Pea Protein Ingredient Market Growth and Industry Forecast

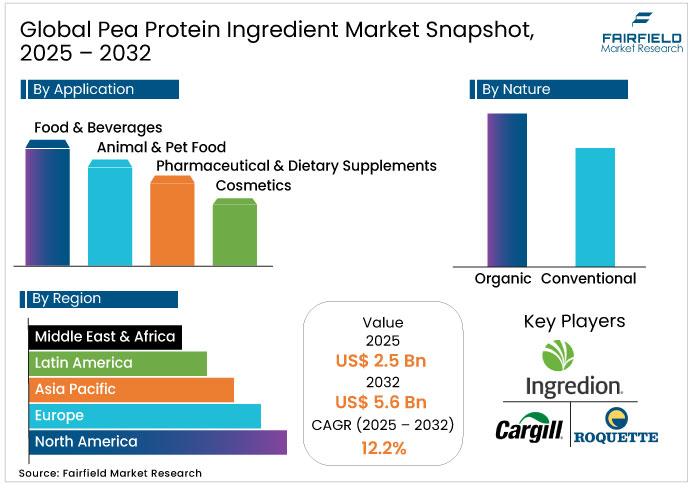

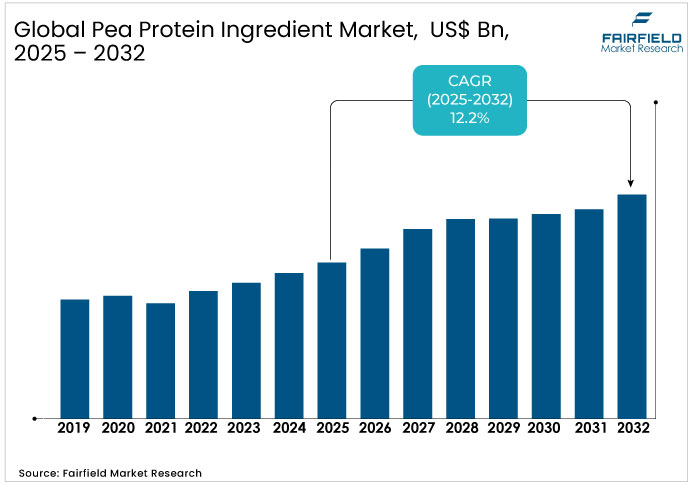

The global pea protein ingredient market is valued at USD 2.5 Bn in 2025 and is likely to reach USD 5.6 Bn by 2032, growing at a CAGR of 12.2% over the forecast period 2025 - 2032.

Pea Protein Ingredient Market Summary: Key Insights & Trends

- Conventional pea protein leads the Pea Protein Ingredient market with around 80% share, supported by large-scale yields.

- Organic pea protein is the fastest growing, rising steadily despite higher costs, holding a smaller but expanding share.

- Pea protein isolate dominates the type segment with about 76% share due to its high purity.

- Pea protein concentrate is the fastest-growing type, gaining share through cost-effective use in bakery products.

- Food & beverages lead applications with about 55% share, supported by versatile use in meat analogs and beverages.

- Animal & pet food is a rapidly expanding application, steadily gaining share from sustainability-driven feed demand.

- North America leads regionally with about 35% share, driven by vegan adoption and strong R&D support.

- Europe follows with around 30% share, led by sustainability policies and expanding organic mandates.

- Asia Pacific is the fastest-growing region, steadily increasing its share through urbanization and dietary shifts.

Key Growth Drivers

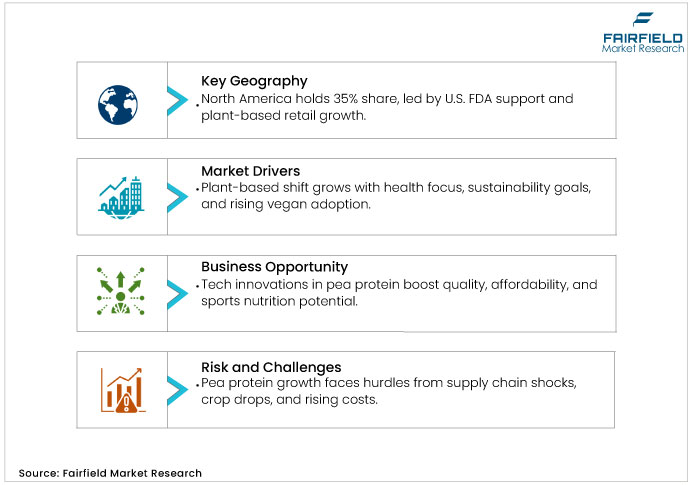

- Global Shift to Plant-Based Diets Fuels Pea Protein Ingredient Growth

The shift toward plant-based diets is propelled by health awareness and environmental sustainability, as reported by the Food and Agriculture Organization (FAO). In 2023, animal agriculture accounted for 14.5% of global greenhouse gas emissions, prompting consumers to seek alternatives like pea protein. The U.S. Department of Agriculture (USDA) notes that plant-based protein markets are projected to reach USD 20 billion by 2025, with a 10% annual growth rate. This is further impacted by increasing adoption in food and beverages, where pea protein's hypoallergenic properties support allergen-free formulations. Technological advancements, such as improved extraction methods, enhance solubility and taste, aligning with demographic shifts toward veganism, which has grown 3.2% in Europe per 2023 data. Regulatory changes, including EU investments of EUR 20 million in plant-based research, further boost production efficiency and market penetration.

- Nutritional Value and Health Benefits Drive Functional Uses of Pea Protein

Pea protein's high nutritional profile, including essential amino acids and digestibility, drives its use in supplements and functional foods, according to USDA data. In 2023, the global burden of celiac disease affected 3.2 million Americans, increasing demand for gluten-free options like pea protein, which offers 50-60% protein content in concentrates. This factor influences the pea protein ingredients by expanding applications in sports nutrition, where branched-chain amino acids support muscle recovery. Macroeconomic trends, such as rising disposable incomes in developing economies, contribute to a 12% growth in functional food sales. International organizations like FAO highlight pea protein's role in addressing protein deficiencies, with production rising 5% annually. Demographic shifts, including aging populations seeking hypoallergenic proteins, combined with technological innovations in hydrolysate forms for better absorption, position pea protein as a key ingredient in pharmaceutical supplements.

- Sustainability Advantages Strengthen Pea Protein Ingredient Adoption Worldwide

Sustainability concerns drive pea protein adoption, as it requires fewer resources than animal proteins, per FAO reports. In 2022, livestock production emitted 14.5% of global GHGs, leading to a 30% rise in plant-based alternatives. The USDA's 2023 Agricultural Innovation Agenda allocated USD 5 million for plant-based research, supporting pea cultivation that yields 13.5 million metric tons globally. This driver affects the Pea Protein Ingredient Market by promoting eco-friendly supply chains, reducing costs by 8-10% through efficient farming. Regulatory bodies like the European Commission invested EUR 10 billion in sustainable agriculture under CAP 2023, enhancing pea protein's viability. Macroeconomic trends, including urbanization increasing protein needs by 79 million urban migrants annually (2019-2025), align with technological advancements in dry processing for lower water use. Demographic shifts toward flexitarian diets, with 61% preferring plant sources per Kerry's 2021 survey, further accelerate market growth.

Key Restraints

- Supply Chain Instability and Geopolitical Risks Challenge Pea Protein Ingredient Growth

Supply chain issues, including crop yield fluctuations and geopolitical tensions, hinder growth in the pea protein ingredient market. The USDA reported a 3% decline in U.S. dry pea seeding for 2021-22, leading to a 44% production drop to 0.5 million metric tons. This causes price surges of 12-14% due to transportation shortages, impacting competitors' costs and availability. Bottlenecks in post-harvest storage exacerbate losses, creating uncertainty for manufacturers.

- Rising Production Costs and Certification Barriers Limit Pea Protein Ingredient Expansion

Elevated production costs, driven by processing intensity, restrain market expansion. AgFunder noted an 8-10% rise in raw material costs for plant-based ingredients in 2023, with pea protein isolates increasing 5-7%. Regulatory hurdles for organic certification add expenses, threatening smaller competitors. Supply chain dependencies on key producers like Russia face trade restrictions, limiting scalability.

Pea Protein Ingredient Market Trends and Opportunities

- Innovative Processing Technologies Unlock New Opportunities in Pea Protein Ingredient Industry

Advancements in extraction and texturization technologies present opportunities in the pea protein ingredient market, estimated at USD 1.5 billion by 2030 for innovative applications. Benson Hill's 2021 yellow pea breeding program aims to yield superior peas, improving protein density by 20%. In developing economies like India, where plant-based demand grows 10% annually, these technologies address unmet needs for affordable, high-quality proteins. Supportive policies, including USD 16.5 million from USDA's NIFA for plant-based R&D, enable hybrid formulations enhancing amino acid profiles, targeting a USD 20 billion sports nutrition segment by 2025.

- Urbanization and Health Trends Accelerate Protein Adoption in Emerging Regions

Expanding markets in Asia-Pacific and Latin America will offer significant opportunities, with strong growth expected across the region. China’s pea protein industry is advancing rapidly, fueled by urbanization and rising health awareness. In India, unmet demand for allergen-free proteins aligns with growing vegan adoption and supportive government initiatives. Policy shifts promoting sustainable agriculture and local cultivation are further enhancing market potential while reducing import dependence.

Segment-wise Trends & Analysis

Conventional Protein Leads due to Lower Production Costs and Global Availability

The conventional segment leads the pea protein ingredient market with an 80% share in 2025, valued at US$2.0 billion, due to lower production costs and widespread availability, as per USDA data on conventional pea yields exceeding 25 million tons annually. Organic, however, emerges as the fastest-growing at 15.5% CAGR, driven by premium pricing and certifications boosting margins by 25%.

- Key trend: Rising e-commerce sales of organic variants up 30% in 2025.

- Challenge: Higher certification costs limit small-farm adoption.

- Opportunity: Subsidies in EU for organic conversion add 10% to yields.

- Trend: Integration with blockchain for traceability enhances consumer trust.

Pea Protein Isolate Leads with High Purity and Widespread Premium Applications

Pea protein isolate dominates with 76% market share in 2025, amounting to US$1.9 Bn, favored for its 90% purity in high-end applications like supplements. Concentrate follows as the fastest-growing at 13.8% CAGR, propelled by cost advantages in baked goods. Hydrolysate trails but gains from digestibility improvements.

- Trend: Isolate's use in ready-to-drink shakes rises 20%.

- Challenge: High extraction energy increases costs by 15%.

- Opportunity: Hydrolysate in sports nutrition targets US$2 Bn unmet segment.

- Challenge: Flavor masking tech lags, affecting 10% adoption.

Food and Beverages Lead Supported by Versatile Use Across Multiple Categories

Food & beverages command 55% share, valued at US$1.375 Bn in 2025, leading due to versatile use in meat analogs. Animal & pet food is the fastest-growing segment, supported by rising demand for sustainable feed solutions, supported by sustainable feed demands. Pharma and cosmetics lag but expand via functional claims.

- Trend: Beverages incorporate 40% more pea protein for fortification.

- Challenge: Texture issues in extrusion processes affect 15% products.

- Opportunity: Pet food premiums yield $0.5 billion in Asia by 2030.

- Trend: Cosmetics shift to pea-derived emulsifiers, up 25%

Regional Trends & Analysis

North America Leads with Strong Vegan Trends and Robust R&D Support

North America leads with 35% global share, driven by vegan trends and robust R&D. U.S. dominates, supported by FDA approvals and retail expansions in plant-based aisles, per PBFA 2025 data.

U.S. Pea Protein Ingredient Market – 2025 Snapshot & Outlook

The U.S. market reaches $0.9 billion in 2025, growing at 13% CAGR to $2.0 billion by 2032. Demand surges from 45% plant-based adoption per Nielsen 2025 survey. Government policies like the 2025 Farm Bill provide $1 billion in crop incentives, enhancing margins by 12%. Retail shifts to e-commerce boost accessibility, with Amazon sales up 25%. Consumer trend: 62% seek sustainable proteins, citing EFSA digestibility data.

Technological advancements in U.S. facilities improve yields by 18%, per USDA reports. Export opportunities to EU add 10% revenue. Challenges include tariff impacts on imports.

- Plant-based meat sales hit US$1.5 billion annually.

- R&D investments total US$300 million in 2025.

- Vegan population exceeds 10 million consumers.

Europe Leads Through Sustainability Policies and Expanding Organic Product Mandates

Europe captures 30% of the pea protein ingredient market, emphasizing sustainability via EU Farm to Fork strategy. Germany and the U.K. lead with organic mandates and Brexit-adjusted imports, growing 11.5% per Eurostat 2025.

Germany Pea Protein Ingredient Market – 2025 Snapshot & Outlook

Germany's market hits $0.4 billion in 2025, at 12% CAGR to $0.9 billion by 2032. Bioeconomy policies subsidize 15% of production costs. Tax incentives for green tech yield 8% margin gains. Retail organic channels expand 20%. Trend: 55% consumers prefer pea over soy, per the German Nutrition Society survey.

Innovations in hydrolysates support pharma exports, up 22%. Supply chains integrate with French pea farms.

- Organic share reaches 40% in supplements.

- Export volumes grow 18% to Asia.

- Sustainability certifications cover 70% output.

U.K. Pea Protein Ingredient Market – 2025 Snapshot & Outlook

U.K. market stands at $0.3 billion in 2025, with 11.8% CAGR to $0.7 billion by 2032. Post-Brexit subsidies aid local sourcing, cutting costs 10%. VAT reductions on healthy foods drive 15% sales. E-commerce penetration hits 40%. Trend: 48% cite allergy avoidance, per FSA 2025 data.

Functional food R&D invests £200 million. Partnerships with EU suppliers stabilize supply.

- Pet food applications surge 25%.

- Clean-label demands influence 60% purchases.

- Innovation hubs launch 10 new variants yearly.

Asia Pacific Leads with Urbanization, Protein Gaps, and Sectoral Innovations

Asia Pacific grows at 14% in the industry, led by urbanization and protein gaps. Japan focuses on aging nutrition, South Korea on K-beauty cosmetics, China on feed scalability, per Asia Protein Association 2025.

Japan Pea Protein Ingredient Market – 2025 Snapshot & Outlook

Japan's market totals $0.25 billion in 2025, at 12.5% CAGR to $0.6 billion by 2032. Aging policies fund 20% R&D for supplements. Tax breaks on imports enhance affordability by 9%. Retail konbini chains stock 30% more variants. Trend: 65% elderly seek joint health, per MHLW survey.

Hydrolysate tech improves absorption 20%. Domestic pea trials expand acreage 12%.

- Supplement sales exceed ¥50 billion.

- Cosmetics integration grows 22%.

- Regulatory approvals streamline 15 launches.

India Pea Protein Ingredient Market – 2025 Snapshot & Outlook

India's market achieves $0.35 billion in 2025, with 15.2% CAGR to $1.0 billion by 2032. PLI scheme subsidizes 25% manufacturing. GST reductions boost exports 18%. Urban retail penetration rises 35%. Trend: 40% youth adopt veganism, per FSSAI 2025 data.

Local sourcing cuts logistics 15%. Animal feed demand from dairy sector surges.

- Feed applications capture 50% share.

- Organic farming initiatives cover 20% fields.

- E-commerce drives 30% volume growth.

Competitive Landscape Analysis

The players in the pea protein ingredient market is focusing on capacity expansions to meet rising demand and close supply gaps. Industry leaders are investing heavily, with Roquette’s 2025 facility upgrade boosting annual output by 50,000 tons and Cargill strengthening its sourcing network through strategic partnerships. These initiatives are designed to offset raw material volatility and ensure consistent supply.

New regulations on sustainability labeling will raise compliance costs by 8%, while M&As like Ingredion's 2025 acquisition of a bio-tech firm enhance innovation pipelines. Early movers will benefit from premium pricing at 15% margins, while latecomers may face supply shortages.

Key Companies

- Roquette Frères

- Cargill, Incorporated

- Ingredion Incorporated

- Glanbia PLC

- DuPont de Nemours

- Emsland Group

- Burcon NutraScience

- PURIS

- Axiom Foods, Inc.

- Cosucra Groupe Warcoing SA

- Yantai Shuangta Foods Co., Ltd.

- Shandong Jianyuan Group

- Fenchem Inc.

- The Scoular Company

- Martin & Pleasance

Recent Developments:

- June 2025 - Roquette expanded its NUTRALYS® plant protein portfolio with two new textured proteins: T WHEAT 600L, a wheat-based fiber-rich ingredient mimicking chicken-such as texture and color; and T PEA 700XC, a large-chunk pea protein that retains its bite and appearance even after cooking.

- June 2025 - Cargill’s 2025 Protein Profile highlights that protein has become central to diets, influencing every meal occasion with consumers increasingly valuing it for nutrition, taste, and emotional wellbeing.

Global Pea Protein Ingredient Market Segmentation-

By Nature

- Organic

- Conventional

By Type

- Isolate

- Concentrate

- Hydrolysate

By Application

- Food & Beverages

- Cereals & Snacks

- Meat Substitute

- Bakery & Confectionery

- Performance Nutrition

- Beverages & Desserts

- Animal & Pet Food

- Pharmaceutical & Dietary Supplements

- Cosmetics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Pea Protein Ingredient Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global Pea Protein Ingredient Market Outlook, 2019 - 2032

3.1. Global Pea Protein Ingredient Market Outlook, by Nature, Value (US$ Bn), 2019 - 2032

3.1.1. Organic

3.1.2. Conventional

3.2. Global Pea Protein Ingredient Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

3.2.1. Food & Beverages

3.2.1.1. Cereals & Snacks

3.2.1.2. Meat Substitute

3.2.1.3. Bakery & Confectionery

3.2.1.4. Performance Nutrition

3.2.1.5. Beverages & Desserts

3.2.2. Animal & Pet Food

3.2.3. Pharmaceutical & Dietary Supplements

3.2.4. Cosmetics

3.3. Global Pea Protein Ingredient Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

3.3.1. Isolate

3.3.2. Concentrate

3.3.3. Hydrolysate

3.4. Global Pea Protein Ingredient Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.4.1. North America

3.4.2. Europe

3.4.3. Asia Pacific

3.4.4. Latin America

3.4.5. Middle East & Africa

4. North America Pea Protein Ingredient Market Outlook, 2019 - 2032

4.1. North America Pea Protein Ingredient Market Outlook, by Nature, Value (US$ Bn), 2019 - 2032

4.1.1. Organic

4.1.2. Conventional

4.2. North America Pea Protein Ingredient Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

4.2.1. Food & Beverages

4.2.1.1. Cereals & Snacks

4.2.1.2. Meat Substitute

4.2.1.3. Bakery & Confectionery

4.2.1.4. Performance Nutrition

4.2.1.5. Beverages & Desserts

4.2.2. Animal & Pet Food

4.2.3. Pharmaceutical & Dietary Supplements

4.2.4. Cosmetics

4.3. North America Pea Protein Ingredient Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

4.3.1. Isolate

4.3.2. Concentrate

4.3.3. Hydrolysate

4.4. North America Pea Protein Ingredient Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.4.1. U.S. Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

4.4.2. U.S. Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

4.4.3. U.S. Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

4.4.4. Canada Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

4.4.5. Canada Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

4.4.6. Canada Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

4.5. BPS Analysis/Market Attractiveness Analysis

5. Europe Pea Protein Ingredient Market Outlook, 2019 - 2032

5.1. Europe Pea Protein Ingredient Market Outlook, by Nature, Value (US$ Bn), 2019 - 2032

5.1.1. Organic

5.1.2. Conventional

5.2. Europe Pea Protein Ingredient Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

5.2.1. Food & Beverages

5.2.1.1. Cereals & Snacks

5.2.1.2. Meat Substitute

5.2.1.3. Bakery & Confectionery

5.2.1.4. Performance Nutrition

5.2.1.5. Beverages & Desserts

5.2.2. Animal & Pet Food

5.2.3. Pharmaceutical & Dietary Supplements

5.2.4. Cosmetics

5.3. Europe Pea Protein Ingredient Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

5.3.1. Isolate

5.3.2. Concentrate

5.3.3. Hydrolysate

5.4. Europe Pea Protein Ingredient Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.4.1. Germany Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

5.4.2. Germany Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

5.4.3. Germany Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

5.4.4. Italy Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

5.4.5. Italy Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

5.4.6. Italy Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

5.4.7. France Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

5.4.8. France Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

5.4.9. France Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

5.4.10. U.K. Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

5.4.11. U.K. Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

5.4.12. U.K. Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

5.4.13. Spain Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

5.4.14. Spain Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

5.4.15. Spain Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

5.4.16. Russia Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

5.4.17. Russia Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

5.4.18. Russia Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

5.4.19. Rest of Europe Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

5.4.20. Rest of Europe Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

5.4.21. Rest of Europe Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

5.5. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Pea Protein Ingredient Market Outlook, 2019 - 2032

6.1. Asia Pacific Pea Protein Ingredient Market Outlook, by Nature, Value (US$ Bn), 2019 - 2032

6.1.1. Organic

6.1.2. Conventional

6.2. Asia Pacific Pea Protein Ingredient Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

6.2.1. Food & Beverages

6.2.1.1. Cereals & Snacks

6.2.1.2. Meat Substitute

6.2.1.3. Bakery & Confectionery

6.2.1.4. Performance Nutrition

6.2.1.5. Beverages & Desserts

6.2.2. Animal & Pet Food

6.2.3. Pharmaceutical & Dietary Supplements

6.2.4. Cosmetics

6.3. Asia Pacific Pea Protein Ingredient Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

6.3.1. Isolate

6.3.2. Concentrate

6.3.3. Hydrolysate

6.4. Asia Pacific Pea Protein Ingredient Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.4.1. China Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

6.4.2. China Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

6.4.3. China Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

6.4.4. Japan Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

6.4.5. Japan Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

6.4.6. Japan Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

6.4.7. South Korea Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

6.4.8. South Korea Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

6.4.9. South Korea Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

6.4.10. India Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

6.4.11. India Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

6.4.12. India Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

6.4.13. Southeast Asia Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

6.4.14. Southeast Asia Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

6.4.15. Southeast Asia Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

6.4.16. Rest of SAO Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

6.4.17. Rest of SAO Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

6.4.18. Rest of SAO Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

6.5. BPS Analysis/Market Attractiveness Analysis

7. Latin America Pea Protein Ingredient Market Outlook, 2019 - 2032

7.1. Latin America Pea Protein Ingredient Market Outlook, by Nature, Value (US$ Bn), 2019 - 2032

7.1.1. Organic

7.1.2. Conventional

7.2. Latin America Pea Protein Ingredient Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

7.2.1. Food & Beverages

7.2.1.1. Cereals & Snacks

7.2.1.2. Meat Substitute

7.2.1.3. Bakery & Confectionery

7.2.1.4. Performance Nutrition

7.2.1.5. Beverages & Desserts

7.2.2. Animal & Pet Food

7.2.3. Pharmaceutical & Dietary Supplements

7.2.4. Cosmetics

7.3. Latin America Pea Protein Ingredient Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

7.3.1. Isolate

7.3.2. Concentrate

7.3.3. Hydrolysate

7.4. Latin America Pea Protein Ingredient Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.4.1. Brazil Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

7.4.2. Brazil Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

7.4.3. Brazil Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

7.4.4. Mexico Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

7.4.5. Mexico Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

7.4.6. Mexico Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

7.4.7. Argentina Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

7.4.8. Argentina Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

7.4.9. Argentina Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

7.4.10. Rest of LATAM Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

7.4.11. Rest of LATAM Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

7.4.12. Rest of LATAM Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

7.5. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Pea Protein Ingredient Market Outlook, 2019 - 2032

8.1. Middle East & Africa Pea Protein Ingredient Market Outlook, by Nature, Value (US$ Bn), 2019 - 2032

8.1.1. Organic

8.1.2. Conventional

8.2. Middle East & Africa Pea Protein Ingredient Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

8.2.1. Food & Beverages

8.2.1.1. Cereals & Snacks

8.2.1.2. Meat Substitute

8.2.1.3. Bakery & Confectionery

8.2.1.4. Performance Nutrition

8.2.1.5. Beverages & Desserts

8.2.2. Animal & Pet Food

8.2.3. Pharmaceutical & Dietary Supplements

8.2.4. Cosmetics

8.3. Middle East & Africa Pea Protein Ingredient Market Outlook, by Type, Value (US$ Bn), 2019 - 2032

8.3.1. Isolate

8.3.2. Concentrate

8.3.3. Hydrolysate

8.4. Middle East & Africa Pea Protein Ingredient Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.4.1. GCC Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

8.4.2. GCC Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

8.4.3. GCC Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

8.4.4. South Africa Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

8.4.5. South Africa Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

8.4.6. South Africa Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

8.4.7. Egypt Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

8.4.8. Egypt Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

8.4.9. Egypt Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

8.4.10. Nigeria Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

8.4.11. Nigeria Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

8.4.12. Nigeria Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

8.4.13. Rest of Middle East Pea Protein Ingredient Market Outlook, by Nature, 2019 - 2032

8.4.14. Rest of Middle East Pea Protein Ingredient Market Outlook, by Application, 2019 - 2032

8.4.15. Rest of Middle East Pea Protein Ingredient Market Outlook, by Type, 2019 - 2032

8.5. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2024

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Roquette Frères

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Cargill, Incorporated

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. Ingredion Incorporated

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Glanbia PLC

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. DuPont de Nemours

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. Emsland Group

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. Burcon NutraScience

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. PURIS

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. Axiom Foods, Inc.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Cosucra Groupe Warcoing SA

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Nature Coverage |

|

|

Type Coverage |

|

|

Application Coverage |

Cosmetics |

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |