Plant-Based Beverages Market Outlook

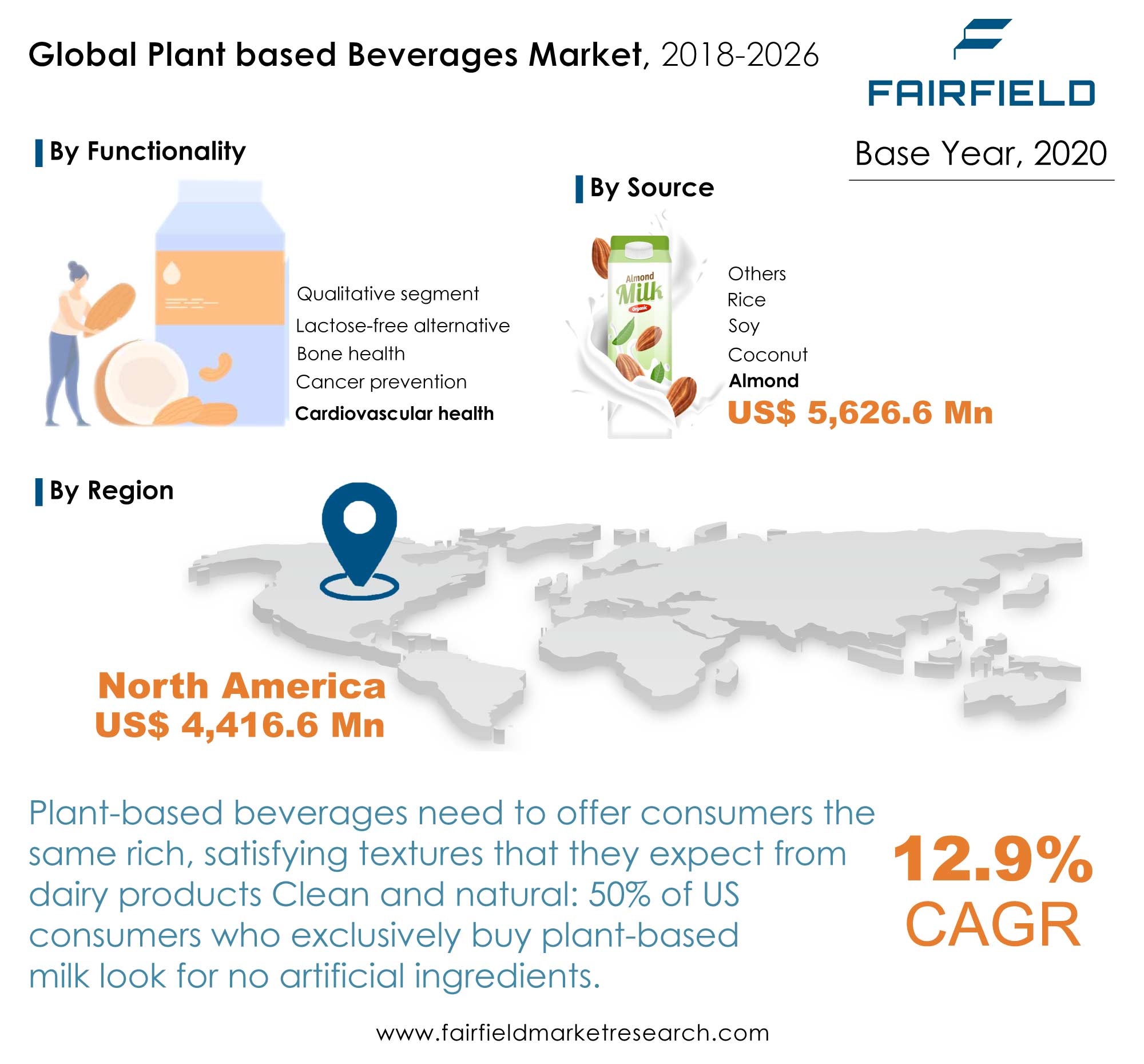

The global plant-based beverages market was valued at US$15.3 Bn in 2019 and will reach past the valuation of US$34.8 Bn by 2026 end, registering a CAGR of 12.9 % between the forecast years of 2021 to 2026.

Demand for Healthier Drinks to Drive Global Plant-based Beverages Market

Over 1,400 foods and beverages contain prebiotic compounds. Manufacturers in a range of end-use sectors are using plant-based beverages to develop low-calorie foods, which is supporting the growth of plant-based beverages market. Because of increased demand for healthy foods containing plant-based ingredients, the market for plant-based beverages is also predicted to thrive, primarily in North America, Asia Pacific, and Europe. The boom around health foods and beverages has been leading to proliferating popularity of healthy food products, and innovative beverage products. Brands have also been leveraging the thriving trend to introduce the various innovative drink ranges, thereby boosting the expansion of plant-based beverages market.

Growing Fondness for Non-dairy Products Favours Sales in Plant-based Beverages Market

Protein is a key trend and is particularly relevant to plant-based beverages. Alternative sources of high-quality protein is one of the main concerns when moving away from dairy to follow a plant-based or meat-free lifestyle. Claims relating to protein quality can be used to reassure consumers that numerous emerging new ‘green’ protein sources are as healthy and nutritious as animal protein sources. Consumers are receptive towards plant-based protein and interestingly, they perceive non-dairy as high in protein. Over 45% of US consumers drink non-dairy milk because it is nutritious and over 35% because it is a good source of protein15. There are still a limited number of products with added protein in the ready-to-drink plant-based beverages category and this represents a significant opportunity or ‘white space’ for manufacturers in the global plant-based beverages market.

High Costs Associated with Manufacturing and R&D Remain a Limiting Factor Facing Plant-based Beverages Market

The plant-based beverages market has grown rapidly, both for foods and supplements intended to enhance wellness in healthy individuals, and for preparations for the dietary management of disease. Regulation of plant beverages varies between regions. Unless specific disease-related health claims, plant beverages are regulated as food supplements and the regulatory guideline places more emphasis on the authorization of claims rather than on the basic parameters of quality, safety, and efficacy. Manufacturing processes, conditions, and ingredients are important determinants of product characteristics and changes to manufacturing are likely to give rise to a product not identical to the original in efficacy and safety if proper measures and controls are not taken. Current laws and the lack of stringent regulations of plant beverages manufacturing mean that the trademark owner can commercialize any formulation under the same brand, even if significantly different from the original. These regulatory deficits may have serious consequences for patients where probiotics are used as part of clinical guideline-recommended management of serious conditions such as inflammatory bowel diseases (IBD) and may make doctors liable for prescribing a formulation not previously tested for safety and efficacy.

Substantial investments in R&D activities and investments in laboratories, research equipment, and hiring trained professionals that require high investment for the development of plant-based beverages is a barrier to the growth of mid-sized companies. Plant-based beverages applications are linked with health benefits that make it challenging for manufacturers in the plant-based beverages market to get an adequate return on investments on high initial investments.

Global Plant-based beverages Market: Competitive Landscape

Globally, North America are expected to lead the global plant-based beverages market by the end of 2026. Nonstop product launches, and demand for healthy drinks are expected to drive these regional markets. Changing lifestyles and busy schedules, have increased unhealthy habits among consumers in recent years leading to various health-related problems like IBD, and obesity. As a result, rising preference for healthy food and heightened health concerns among consumers are anticipated to be the primary drivers for plant-based beverages markets over the forecast period. Asia Pacific, plant-based beverages market is developing strong and will be the fastest growing market anticipating a high CAGR. Increasing population, rising spending capacity on staple food, high demand for fast food and escalating disposable income in consumers are major factors for future growth in the region.

The global plant-based beverages market is highly diversified and competitive in nature owing to the presence of large number of local and international manufacturers, globally. Moreover, numerous producers of plant-based beverages have made huge production facilities available in several countries. Some of the leading market players identified are Califia Farms LP, Good Karma Foods, Inc., Danone SA, Ripple Foods, PBC, Koia, Harmless Harvest Inc, Pureharvest and Blue Diamond Growers. Product market is witnessing a strong competition, globally. Many market players are acquiring or merging with small and large manufacturers to sustain in the plant-based beverages market.

The Global Plant-Based Beverages Market is Segmented as Below:

By Sources Coverage

- Almond

- Soy

- Coconut

- Rice

- Others (cashew, oats, pea, and hemp)

By Functionality Coverage

- Cardiovascular health

- Cancer prevention

- Bone health

- Lactose-free alternative

- Qualitative segment

Geographical Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Turkey

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- Egypt

- Rest of Middle East & Africa

Leading Companies

- Califia Farms LP

- Good Karma Foods, Inc.

- Danone SA

- Ripple Foods, PBC

- Koia

- Harmless Harvest Inc

- Pureharvest

- Blue Diamond Growers

Inside This Report You Will Find:

1. Executive Summary

2. Market Overview

3. Global Plant-based Beverages Market Outlook, 2018 - 2026

4. North America Plant-based Beverages Market Outlook, 2018 - 2026

5. Europe Plant-based Beverages Market Outlook, 2018 - 2026

6. Asia Pacific Plant-based Beverages Market Outlook, 2018 - 2026

7. Latin America Plant-based Beverages Market Outlook, 2018 - 2026

8. Middle East & Africa Plant-based Beverages Market Outlook, 2018 - 2026

9. Competitive Landscape

10. Appendix

Post Sale Support, Research Updates & Offerings:

We value the trust shown by our customers in Fairfield Market Research. We support our clients through our post sale support, research updates and offerings.

- The report will be prepared in a PPT format and will be delivered in a PDF format.

- Additionally, Market Estimation and Forecast numbers will be shared in Excel Workbook.

- If a report being sold was published over a year ago, we will offer a complimentary copy of the updated research report along with Market Estimation and Forecast numbers within 2-3 weeks’ time of the sale.

- If we update this research study within the next 2 quarters, post purchase of the report, we will offer a Complimentary copy of the updated Market Estimation and Forecast numbers in Excel Workbook.

- If there is a geopolitical conflict, pandemic, recession, and the like which can impact global economic scenario and business activity, which might entirely alter the market dynamics or future projections in the industry, we will create a Research Update upon your request at a nominal charge.

1. Executive Summary

1.1. Global Plant-based Beverages Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Analyst Recommendations

2. Market Overview

2.1. Market Definitions

2.2. Market Taxonomy

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.4. Value Chain Analysis

2.5. Porter’s Five Forces Analysis

2.6. Covid-19 Impact Analysis

2.7. Key Patents

3. Global Plant-based Beverages Market Outlook, 2018 - 2026

3.1. Global Plant-based Beverages Market Outlook, by Functionality, Value (US$ ‘000), 2018 - 2026

3.1.1. Key Highlights

3.1.1.1. Cardiovascular health

3.1.1.2. Cancer prevention

3.1.1.3. Bone health

3.1.1.4. Lactose-free alternative

3.1.1.5. Qualitative segment

3.1.2. BPS Analysis/Market Attractiveness Analysis

3.2. Global Plant-based Beverages Market Outlook, by Sources, Value (US$ ‘000), 2018 - 2026

3.2.1. Key Highlights

3.2.1.1. Almond

3.2.1.2. Soy

3.2.1.3. Coconut

3.2.1.4. Rice

3.2.1.5. Others (cashew, oats, pea, and hemp)

3.2.2. BPS Analysis/Market Attractiveness Analysis

3.3. Global Plant-based Beverages Market Outlook, by Region, Value (US$ ‘000), 2018 - 2026

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

3.3.2. BPS Analysis/Market Attractiveness Analysis

4. North America Plant-based Beverages Market Outlook, 2018 - 2026

4.1. Global Plant-based Beverages Market Outlook, by Functionality, Value (US$ ‘000), 2018 - 2026

4.1.1. Key Highlights

4.1.1.1. Cardiovascular health

4.1.1.2. Cancer prevention

4.1.1.3. Bone health

4.1.1.4. Lactose-free alternative

4.1.1.5. Qualitative segment

4.1.2. BPS Analysis/Market Attractiveness Analysis

4.2. Global Plant-based Beverages Market Outlook, by Sources, Value (US$ ‘000), 2018 - 2026

4.2.1. Key Highlights

4.2.1.1. Almond

4.2.1.2. Soy

4.2.1.3. Coconut

4.2.1.4. Rice

4.2.1.5. Others (cashew, oats, pea, and hemp)

4.2.2. BPS Analysis/Market Attractiveness Analysis

4.3. North America Plant-based Beverages Market Outlook, by Country, Value (US$ ‘000), 2018 - 2026

4.3.1. Key Highlights

4.3.1.1. U.S. Plant-based Beverages Market by Value (US$ ‘000), 2018 - 2026

4.3.1.2. Canada Plant-based Beverages Market by Value (US$ ‘000), 2018 - 2026

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Plant-based Beverages Market Outlook, 2018 - 2026

5.1. Global Plant-based Beverages Market Outlook, by Functionality, Value (US$ ‘000), 2018 - 2026

5.1.1. Key Highlights

5.1.1.1. Cardiovascular health

5.1.1.2. Cancer prevention

5.1.1.3. Bone health

5.1.1.4. Lactose-free alternative

5.1.1.5. Qualitative segment

5.1.2. BPS Analysis/Market Attractiveness Analysis

5.2. Global Plant-based Beverages Market Outlook, by Sources, Value (US$ ‘000), 2018 - 2026

5.2.1. Key Highlights

5.2.1.1. Almond

5.2.1.2. Soy

5.2.1.3. Coconut

5.2.1.4. Rice

5.2.1.5. Others (cashew, oats, pea, and hemp)

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Plant-based Beverages Market Outlook, by Country, Value (US$ ‘000), 2018 - 2026

5.3.1. Key Highlights

5.3.1.1. Germany Plant-based Beverages Market by Value (US$ ‘000), 2018 - 2026

5.3.1.2. France Plant-based Beverages Market by Product, Value (US$ ‘000), 2018 - 2026

5.3.1.3. U.K. Plant-based Beverages Market by Value (US$ ‘000), 2018 - 2026

5.3.1.4. Italy Plant-based Beverages Market by Value (US$ ‘000), 2018 - 2026

5.3.1.5. Spain Plant-based Beverages Market by Product, Value (US$ ‘000), 2018 - 2026

5.3.1.6. Rest of Europe Plant-based Beverages Market Value (US$ ‘000), 2018 - 2026

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Plant-based Beverages Market Outlook, 2018 - 2026

6.1. Global Plant-based Beverages Market Outlook, by Functionality, Value (US$ ‘000), 2018 - 2026

6.1.1. Key Highlights

6.1.1.1. Cardiovascular health

6.1.1.2. Cancer prevention

6.1.1.3. Bone health

6.1.1.4. Lactose-free alternative

6.1.1.5. Qualitative segment

6.1.2. BPS Analysis/Market Attractiveness Analysis

6.2. Global Plant-based Beverages Market Outlook, by Sources, Value (US$ ‘000), 2018 - 2026

6.2.1. Key Highlights

6.2.1.1. Almond

6.2.1.2. Soy

6.2.1.3. Coconut

6.2.1.4. Rice

6.2.1.5. Others (cashew, oats, pea, and hemp)

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Plant-based Beverages Market Outlook, by Country, Value (US$ ‘000), 2018 - 2026

6.3.1. Key Highlights

6.3.1.1. India Plant-based Beverages Market by Value (US$ ‘000), 2018 - 2026

6.3.1.2. China Plant-based Beverages Market by Value (US$ ‘000), 2018 - 2026

6.3.1.3. Japan Plant-based Beverages Market by Value (US$ ‘000), 2018 - 2026

6.3.1.4. Australia & New Zealand Plant-based Beverages Market Value (US$ ‘000), 2018 - 2026

6.3.1.5. Rest of Asia Pacific Market by Value (US$ ‘000), 2018 - 2026

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Plant-based Beverages Market Outlook, 2018 - 2026

7.1. Global Plant-based Beverages Market Outlook, by Functionality, Value (US$ ‘000), 2018 - 2026

7.1.1. Key Highlights

7.1.1.1. Cardiovascular health

7.1.1.2. Cancer prevention

7.1.1.3. Bone health

7.1.1.4. Lactose-free alternative

7.1.1.5. Qualitative segment

7.1.2. BPS Analysis/Market Attractiveness Analysis

7.2. Global Plant-based Beverages Market Outlook, by Sources, Value (US$ ‘000), 2018 - 2026

7.2.1. Key Highlights

7.2.1.1. Almond

7.2.1.2. Soy

7.2.1.3. Coconut

7.2.1.4. Rice

7.2.1.5. Others (cashew, oats, pea, and hemp)

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Plant-based Beverages Market Outlook, by Country, Value (US$ ‘000), 2018 - 2026

7.3.1. Key Highlights

7.3.1.1. Brazil Plant-based Beverages Market by Value (US$ ‘000), 2018 - 2026

7.3.1.2. Mexico Plant-based Beverages Market by Value (US$ ‘000), 2018 - 2026

7.3.1.3. Rest of Latin America Plant-based Beverages Market by Value (US$ ‘000), 2018 - 2026

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Plant-based Beverages Market Outlook, 2018 - 2026

8.1. Global Plant-based Beverages Market Outlook, by Functionality, Value (US$ ‘000), 2018 - 2026

8.1.1. Key Highlights

8.1.1.1. Cardiovascular health

8.1.1.2. Cancer prevention

8.1.1.3. Bone health

8.1.1.4. Lactose-free alternative

8.1.1.5. Qualitative segment

8.1.2. BPS Analysis/Market Attractiveness Analysis

8.2. Global Plant-based Beverages Market Outlook, by Sources, Value (US$ ‘000), 2018 - 2026

8.2.1. Key Highlights

8.2.1.1. Almond

8.2.1.2. Soy

8.2.1.3. Coconut

8.2.1.4. Rice

8.2.1.5. Others (cashew, oats, pea, and hemp)

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Plant-based Beverages Market Outlook, by Country, Value (US$ ‘000), 2018 - 2026

8.3.1. Key Highlights

8.3.1.1. GCC Plant-based Beverages Market by Value (US$ ‘000), 2018 - 2026

8.3.1.2. South Africa Plant-based Beverages Market by Value (US$ ‘000), 2018 - 2026

8.3.1.3. Rest of Middle East & Africa Plant-based Beverages Market by Value (US$ ‘000), 2018 - 2026

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Market Share Analysis, 2019

9.2. Company Profiles

9.2.1. Califia Farms LP

9.2.1.1. Company Overview

9.2.1.2. Key Retailing Partners

9.2.1.3. Business Segment Revenue

9.2.1.4. Ingredient Overview

9.2.1.5. Product Offering & its Presence

9.2.1.6. Certifications & Claims

9.2.2. Good Karma Foods, Inc.

9.2.3. Danone SA

9.2.4. Ripple Foods, PBC

9.2.5. Koia

9.2.6. Harmless Harvest Inc

9.2.7. Pureharvest

9.2.8. Blue Diamond Growers

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2020 |

|

2018 - 2020 |

2021 - 2026 |

Value: US$ Million

|

||

|

REPORT FEATURES |

DETAILS |

|

Sources Coverage |

|

|

Functionality Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Product-, Application-, Region-, Country-wise Trends & Analysis, COVID-19 Impact Analysis, Key Trends |