Drug-coated Balloon Catheter Market Forecast

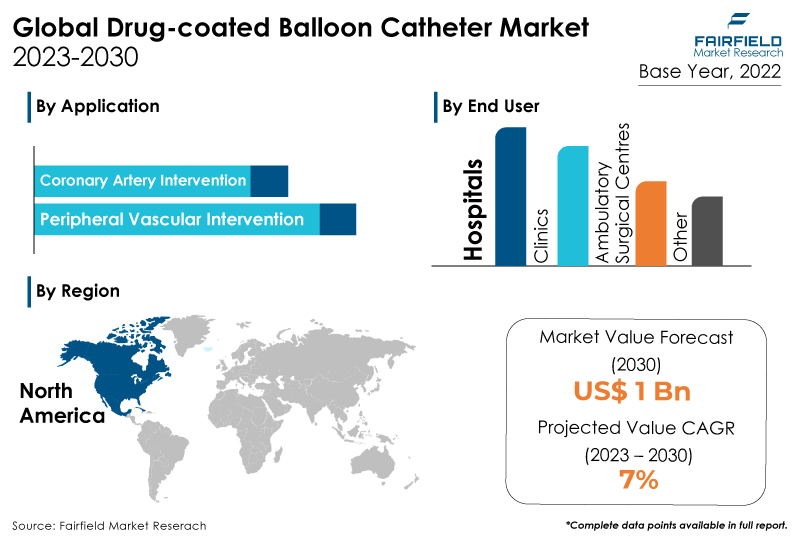

- Global drug-coated balloon (DCB) catheter market to ascend at a significant CAGR of 7% during the assessment period, 2023 - 2030

- Global market valuation of drug-coated balloon catheters to exceed US$1 Bn by the end of 2030

Market Analysis in Brief

The rise in the need for minimally invasive procedures and innovations in drug-coated/drug-eluting balloons are expected to drive market growth. Older individuals are more susceptible to diseases like peripheral and cardiovascular abnormalities, making drug-coated/drug-eluting balloons a valuable treatment option, thus significantly impacting the expansion of the use of drug-coated balloon catheters. Market growth has been accelerated by using cutting-edge products and surgeries, enhancing life expectancy and diagnostic procedures among the senior demographic. Key players are actively developing affordable, precise, and efficient drug-eluting/drug-coated balloon catheters to improve medication delivery, contributing to the market expansion over the projection period.

Key Report Findings

- The market for drug-coated balloon catheters will demonstrate notable expansion in revenue between 2023 and 2030.

- Hospitals capture the largest market share of the drug-coated balloon catheter market on the back of their advanced healthcare infrastructure, experienced interventional cardiologists, and high patient volume seeking cardiovascular treatments.

- Peripheral vascular disease held the major market share in the drug-coated balloon catheter market due to its high prevalence and the effectiveness of drug-coated balloon catheters in treating the condition.

- North America will continue to lead its way, whereas Asia Pacific's drug-coated balloon catheter market will experience the strongest growth till 2030.

Growth Drivers

Growing Occurrence of Cardiovascular Disorders

The increasing prevalence of cardiovascular disorders has been a significant driving force behind the growth of the drug-coated balloon catheter market. Cardiovascular disorders like coronary and peripheral artery disease have become global health concerns. These conditions often lead to the formation of arterial plaque and narrowing of blood vessels, requiring effective treatment options to restore blood flow and prevent complications.

Drug-coated balloon catheters offer a promising solution, specifically designed to deliver drugs directly to the diseased arterial walls during angioplasty procedures. The drug-coated balloons release medication that helps prevent restenosis (re-narrowing of the artery) and inhibits further plaque formation, reducing the need for repeat procedures and improving patient outcomes.

Furthermore, the rising awareness of minimally invasive treatment options has also contributed to the growing adoption of drug-coated balloon catheters. Less intrusive treatments are preferred by patients and healthcare professionals because they provide advantages over more standard surgical interventions, such as shorter hospital stays, quicker recovery times, and fewer complication rates. Drug-coated balloon catheters are well-suited for these preferences as they can be delivered via a catheter through a small incision, avoiding open surgeries. As a result, the demand for drug-coated balloon catheters has surged, particularly for cases where angioplasty with stenting may not be the optimal treatment option.

In addition to their efficacy and minimally invasive nature, technological advancements and ongoing research and development efforts have expanded the range of drug-coated balloon catheters available in the market. Manufacturers are continually improving the design of these catheters, optimising drug delivery mechanisms, and enhancing coating materials to achieve better clinical outcomes. With increasing number of patients seeking effective and less invasive treatment options for cardiovascular disorders, the drug-coated balloon catheter market is expected to continue its growth trajectory in the coming years.

Increasing Demand for Minimally Invasive Procedures

The rising demand for minimally invasive procedures has been a key driver behind the growth of the drug-coated balloon catheter market. Drug-coated balloon catheters align perfectly with this demand as they offer a minimally invasive approach to treating cardiovascular disorders, including coronary and peripheral artery disease.

The catheters can be inserted through a small incision and navigated to the affected blood vessels, where the drug-coated balloon delivers medication directly to the arterial walls during the angioplasty procedure. This targeted drug delivery helps prevent restenosis and enhances the efficacy of the treatment, making drug-coated balloon catheters an appealing choice for both patients and healthcare providers.

Moreover, the increasing prevalence of cardiovascular diseases and the ageing population have further bolstered the demand for minimally invasive treatment options. As the burden of cardiovascular disorders rises, there is a greater need for effective and efficient therapies that can be delivered through less invasive methods. This alignment with the evolving healthcare landscape has contributed to the growing adoption of drug-coated balloon catheters in cardiovascular treatments.

Additionally, advancements in medical technology and ongoing research and development efforts have led to continuous improvements in drug-coated balloon catheter design and drug delivery capabilities. These advancements have enhanced the safety and efficacy of catheters, making them more appealing to healthcare practitioners. The demand for drug-coated balloon catheters in the healthcare industry is anticipated to continue growing as more people seek out less invasive treatments for cardiovascular ailments.

Growth Challenges

Potential Risks Related to Catheterization Procedures

The risk associated with catheterization procedures presents a significant challenge for the drug-coated balloon catheter market. Catheterization procedures, including angioplasty with drug-coated balloon catheters, involve threading a catheter through blood vessels to reach the affected area. While these procedures are generally considered minimally invasive, they are not without risks.

Some patients may experience complications such as bleeding, infection, or damage to blood vessels during the catheterization process. These risks can deter patients and healthcare providers from choosing catheter-based treatments, including drug-coated balloon catheters, as the potential complications may outweigh the benefits in certain cases.

Furthermore, patients with complex cardiovascular conditions or multiple comorbidities may have an increased risk associated with catheterization procedures. The suitability of drug-coated balloon catheters may vary based on the patient's medical history and condition. Healthcare providers may opt for alternative treatment options, such as stent implantation or coronary artery bypass surgery, for patients at higher risk of complications. As a result, the broader adoption of drug-coated balloon catheters in such cases may be limited, posing a challenge to the market's growth.

Moreover, the limited availability of experienced interventional cardiologists and catheterization facilities can also hinder the adoption of drug-coated balloon catheters. Performing catheter-based procedures requires specialised skills and training. In regions with a shortage of skilled interventional cardiologists or advanced catheterization centers, patients may need more access to drug-coated balloon catheter treatments. This need for more expertise and facilities can restrict the market expansion, especially in certain geographical areas.

To overcome these challenges, continuous efforts are required to improve patient selection criteria, enhance training and expertise among healthcare professionals, and establish adequate catheterization facilities. As the safety and effectiveness of drug-coated balloon catheters are further validated through clinical trials and real-world evidence, and healthcare systems address the associated risks with comprehensive risk assessment protocols, the market for drug-coated balloon catheters can advance, offering a promising solution for a range of cardiovascular conditions.

Overview of Key Segments

Hospitals Consume the Largest Share of Market

The hospital end-user segment has captured the largest market share in the drug-coated balloon catheter market for several reasons. Firstly, hospitals are the primary healthcare facilities where most interventional cardiology procedures are performed. Drug-coated balloon catheters are commonly used for treating various cardiovascular conditions, such as coronary and peripheral artery disease, often requiring specialised interventions.

Hospitals house well-equipped catheterization labs and experienced interventional cardiologists, making them the ideal setting for performing these procedures. The high volume of patients with cardiovascular diseases seeking treatment in hospitals has driven the significant adoption of drug-coated balloon catheters in this end-user segment.

Secondly, hospitals are at the forefront of medical advancements and research. They are often involved in clinical trials and studies evaluating the safety and efficacy of new medical technologies, including drug-coated balloon catheters. These studies ' positive clinical outcomes and evidence further encourage hospitals to integrate drug-coated balloon catheters into their standard treatment protocols. As a result, the hospital end-user segment has become a major driving force behind the market's growth.

Thirdly, hospitals benefit from established referral networks and collaborations with other healthcare providers. When patients with complex cardiovascular conditions are referred to hospitals for specialised treatments, drug-coated balloon catheters may be recommended as an effective and less invasive option for certain cases. This seamless patient flow within the healthcare ecosystem enhances the adoption of drug-coated balloon catheters in hospitals, making them the preferred choice for patients and healthcare practitioners.

Moreover, hospitals play a crucial role in educating and raising awareness among patients and medical professionals about the benefits of drug-coated balloon catheters. Their position as a central hub for healthcare services allows them to disseminate information about innovative treatments and facilitate knowledge sharing among healthcare providers. This active role in promoting the use of drug-coated balloon catheters has further strengthened the hospital end-user segment's dominance in the market.

Peripheral Vascular Disease Dominant

For several reasons, peripheral vascular disease (PVD) has captured the largest market share in the drug-coated balloon catheter market. Firstly, PVD is a prevalent and significant health concern worldwide. It affects the blood vessels outside the heart and brain, commonly involving the arteries in the legs and feet. As the ageing population increases and the prevalence of conditions like diabetes and hypertension rises, the incidence of PVD has also grown.

Drug-coated balloon catheters have emerged as a promising treatment option for PVD, as they offer targeted drug delivery to the affected arterial walls during angioplasty procedures. The use of drug-coated balloon catheters in PVD cases has demonstrated reduced rates of restenosis and improved clinical outcomes, driving their widespread adoption in this patient population.

Secondly, the debilitating nature of peripheral vascular disease contributes to the demand for effective treatment options. Patients with PVD often experience pain, cramping, and difficulty walking due to reduced blood flow to the extremities. The ability of drug-coated balloon catheters to restore blood flow and prevent restenosis makes them a preferred choice for interventional cardiologists and vascular surgeons treating PVD cases.

Furthermore, ongoing research and clinical trials have provided robust evidence supporting the use of drug-coated balloon catheters in treating peripheral vascular disease. Positive clinical outcomes and real-world evidence from these studies have enhanced the confidence of healthcare providers in using drug-coated balloon catheters for PVD patients. Additionally, medical societies and regulatory bodies have endorsed drug-coated balloon catheters for PVD treatment, further bolstering their adoption in the market.

Furthermore, drug-coating technologies and catheter design advancements have led to the development of specialised drug-coated balloon catheters tailored for PVD cases. These advancements have improved the efficacy and safety of the catheters, making them more suitable for treating peripheral vascular disease. As a result, drug-coated balloon catheters have become the go-to choice for many healthcare providers manageing PVD cases, driving their dominant market share in the drug-coated balloon catheter market.

To conclude, peripheral vascular disease's high prevalence, impact on patients' quality of life, and the effectiveness of drug-coated balloon catheters in treating PVD have led to their largest market share in the drug-coated balloon catheter market. As the incidence of PVD continues to rise and healthcare providers seek innovative and less invasive treatment options, the demand for drug-coated balloon catheters for peripheral vascular disease is expected to remain strong in the foreseeable future.

Growth Opportunities Across Regions

North America’s Lead Intact

Due to several factors, North America has captured the largest market share in the drug-coated balloon catheter market. The region has a high prevalence of cardiovascular diseases, such as coronary and peripheral artery disease. The ageing population, sedentary lifestyles, and unhealthy dietary habits have contributed to the increasing incidence of these conditions. As drug-coated balloon catheters offer an effective and minimally invasive treatment option for these cardiovascular disorders, they have gained significant popularity among patients and healthcare providers in North America.

Additionally, North America is the forefront of medical research and technological advancements. The region boasts a robust healthcare infrastructure with well-established catheterization labs and experienced interventional cardiologists. This enables swift adoption and implementation of the latest medical technologies, including drug-coated balloon catheters. Moreover, North American medical societies and regulatory bodies have been proactive in endorsing evidence-based practices and guidelines, further supporting the use of drug-coated balloon catheters in appropriate patient populations.

Furthermore, favourable reimbursement policies in North America have played a vital role in driving the adoption of drug-coated balloon catheters. Government healthcare programs, private insurance companies, and reimbursement agencies in the region have recognised the clinical benefits of drug-coated balloon catheter treatments and have included them in their coverage policies. This has increased patient access to drug-coated balloon catheters, making them a preferred choice for patients and healthcare providers.

Furthermore, North America has witnessed a growing focus on interventional cardiology research and clinical trials, further validating the safety and effectiveness of drug-coated balloon catheters. The availability of robust clinical data and real-world evidence has contributed to greater confidence in using these catheters, fostering their adoption in the region.

In conclusion, the combination of high disease prevalence, advanced healthcare infrastructure, favourable reimbursement policies, and a strong focus on research and clinical trials has positioned North America as the leading market for drug-coated balloon catheters. As cardiovascular diseases continue to pose significant health challenges in the region, the demand for minimally invasive and effective treatment options like drug-coated balloon catheters is expected further to drive the market's growth in North America.

Asia Pacific Sets a Lucrative Market

Due to several key factors, Asia Pacific is experiencing the fastest CAGR in the drug-coated balloon catheter market. Lifestyle changes, urbanisation, and an ageing population have contributed to the rising burden of these conditions. As healthcare systems in the Asia Pacific region strive to provide advanced and effective treatments for cardiovascular disorders, adopting drug-coated balloon catheters has gained traction as a promising and minimally invasive solution.

Secondly, the rapid economic growth in many countries across the Asia Pacific has improved healthcare infrastructure and increased access to medical services. As a result, more patients seek advanced cardiovascular treatments, including drug-coated balloon catheters, which offer better outcomes and quicker recovery times than traditional surgical interventions. The growth of medical tourism in the region has also contributed to the rising demand for high-quality interventional cardiology procedures, further propelling the adoption of drug-coated balloon catheters.

Additionally, favourable regulatory policies and reimbursement schemes in certain Asia Pacific countries have encouraged the adoption of innovative medical technologies, including drug-coated balloon catheters. Governments and healthcare agencies in the region have recognised the potential benefits of these catheters in reducing the need for repeat procedures and improving patient outcomes. This support has led to increased investments by regional medical device manufacturers, expanding the availability and accessibility of drug-coated balloon catheters.

Furthermore, ongoing medical research and technology advancements have spurred collaborations between global medical device companies and local healthcare institutions in the Asia Pacific. These collaborations have resulted in the development of region-specific drug-coated balloon catheters that cater to the unique healthcare needs of the local population. These tailored solutions have further contributed to the market growth in the Asia Pacific region.

In conclusion, increasing disease prevalence, improved healthcare infrastructure, supportive regulatory policies, and ongoing technological advancements have positioned Asia Pacific with the fastest CAGR in the drug-coated balloon catheter market. As the demand for advanced cardiovascular treatments continues to rise in the region, adopting drug-coated balloon catheters is expected to maintain its momentum, driving further market expansion in the Asia Pacific.

Drug-coated Balloon Catheter Market: Competitive Landscape

Some of the leading players at the forefront in the drug-coated balloon catheter market space include Medtronic plc, Bayer AG, B. Braun SE, Koninklijke Philips N.V., Eurocor GmbH, Biosensors International Group, Boston Scientific Corporation, iVascular, Aachen Resonance GmbH, BIOTRONIK, Cardionovum GmbH, Caliber Therapeutics, Biosensors International, MedAlliance, Concept Medical, Inc., and Lepu Medical Technology (Beijing) Co., Ltd.

Recent Notable Developments

In June 2023, Surmodics, Inc., a leading provider of medical devices and in vitro diagnostic technologies to the healthcare industry, announced the receipt of the U.S. Food and Drug Administration (FDA) approval for the SurVeil™ drug-coated balloon (DCB). The SurVeil DCB had received CE Mark Certification in the European Union in June 2020.

In May 2023, Concept Medical, Inc,, a global drug delivery devices company, received its third IDE approval (Investigational Device Exemption Approval) from the US Food and Drug Administration (FDA) for its ‘Magic Touch SCB’ drug-coated balloon (Sirolimus-coated). The IDE approval is for the treatment of small vessels (SV) in coronary arteries.

In September 2022, Concept Medical, Inc. previously received IDE approvals for the ‘Magic Touch SCB’ to treat coronary in-stent restenosis (ISR), and Magic Touch PTA to treat Below-the-knee peripheral arterial diseases (PAD) in February 2022.

In September 2022, Advanced NanoTherapies obtained approval from the US FDA for its SirPlux Duo Drug-Coated Balloon, intended to treat coronary artery disease in vessels less than 3.0 mm.

In May 2022, MedAlliance obtained FDA investigational device exemption approval for its SELUTION SLR drug-eluting balloon. The SELUTION SLR is designed to offer controlled and sustained drug release for below-the-knee indications in peripheral artery disease.

The Global Drug-coated Balloon Catheter Market is Segmented as Below:

By Drug

- Paclitaxel

- Sirolimus

By Application

- Coronary Artery Intervention

- Peripheral Vascular Intervention

By End User

- Hospital

- Clinics

- Ambulatory Surgical Centers

- Other

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Drug-coated Balloon Catheter Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Drug-coated Balloon Catheter Market Outlook, 2018 - 2030

3.1. Global Drug-coated Balloon Catheter Market Outlook, by Drug, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Paclitaxel

3.1.1.2. Sirolimus

3.2. Global Drug-coated Balloon Catheter Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Coronary Artery Intervention

3.2.1.2. Peripheral Vascular Intervention

3.3. Global Drug-coated Balloon Catheter Market Outlook, by End-use, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Hospital

3.3.1.2. Clinics

3.3.1.3. Ambulatory Surgical Centers

3.3.1.4. Other

3.4. Global Drug-coated Balloon Catheter Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Drug-coated Balloon Catheter Market Outlook, 2018 - 2030

4.1. North America Drug-coated Balloon Catheter Market Outlook, by Drug, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Paclitaxel

4.1.1.2. Sirolimus

4.2. North America Drug-coated Balloon Catheter Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Coronary Artery Intervention

4.2.1.2. Peripheral Vascular Intervention

4.3. North America Drug-coated Balloon Catheter Market Outlook, by End-use, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Hospital

4.3.1.2. Clinics

4.3.1.3. Ambulatory Surgical Centers

4.3.1.4. Other

4.3.2. Market Attractiveness Analysis

4.4. North America Drug-coated Balloon Catheter Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Drug-coated Balloon Catheter Market by Drug, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Drug-coated Balloon Catheter Market by Application, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

4.4.1.4. Canada Drug-coated Balloon Catheter Market by Drug, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Drug-coated Balloon Catheter Market by Application, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Drug-coated Balloon Catheter Market Outlook, 2018 - 2030

5.1. Europe Drug-coated Balloon Catheter Market Outlook, by Drug, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Paclitaxel

5.1.1.2. Sirolimus

5.2. Europe Drug-coated Balloon Catheter Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Coronary Artery Intervention

5.2.1.2. Peripheral Vascular Intervention

5.3. Europe Drug-coated Balloon Catheter Market Outlook, by End-use, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Hospital

5.3.1.2. Clinics

5.3.1.3. Ambulatory Surgical Centers

5.3.1.4. Other

5.3.2. BPS Analysis/Market Attractiveness Analysis

5.4. Europe Drug-coated Balloon Catheter Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Drug-coated Balloon Catheter Market by Drug, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Drug-coated Balloon Catheter Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Drug-coated Balloon Catheter Market by Drug, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Drug-coated Balloon Catheter Market by Application, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Drug-coated Balloon Catheter Market By Drug, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Drug-coated Balloon Catheter Market By Application, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Drug-coated Balloon Catheter Market By Drug, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Drug-coated Balloon Catheter Market By Application, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

5.4.1.13. Turkey Drug-coated Balloon Catheter Market By Drug, Value (US$ Bn), 2018 - 2030

5.4.1.14. Turkey Drug-coated Balloon Catheter Market By Application, Value (US$ Bn), 2018 - 2030

5.4.1.15. Turkey Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia Drug-coated Balloon Catheter Market By Drug, Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia Drug-coated Balloon Catheter Market By Application, Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest Of Europe Drug-coated Balloon Catheter Market By Drug, Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest Of Europe Drug-coated Balloon Catheter Market By Application, Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest Of Europe Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Drug-coated Balloon Catheter Market Outlook, 2018 - 2030

6.1. Asia Pacific Drug-coated Balloon Catheter Market Outlook, by Drug, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Paclitaxel

6.1.1.2. Sirolimus

6.2. Asia Pacific Drug-coated Balloon Catheter Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Coronary Artery Intervention

6.2.1.2. Peripheral Vascular Intervention

6.3. Asia Pacific Drug-coated Balloon Catheter Market Outlook, by End-use, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Hospital

6.3.1.2. Clinics

6.3.1.3. Ambulatory Surgical Centers

6.3.1.4. Other

6.3.2. BPS Analysis/Market Attractiveness Analysis

6.4. Asia Pacific Drug-coated Balloon Catheter Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Drug-coated Balloon Catheter Market by Drug, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Drug-coated Balloon Catheter Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Drug-coated Balloon Catheter Market by Drug, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Drug-coated Balloon Catheter Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Drug-coated Balloon Catheter Market by Drug, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Drug-coated Balloon Catheter Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Drug-coated Balloon Catheter Market by Drug, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Drug-coated Balloon Catheter Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Drug-coated Balloon Catheter Market by Drug, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Drug-coated Balloon Catheter Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Drug-coated Balloon Catheter Market by Drug, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Drug-coated Balloon Catheter Market by Application, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Drug-coated Balloon Catheter Market Outlook, 2018 - 2030

7.1. Latin America Drug-coated Balloon Catheter Market Outlook, by Drug, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Paclitaxel

7.1.1.2. Sirolimus

7.2. Latin America Drug-coated Balloon Catheter Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Coronary Artery Intervention

7.2.1.2. Peripheral Vascular Intervention

7.3. Latin America Drug-coated Balloon Catheter Market Outlook, by End-use, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Hospital

7.3.1.2. Clinics

7.3.1.3. Ambulatory Surgical Centers

7.3.1.4. Other

7.3.2. BPS Analysis/Market Attractiveness Analysis

7.4. Latin America Drug-coated Balloon Catheter Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Drug-coated Balloon Catheter Market by Drug, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Drug-coated Balloon Catheter Market by Application, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Drug-coated Balloon Catheter Market by Drug, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Drug-coated Balloon Catheter Market by Application Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina Drug-coated Balloon Catheter Market by Drug, Value (US$ Bn), 2018 - 2030

7.4.1.8. Argentina Drug-coated Balloon Catheter Market by Application, Value (US$ Bn), 2018 - 2030

7.4.1.9. Argentina Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America Drug-coated Balloon Catheter Market by Drug, Value (US$ Bn), 2018 - 2030

7.4.1.11. Rest of Latin America Drug-coated Balloon Catheter Market by Application, Value (US$ Bn), 2018 - 2030

7.4.1.12. Rest of Latin America Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Drug-coated Balloon Catheter Market Outlook, 2018 - 2030

8.1. Middle East & Africa Drug-coated Balloon Catheter Market Outlook, by Drug, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Paclitaxel

8.1.1.2. Sirolimus

8.2. Middle East & Africa Drug-coated Balloon Catheter Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Coronary Artery Intervention

8.2.1.2. Peripheral Vascular Intervention

8.3. Middle East & Africa Drug-coated Balloon Catheter Market Outlook, by End-use, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Hospital

8.3.1.2. Clinics

8.3.1.3. Ambulatory Surgical Centers

8.3.1.4. Other

8.3.2. BPS Analysis/Market Attractiveness Analysis

8.4. Middle East & Africa Drug-coated Balloon Catheter Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Drug-coated Balloon Catheter Market by Drug, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Drug-coated Balloon Catheter Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Drug-coated Balloon Catheter Market by Drug, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Drug-coated Balloon Catheter Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

8.4.1.7. Egypt Drug-coated Balloon Catheter Market by Drug, Value (US$ Bn), 2018 - 2030

8.4.1.8. Egypt Drug-coated Balloon Catheter Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.9. Egypt Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

8.4.1.10. Nigeria Drug-coated Balloon Catheter Market by Drug, Value (US$ Bn), 2018 - 2030

8.4.1.11. Nigeria Drug-coated Balloon Catheter Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.12. Nigeria Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Drug-coated Balloon Catheter Market by Drug, Value (US$ Bn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Drug-coated Balloon Catheter Market by Application, Value (US$ Bn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Drug-coated Balloon Catheter Market, by End-user, Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs Application Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Medtronic plc

9.4.1.1. Company Overview

9.4.1.2. Application Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Bayer AG

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Koninklijke Philips N.V.

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. B. Braun SE

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Boston Scientific Corporation

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Biosensors International Group

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Eurocor GmbH

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. iVascular

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Biotronik

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Caliber Therapeutics

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

9.4.11. Concept Medical, Inc.

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Drug Coverage |

|

|

Application Coverage |

|

|

End User Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |