Latin America Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Wiring Devices Market Outlook, 2019 - 2032

8.1. Middle East & Africa Wiring Devices Market Outlook, by Product Type, Value (US$ Bn), 2019 - 2032

8.1.1. Key Highlights

8.1.1.1. Current Carrying Devices

8.1.1.1.1. Receptacles

8.1.1.1.2. Electric Switches

8.1.1.1.3. Connectors

8.1.1.1.4. Others

8.1.1.2. Non-current Carrying Devices

8.1.1.2.1. Faceplates

8.1.1.2.2. Electric Insulator

8.1.1.2.3. Conduit, Trunking, and Raceways

8.1.1.2.4. Others

8.1.1.3. Circuit Protection Devices

8.1.1.3.1. Fuses

8.1.1.3.2. Circuit Breakers

8.1.1.3.3. Others

8.2. Middle East & Africa Wiring Devices Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

8.2.1. Key Highlights

8.2.1.1. Commercial

8.2.1.2. Industrial

8.2.1.3. Residential

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Wiring Devices Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.3.1. Key Highlights

8.3.1.1. GCC Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

8.3.1.2. GCC Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

8.3.1.3. South Africa Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

8.3.1.4. South Africa Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

8.3.1.5. Rest of Middle East & Africa Wiring Devices Market by Product Type, Value (US$ Bn), 2019 - 2032

8.3.1.6. Rest of Middle East & Africa Wiring Devices Market by Application, Value (US$ Bn), 2019 - 2032

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs by Application Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Legrand

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Schneider Electric

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Panasonic Corporation

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. ABB

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Honeywell International, Inc.

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Eaton Corporation

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. TE Connectivity

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Hubbell Incorporated

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. SMK Corporation

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Lutron Electronics Co., Inc

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Orbit Industries Inc

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

9.4.12. IPEX Electrical Inc.

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Product Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |