The Electric and Fuel Cell Truck Market is valued at USD 40.1 Bn in 2026 and is projected to reach USD 338 Bn, growing at a CAGR of 36% by 2033

Market Analysis in Brief

Electric and fuel cell trucks are the best alternatives to trucks with internal combustion engines. Electric and fuel cell truck are considered as a promising alternative to traditional diesel-powered trucks a fight against climate change and the quest for sustainable transportation. These trucks are electronic-based vehicles with embedded systems, fuel cells, batteries, and capacitors to charge the batteries.

Fuel cell trucks uses hydrogen fuel cells to generate electricity that in turn powers the electric motors in the truck. Electric and fuel cell truck offers significant environmental benefits, fuel efficiency, and noise reduction. ITM Power, a UK-based maker of hydrogen energy, announced the formation of the H2Oz bus project and the signing of an MoU with partners in May 2020. Evaluation and implementation of the hydrogen fuel electric bus concept for Australia's public bus transportation.

Additionally, vehicles with internal combustion engines and hydrogen fuel cells can produce the pollution stored in the hydrogen. The rising demand for electric and fuel-cell vehicles mostly relies on electricity. Increased government initiatives for developing electric and fuel cell trucks with infrastructures for refuelling the petrol developed and considering the environment by producing and manufacturing the electric and fuel cell trucks with increased consumer demands extended the market due to less carbon emission. This helps the environment to be green and clean.

Due to fuel efficiency, low emissions, and rising petrol and diesel prices, there is an increase in demand for electric and fuel trucks. which contributes to a greater extent to the market's growth during the predicted period. The market for electric and fuel cells has grown because of increased investments and public knowledge of newly developed features in the automotive industry.

Key Report Findings

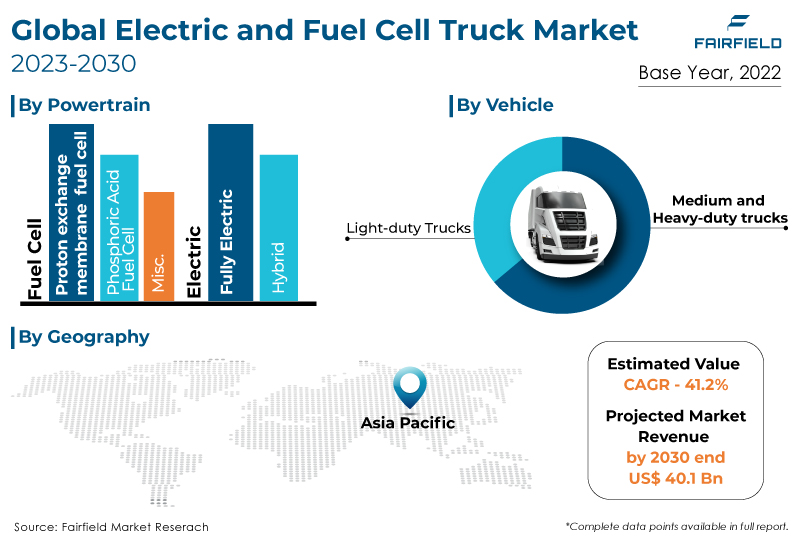

- The market for electric and fuel cell truck will demonstrate more than 40x expansion in revenue over the decade, i.e., between 2020 and 2030.

- Proton exchange membrane fuel cell hold the major share in the fuel cell truck segment.

- Demand for medium and heavy trucks will continue to be on the rise.

- Asia Pacific will continue to lead its way, whereas North America's electric and fuel cell truck market will experience the strongest growth till 2030.

Growth Drivers

Commitment of OEMs and Suppliers to Net Zero Emission Plans and Reduced Cost of Ownership (TCO)

In 2022, medium and heavy truck fleet represented less than 10% of the global on-road vehicle. Majority of the fleet used diesel as the primary fuel as it offers high average annual mileage. The high diesel consumption of truck sector contributed to more than 31% (or 6.5% of the global CO2 emissions) of the global transport sector's GHG emissions. Government interest in developing electric and fuel cell trucks has grown due to reduced carbon and noise pollution emissions, increased environmental awareness, and the need to maintain a global economy.

Market participants in the automotive industry are also increasing their investments, encouraging the development of new technologies for electric and fuel-cell trucks through increased research and development. Increased R&D spending, continual innovation, production of new products, and the emergence of electric and fuel cell trucks all contributed to the market's expansion.

Favourable Policies, and Supportive Government Initiatives

Government support and encouragement to build more fuel cells and electric trucks that emit less carbon dioxide and benefit the global ecology are increasing, helping to push the industry. The major players in the market who are engaged in creating the new, improved electric fuel cell truck with innovations have demonstrated a rise in the market with higher benefits, low carbon dioxide emissions, and reduced air pollution, contributing to growing the market revenue share.

Increased market demand for newly created technologies with new features placed in automobiles. Driving the market for electric and fuel cell trucks with less noise and carbon emissions. It helps keep a green ecology in the environment. In the automotive sector, fuel cells are widely used in various vehicles, including buses, trains, passenger cars, and light commercial vehicles. With stored electricity in the battery, it can be used as a power bank whenever necessary. Increased government funding for the development of trucks is being made possible by growing transportation costs, a greater emphasis on protecting the environment, and growth in the market due to research and development.

Market Challenges

Prohibitive Costs

The cost of electric and fuel cell trucks has increased due to the market's rising desire for new technologies, resulting in high costs for the raw materials needed for manufacturing. This is the main issue that could have an impact on market rates. Using hydrogen and oxygen, fuel cells generate power that is stored in batteries through a chemical reaction. Because hydrogen is extremely flammable and can start a fire, it must be handled carefully. Hydrogen's highly combustible characteristics may hamper electric and fuel cell truck market growth.

Furthermore, electric truck charging ecosystem is likely to destabilise electricity distribution systems. Currently, electric truck performance is also lesser when compared to its diesel counterparts, especially in model options, recharge time, range, payloads, and overall vehicle maintenance.

Overview of Key Segments

Fully Electric and Proton Exchange Membrane Fuel Cell (PEMFC) Categories Surge Ahead

One of the cleanest and most effective energy conversion technologies, PEMFC is anticipated to be a key component of future energy solutions. Through the interaction of hydrogen and oxygen over a suitable catalyst, the PEM fuel cell directly converts a fuel's chemical energy into electricity with water as a byproduct. Pt currently possesses the highest catalytic activity for hydrogen oxidation reaction at the anode side and oxygen reduction reaction (ORR) at the cathode, making carbon-supported Pt materials the most suggested catalysts for PEM fuel cells.

The fuel cell truck market is dominated by proton exchange membrane fuel cells due to high power density, low operating temperatures, and quick startup times are just a few of the latest breakthroughs and technology that have the PEMFC at their advantage. Due to its enhanced stability, higher power production, and other benefits, phosphoric acid fuel cells are also available for transportation applications. It can encourage market expansion on a large scale.

Medium- and Heavy-duty Trucks Remain Dominant

Increasing new launches of medium- and heavy-duty electric truck models in the market, a continual drop in battery costs, and strong support from policymakers across the globe have aided to bring medium- and heavy-duty electric truck into the mainstream transportation sector. Medium- and heavy-duty electric trucks are considered as a promising solution to the decarbonizing of transportation sector worldwide.

medium- and heavy-duty electric trucks are expected to cheaper to buy, operate, and maintain than diesel trucks by 2030. Light-duty trucks are expected to be cost competitive before 2030. Medium- and heavy-duty trucks category will dominate the electric and fuel cell truck market over the forecast period. Furthermore, hydrogen fuel cell electric trucks are forecasted to become cost competitive for long-haul with greater than 400 Kms of range.

Growth Opportunities Across Regions

Asia Pacific Spearheads

The electric and fuel cell truck market will continue to dominate Asia Pacific due to increased goods transportation and improved innovations with new technologies in the electric and fuel cell trucks. Asia Pacific region will continue to occupy the top spot with an increased revenue share. Expanding the market rate is aided by improved infrastructure, more government funding, and an emphasis on zero emissions and reduced noise pollution in the electric and fuel cell markets. The demand for fuel-cell commercial cars in the area is also anticipated to rise due to several recent events regarding investments in fuel-cell-powered vehicles. With plans for hydrogen technology and investments in this industry, several significant cities and nations have announced their aim to minimise emissions from commercial vehicles.

Furthermore, by 2050, the Japanese government hopes to be carbon neutral thanks to hydrogen-powered automobiles. According to its third Strategic Roadmap for Hydrogen and Fuel Cells, it has set a lofty goal of putting 320 hydrogen filling stations and 200,000 fuel cell vehicles (FCVs) on the road by 2025, up from just 3,600 in 2019.

North America Develops a Lucrative Market

The market for electric and fuel cell truck across North America will display a significant growth over the forecast period. The US market for medium- and heavy-duty trucks is likely to follow the trajectory of China’s EV growth. In the US, California is commanding the demand for medium- and heavy-duty truck. Due to increased research & development efforts and launches of new medium-and heavy-duty models leading market participants, North America is also significantly boosting the industry's growth and demand.

Electric and Fuel Cell Truck Market: Competitive Landscape

Some of the leading players at the forefront in the electric and fuel cell truck market space include Volvo Inc., Daimler AG, BYD, Traton Group, Renault Trucks, SANY, China FAW Group Corp., Ltd., Dongfeng Motor Corporation Ltd., SAIC Motor, Zhejiang Geely Holding Group Co., Ltd., and Zhengzhou Yutong Group Co., Ltd.

Recent Notable Developments

In October 2021, the launch of the 'Renault Master Van H2-Tech prototype' by Plug Power Inc. in October 2021 will use HYVIA hydrogen. Providing turnkey hydrogen solutions in 2021 at the Plug Power Symposium with enhanced environmental awareness and a stronger global economy. Launching a vehicle in North America with upgraded features and a hydrogen fuel cell.

In November 2021, Arcola Energy, a systems engineering firm based in the UK that specialises in integrating hydrogen fuel cell power trains and vehicle systems, was acquired by Ballard Power Systems, the largest company in the PE fuel cell engine development and production for medium and heavy-duty vehicles.

The Global Electric and Fuel Cell Truck Market is Segmented as Below:

By Powertrain

- Electric

- Fully Electric

- Hybrid

- Fuel Cell

- Phosphoric Acid Fuel Cell

- Proton Exchange Membrane Fuel Cell

- Miscellaneous

By Range

- Below 400 Km

- Above 400 Km

By Vehicles

- Light-duty Trucks

- Medium-duty Trucks

- Heavy-duty Trucks

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC

- Rest of Middle East & Africa

Leading Companies

- Volvo Inc.

- Daimler AG

- BYD

- Traton Group

- Renault Trucks

- SANY

- China FAW Group Corp., Ltd.

- Dongfeng Motor Corporation Ltd.

- SAIC Motor

- XCMG

- DAF Trucks

- BAIC Group

- Zhejiang Geely Holding Group Co., Ltd.

- Zhengzhou Yutong Group Co., Ltd.

- Nikola Motor

- Proterra

- Tesla Inc.

- Executive Summary

- Global Electric and Fuel Cell Truck Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Electric and Fuel Cell Truck Market Outlook, 2020 - 2033

- Global Electric and Fuel Cell Truck Market Outlook, by Powertrain, Value (US$ Mn), 2020-2033

- Electric

- Fully Electric

- Hybrid

- Fuel Cell

- Phosphoric Acid Fuel Cell

- Proton Exchange Membrane Fuel Cell

- Miscellaneous

- Global Electric and Fuel Cell Truck Market Outlook, by Range, Value (US$ Mn), 2020-2033

- Below 400 Km

- Above 400 Km

- Global Electric and Fuel Cell Truck Market Outlook, by Vehicles, Value (US$ Mn), 2020-2033

- Light-duty Trucks

- Medium-duty Trucks

- Heavy-duty Trucks

- Global Electric and Fuel Cell Truck Market Outlook, by Region, Value (US$ Mn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Electric

- Global Electric and Fuel Cell Truck Market Outlook, by Powertrain, Value (US$ Mn), 2020-2033

- North America Electric and Fuel Cell Truck Market Outlook, 2020 - 2033

- North America Electric and Fuel Cell Truck Market Outlook, by Powertrain, Value (US$ Mn), 2020-2033

- Electric

- Fully Electric

- Hybrid

- Fuel Cell

- Phosphoric Acid Fuel Cell

- Proton Exchange Membrane Fuel Cell

- Miscellaneous

- North America Electric and Fuel Cell Truck Market Outlook, by Range, Value (US$ Mn), 2020-2033

- Below 400 Km

- Above 400 Km

- North America Electric and Fuel Cell Truck Market Outlook, by Vehicles, Value (US$ Mn), 2020-2033

- Light-duty Trucks

- Medium-duty Trucks

- Heavy-duty Trucks

- North America Electric and Fuel Cell Truck Market Outlook, by Country, Value (US$ Mn), 2020-2033

- S. Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- S. Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- S. Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- Canada Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- Canada Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- Canada Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Electric

- North America Electric and Fuel Cell Truck Market Outlook, by Powertrain, Value (US$ Mn), 2020-2033

- Europe Electric and Fuel Cell Truck Market Outlook, 2020 - 2033

- Europe Electric and Fuel Cell Truck Market Outlook, by Powertrain, Value (US$ Mn), 2020-2033

- Electric

- Fully Electric

- Hybrid

- Fuel Cell

- Phosphoric Acid Fuel Cell

- Proton Exchange Membrane Fuel Cell

- Miscellaneous

- Europe Electric and Fuel Cell Truck Market Outlook, by Range, Value (US$ Mn), 2020-2033

- Below 400 Km

- Above 400 Km

- Europe Electric and Fuel Cell Truck Market Outlook, by Vehicles, Value (US$ Mn), 2020-2033

- Light-duty Trucks

- Medium-duty Trucks

- Heavy-duty Trucks

- Europe Electric and Fuel Cell Truck Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Germany Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- Germany Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- Germany Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- Italy Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- Italy Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- Italy Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- France Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- France Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- France Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- K. Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- K. Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- K. Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- Spain Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- Spain Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- Spain Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- Russia Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- Russia Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- Russia Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- Rest of Europe Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- Rest of Europe Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- Rest of Europe Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Electric

- Europe Electric and Fuel Cell Truck Market Outlook, by Powertrain, Value (US$ Mn), 2020-2033

- Asia Pacific Electric and Fuel Cell Truck Market Outlook, 2020 - 2033

- Asia Pacific Electric and Fuel Cell Truck Market Outlook, by Powertrain, Value (US$ Mn), 2020-2033

- Electric

- Fully Electric

- Hybrid

- Fuel Cell

- Phosphoric Acid Fuel Cell

- Proton Exchange Membrane Fuel Cell

- Miscellaneous

- Asia Pacific Electric and Fuel Cell Truck Market Outlook, by Range, Value (US$ Mn), 2020-2033

- Below 400 Km

- Above 400 Km

- Asia Pacific Electric and Fuel Cell Truck Market Outlook, by Vehicles, Value (US$ Mn), 2020-2033

- Light-duty Trucks

- Medium-duty Trucks

- Heavy-duty Trucks

- Asia Pacific Electric and Fuel Cell Truck Market Outlook, by Country, Value (US$ Mn), 2020-2033

- China Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- China Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- China Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- Japan Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- Japan Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- Japan Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- South Korea Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- South Korea Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- South Korea Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- India Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- India Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- India Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- Southeast Asia Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- Southeast Asia Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- Southeast Asia Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- Rest of SAO Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- Rest of SAO Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- Rest of SAO Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Electric

- Asia Pacific Electric and Fuel Cell Truck Market Outlook, by Powertrain, Value (US$ Mn), 2020-2033

- Latin America Electric and Fuel Cell Truck Market Outlook, 2020 - 2033

- Latin America Electric and Fuel Cell Truck Market Outlook, by Powertrain, Value (US$ Mn), 2020-2033

- Electric

- Fully Electric

- Hybrid

- Fuel Cell

- Phosphoric Acid Fuel Cell

- Proton Exchange Membrane Fuel Cell

- Miscellaneous

- Latin America Electric and Fuel Cell Truck Market Outlook, by Range, Value (US$ Mn), 2020-2033

- Below 400 Km

- Above 400 Km

- Latin America Electric and Fuel Cell Truck Market Outlook, by Vehicles, Value (US$ Mn), 2020-2033

- Light-duty Trucks

- Medium-duty Trucks

- Heavy-duty Trucks

- Latin America Electric and Fuel Cell Truck Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Brazil Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- Brazil Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- Brazil Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- Mexico Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- Mexico Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- Mexico Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- Argentina Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- Argentina Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- Argentina Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- Rest of LATAM Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- Rest of LATAM Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- Rest of LATAM Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Electric

- Latin America Electric and Fuel Cell Truck Market Outlook, by Powertrain, Value (US$ Mn), 2020-2033

- Middle East & Africa Electric and Fuel Cell Truck Market Outlook, 2020 - 2033

- Middle East & Africa Electric and Fuel Cell Truck Market Outlook, by Powertrain, Value (US$ Mn), 2020-2033

- Electric

- Fully Electric

- Hybrid

- Fuel Cell

- Phosphoric Acid Fuel Cell

- Proton Exchange Membrane Fuel Cell

- Miscellaneous

- Middle East & Africa Electric and Fuel Cell Truck Market Outlook, by Range, Value (US$ Mn), 2020-2033

- Below 400 Km

- Above 400 Km

- Middle East & Africa Electric and Fuel Cell Truck Market Outlook, by Vehicles, Value (US$ Mn), 2020-2033

- Light-duty Trucks

- Medium-duty Trucks

- Heavy-duty Trucks

- Middle East & Africa Electric and Fuel Cell Truck Market Outlook, by Country, Value (US$ Mn), 2020-2033

- GCC Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- GCC Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- GCC Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- South Africa Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- South Africa Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- South Africa Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- Egypt Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- Egypt Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- Egypt Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- Nigeria Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- Nigeria Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- Nigeria Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- Rest of Middle East Electric and Fuel Cell Truck Market Outlook, by Powertrain, 2020-2033

- Rest of Middle East Electric and Fuel Cell Truck Market Outlook, by Range, 2020-2033

- Rest of Middle East Electric and Fuel Cell Truck Market Outlook, by Vehicles, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Electric

- Middle East & Africa Electric and Fuel Cell Truck Market Outlook, by Powertrain, Value (US$ Mn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Volvo Inc.

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Daimler AG

- BYD

- Traton Group

- Renault Trucks

- SANY

- China FAW Group Corp., Ltd.

- Dongfeng Motor Corporation Ltd.

- SAIC Motor

- XCMG

- Volvo Inc.

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Powertrain Coverage |

|

|

Range Coverage |

|

|

Vehicle Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Price Trend Analysis, Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |