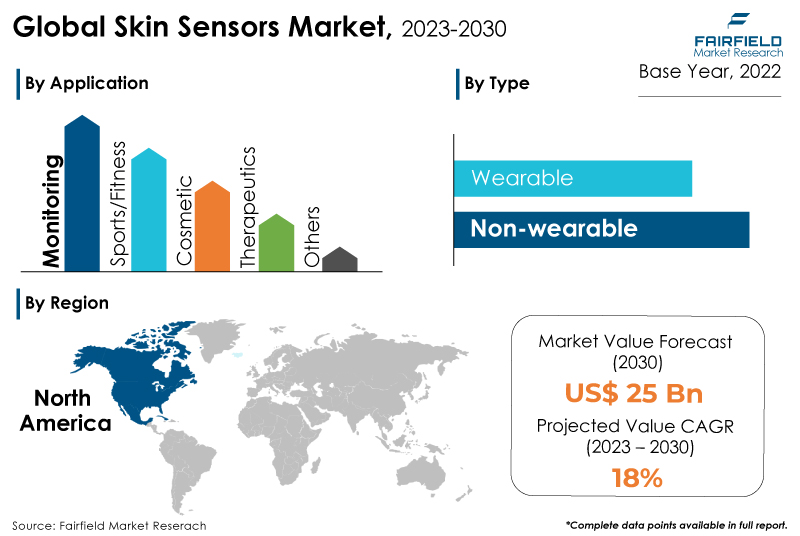

The global skin sensors market will rise at a significant pace of approximately 18% CAGR during the period of assessment 2023 - 2030, reaching an impressive market value of around US$25 Bn by the end of 2030.

Market Analysis in Brief

A skin sensor is a device that measures the electrical characteristics of the skin. Skin sensors are used in a variety of industries, including gaming, cosmetics, and healthcare. Wearable electronic devices with skin-like properties enable real-time and continuous monitoring of human physiological signals such as body temperature, tissue pressure, electrolyte balance, disease-related biomarkers, and body movement. Self-healing, lightning, and sweating electronic skin are just a few advancements that will likely hit the market. In January 2021, physicians were given access to Biosticker. This highly developed on-body sensor makes it simple to monitor vital signs and generates meaningful information from patients in healthcare facilities or at home. Additionally, increased technological advancement and rising consumer acceptability of electronic skin in various applications, including cardiovascular, diabetes, identifying abnormalities, and pregnancy are major driving forces behind the skin sensors market.

Key Report Findings

- The market for skin sensors will demonstrate a massive expansion in revenue through the forecast period 2023 and 2030.

- E-skin usage is anticipated to be influenced by expanding robotics sensor investment and a rising desire for superior and routine health monitoring systems.

- Demand for wearable disposable types remains higher in the skin sensors market.

- The medical monitoring category held the highest skin sensors market revenue share in 2022.

- North America leads the skin sensors market, while Asia Pacific to experience the strongest growth until 2030.

Growth Drivers

Increasing Prevalence of Chronic and Non-communicable Diseases

The need for healthcare apps will rise in response to the increasing prevalence of chronic and non-communicable diseases like cancer, diabetes, and cardiovascular disease. Furthermore, the rising usage of IoT in home healthcare systems, which utilise remote health monitoring for ailments such as chronic diseases and provide users greater flexibility in assessing their health and wellbeing, is expected to boost the growth of the skin sensors market. In addition, it is expected that increased consumer awareness of the technologies utilised in temporary wearable patches would accelerate the growth of the electronic skin industry.

The market is also growing due to expanding research and technological breakthroughs related to the use of synthetic skin. For instance, an electronic skin for a prosthetic hand was successfully developed by specialists at the Korea Institute of Mechatronics and Materials in Daejeon, South Korea. Integrating electronic skin into robotics, microbiology, and synthetic prosthesis systems opens new business potential.

Market Opportunity

Newer Applications in Healthcare and Wellness Monitoring Create Opportunities

The growing use of e-skin products in several healthcare applications, including neurology, cardiology, diabetes, and others, will likely cause the health monitoring segment to grow impressively throughout the forecast period. Additionally, patients can apply patches for the heart, muscle, and brain using e-skin's user-friendly and wearable design, and they can administer tests independently.

By measuring hydration level, heart rate, and the makeup of perspiration, e-skin technologies such as electronic wearable tattoos can assess stress and determine body temperature. For the military to keep track of the health of its soldiers, this kind of e-skin technology can be quite helpful.

Additionally, the non-invasive, real-time dynamic therapeutic feature of the drug delivery systems segment is predicted to cause it to rise steadily throughout the course of the forecast period. These e-skins can utilise muscle movements and patterns from previously saved data to deliver the necessary medication dosage through the skin. Smokers' urge to light up can also be detected by e-skin technology. The transdermal patch will release nicotine into the user's bloodstream, ending the yearning.

Growth Challenges

High Production Costs, and Complexity of Designs

Throughout the forecast period, the market expansion is projected to be hampered by complex designs, material breakdown, and high production costs for skin sensors. Stretching, twisting, and temperature changes, which are not necessarily visible or accessible, can cause damage to electronic skin. As a result, stretchable electronics' functionality and longevity are expected to have a negative impact.

When it comes to the adoption of wearable technology, price is crucial. However, a rise in these devices' production capacity is anticipated to result in a 15-20% price drop. Additionally, it is projected that technical improvement will result in the creation of cost-effective technologies, which could lower the price of these gadgets for healthcare applications.

Overview of Key Segments

Wearable Disposables Hold the Lion’s Share

Recent developments comprise creating a brand-new sensory system that uses disposable modified screen-printed carbon and silver electrodes coated in a membrane soaked with the mediator. Skin antioxidant activity (AOA) measures the impact of fasting, eating, and food loaded with vitamins (antioxidants) on the skin. It is possible to use this apparatus, which consists of a sensory system and a potentiometric analyzer, both on-site and in situ.

The capability of studying a huge population to determine the existence of oxidative stress in the skin is made possible by a proposed new disposable sensing system. Clinical experiments utilising the suggested sensory system are possible, which is crucial for drawing more detailed conclusions about the mechanisms behind the consideration processes. The tool and sensory system described in this work can be used in situ and on-site.

The constant need to access sensory data will drive the development of disposable sensors and the expansion of the availability of increasingly sophisticated sensing and diagnostic equipment. This will be accomplished using more complex material combinations, processing techniques, and higher-level functional integration. The scope and method of applications will continue to expand due to this ever-improved mix of price and functionality to fill in gaps.

Medical Monitoring Remains the Leading Category

The medical monitoring category will dominate the skin sensors market over the forecast period. A rising need for monitoring and sophisticated sensor technology tools enable to detect and inform users about their health state to promote safety has been brought about by the increased degree of awareness surrounding healthcare. Since smaller sensors are more adaptable and can be placed in various devices to receive real-time information, their miniaturisation will substantially impact their use.

For instance, In May 2022, a medical technology start-up, MovanoInc., began leveraging radiofrequency technology to create a proprietary system-on-chip (SoC) platform for various sensors that will be incorporated into wearable medical devices. The company has begun beta-testing a prototype to accomplish blood and glucose sensing.

Additionally, several healthcare monitoring systems employ various sensor types created to monitor a patient's particular bodily parameters continually. The Arduino Nano board has various biosensors that detect body temperature, oxygen level, and heart rate. Recorded signals are relayed to the server utilising a wireless Node MCU ESP8266 connection.

In August 2021, Abbott published findings from the GUIDE-HF clinical study, showing that the CardioMEMS HF System decreased mortality in patients with New York Heart Association (NYHA) Classes II, III, and IV heart failure. CardioMEMS is a tiny implantable sensor that can remotely track and measure pulmonary artery pressure and heart rate.

Growth Opportunities Across Regions

Asia Pacific Holds a Commanding Revenue Share

The skin sensors market will continue to see dominance of Asia Pacific. Due to the continually increasing demand for e-skin products in cosmetics and medicine delivery systems, Asia Pacific is predicted to experience the highest growth in the market during the forecast period. The market is anticipated to increase over the forecast period as more and more e-skin patches are being used in various applications, including biomedical, industrial robotics, and artificial prosthetics.

Additionally, businesses are concentrating on applying machine learning (ML), and Artificial Intelligence (AI) in developing e-skins in this region. The e-skins market will expand due to rising market competitiveness and significant government and departmental research expenditures.

Furthermore, the market is anticipated to grow fastest for the anticipated term in the Asia Pacific area. The aging population and the growth in diabetes prevalence are the two key factors impacting the expansion of skin sensors market.

According to the American Diabetes Association, more than 60% of the world's diabetics reside in Asia. The rapidly rising older population is another factor driving up demand for the electronic skin industry. One in four residents in the Asia Pacific region will be older than 60 by 2050, predicts the UNFPA.

Western Markets to Gain from Research in Skin-like Sensors

The market for skin sensors across North America will demonstrate significant revenue generation during the forecast period. In North America, the market is growing due to an expanding elderly population and product introductions, ongoing technical advancements as well as favourable reimbursement policies. The presence of significant businesses in the sector is further boosting the expansion in the region along with an increase in the number of cutting-edge e-skin product launches and a preference for wearable technology.

The government's attempts to lower the risk of adults' and kids' non-communicable diseases are further accelerating market expansion due to continuous health monitoring. Additionally, the presence of major players in the market, including VivaLnK, Inc., Xsensio, and iRhythm Technologies, who are investing in R&D activities and their products, is anticipated to boost the market during the forecast period.

Skin Sensors Market: Competitive Landscape

Some of the leading players at the forefront in the skin sensors market space include Medtronic plc, GE Healthcare, Abbott Laboratories, ADInstruments, Miravex Limited, Courage + Khazaka Electronic GmbH, MORITEX Corporation, Xsensio, Epicore Biosystems, Inc., and Truer Medical, Inc.

Recent Notable Developments

In 2022, Abbott Laboratories announced the development of a new category of consumer bio wearables called Lingo, which is being designed to track key signals in the body such as glucose, ketones, and lactate to help people better understand their general health and act. These gadgets may identify crucial bodily signals and provide users with more insight into their overall health, allowing them to take proactive steps to improve it. Instead of random urine samples, finger prick tests, and breath readings, it might enable biohackers to employ a continuous stream of data.

In August 2022, Xenoma, and CYBERDYNE, Inc. established financial and business ties. The company's expansion in the healthcare sector is anticipated to be largely attributed to cooperation. Xenoma offers healthcare services through its 'e-skin', a new generation of smart clothing. Xenoma will aid in disease prevention by providing services and aiming to establish data-driven preventive medicine.

In June 2023, Scientists at the California Institute of Technology (Caltech) announced a first-of-its-kind wearable skin sensor that has the potential to wirelessly detect the existence of CRP in human sweat. This sensor will make it simpler for patients and medical professionals to track their health without the requirement for highly invasive blood tests.

In August 2023, The National University of Singapore (NUS) researchers have developed a new aero-elastic pressure sensor, eAir, which can be applied to minimally invasive surgeries and implantable sensors. The technology is designed to address the limitations of existing pressure sensors.

The Global Skin Sensors Market is Segmented as Below:

By Type

- Wearable

- Non-wearable

By Application

- Monitoring

- Sports/Fitness

- Cosmetic

- Therapeutics

- Other

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

Leading Companies

- Medtronic plc

- GE Healthcare

- Abbott Laboratories

- Miravex Limited

- ADInstruments

- MORITEX Corporation

- Courage + Khazaka Electronic GmbH

- Xsensio

- Epicore Biosystems, Inc.

- Truer Medical, Inc.

1. Executive Summary

1.1. Global Skin Sensors Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Skin Sensors Market Outlook, 2018 - 2030

3.1. Global Skin Sensors Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Wearable

3.1.1.2. Non-Wearable

3.2. Global Skin Sensors Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Monitoring

3.2.1.2. Sports/Fitness

3.2.1.3. Cosmetic

3.2.1.4. Therapeutics

3.2.1.5. Other

3.3. Others Global Skin Sensors Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. North America

3.3.1.2. Europe

3.3.1.3. Asia Pacific

3.3.1.4. Latin America

3.3.1.5. Middle East & Africa

4. North America Skin Sensors Market Outlook, 2018 - 2030

4.1. North America Skin Sensors Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Wearable

4.1.1.2. Non-Wearable

4.2. North America Skin Sensors Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Monitoring

4.2.1.2. Sports/Fitness

4.2.1.3. Cosmetic

4.2.1.4. Therapeutics

4.2.1.5. Others

4.2.2. Market Attractiveness Analysis

4.3. North America Skin Sensors Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. U.S. Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

4.3.1.2. U.S. Skin Sensors Market, by Application, Value (US$ Bn), 2018 - 2030

4.3.1.3. Canada Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

4.3.1.4. Canada Skin Sensors Market, by Application, Value (US$ Bn), 2018 - 2030

4.3.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Skin Sensors Market Outlook, 2018 - 2030

5.1. Europe Skin Sensors Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Wearable

5.1.1.2. Non-Wearable

5.2. Europe Skin Sensors Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Monitoring

5.2.1.2. Sports/Fitness

5.2.1.3. Cosmetic

5.2.1.4. Therapeutics

5.2.1.5. Others

5.2.2. BPS Analysis/Market Attractiveness Analysis

5.3. Europe Skin Sensors Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Germany Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.2. Germany Skin Sensors Market, by Application, Value (US$ Bn), 2018 - 2030

5.3.1.3. U.K. Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.4. U.K. Skin Sensors Market, by Application, Value (US$ Bn), 2018 - 2030

5.3.1.5. France Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.6. France Skin Sensors Market, by Application, Value (US$ Bn), 2018 - 2030

5.3.1.7. Italy Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.8. Italy Skin Sensors Market, by Application, Value (US$ Bn), 2018 - 2030

5.3.1.9. Turkey Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.10. Turkey Skin Sensors Market, by Application, Value (US$ Bn), 2018 - 2030

5.3.1.11. Russia Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.12. Russia Skin Sensors Market, by Application, Value (US$ Bn), 2018 - 2030

5.3.1.13. Rest of Europe Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

5.3.1.14. Rest of Europe Skin Sensors Market, by Application, Value (US$ Bn), 2018 - 2030

5.3.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Skin Sensors Market Outlook, 2018 - 2030

6.1. Asia Pacific Skin Sensors Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Wearable

6.1.1.2. Non-Wearable

6.2. Asia Pacific Skin Sensors Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Monitoring

6.2.1.2. Sports/Fitness

6.2.1.3. Cosmetic

6.2.1.4. Therapeutics

6.2.1.5. Others

6.2.2. BPS Analysis/Market Attractiveness Analysis

6.3. Asia Pacific Skin Sensors Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. China Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.2. China Skin Sensors Market, by Application, Value (US$ Bn), 2018 - 2030

6.3.1.3. Japan Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.4. Japan Skin Sensors Market by Application, Value (US$ Bn), 2018 - 2030

6.3.1.5. South Korea Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.6. South Korea Skin Sensors Market by Application, Value (US$ Bn), 2018 - 2030

6.3.1.7. India Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.8. India Skin Sensors Market by Application, Value (US$ Bn), 2018 - 2030

6.3.1.9. Southeast Asia Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.10. Southeast Asia Skin Sensors Market by Application, Value (US$ Bn), 2018 - 2030

6.3.1.11. Rest of Asia Pacific Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

6.3.1.12. Rest of Asia Pacific Skin Sensors Market by Application, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Skin Sensors Market Outlook, 2018 - 2030

7.1. Latin America Skin Sensors Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Wearable

7.1.1.2. Non-Wearable

7.2. Latin America Skin Sensors Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Monitoring

7.2.1.2. Sports/Fitness

7.2.1.3. Cosmetic

7.2.1.4. Therapeutics

7.2.1.5. Others

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Latin America Skin Sensors Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Brazil Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.2. Brazil Skin Sensors Market by Application, Value (US$ Bn), 2018 - 2030

7.3.1.3. Mexico Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.4. Mexico Skin Sensors Market by Application, Value (US$ Bn), 2018 - 2030

7.3.1.5. Argentina Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.6. Argentina Skin Sensors Market by Application, Value (US$ Bn), 2018 - 2030

7.3.1.7. Rest of Latin America Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

7.3.1.8. Rest of Latin America Skin Sensors Market by Application, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Skin Sensors Market Outlook, 2018 - 2030

8.1. Middle East & Africa Skin Sensors Market Outlook, by Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Wearable

8.1.1.2. Non-Wearable

8.2. Middle East & Africa Skin Sensors Market Outlook, by Application, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Monitoring

8.2.1.2. Sports/Fitness

8.2.1.3. Cosmetic

8.2.1.4. Therapeutics

8.2.1.5. Others

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Middle East & Africa Skin Sensors Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. GCC Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.2. GCC Skin Sensors Market by Application, Value (US$ Bn), 2018 - 2030

8.3.1.3. South Africa Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.4. South Africa Skin Sensors Market by Application, Value (US$ Bn), 2018 - 2030

8.3.1.5. Egypt Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.6. Egypt Skin Sensors Market by Application, Value (US$ Bn), 2018 - 2030

8.3.1.7. Nigeria Skin Sensors Market by Type, Value (US$ Bn), 2018 - 2030

8.3.1.8. Nigeria Skin Sensors Market by Application, Value (US$ Bn), 2018 - 2030

8.3.1.9. Rest of Middle East & Africa Skin Sensors Market, by Type, Value (US$ Bn), 2018 - 2030

8.3.1.10. Rest of Middle East & Africa Skin Sensors Market, by Application, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs Type Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Medtronic plc

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. GE Healthcare

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Abbott Laboratories

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Miravex Limited

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. ADInstruments

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. MORITEX Corporation

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Courage + Khazaka Electronic GmbH

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Xsensio

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Epicore Biosystems, Inc.

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. Truer Medical, Inc.

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Type Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |