Global Sterile Injectable Contract Manufacturing Market Forecast

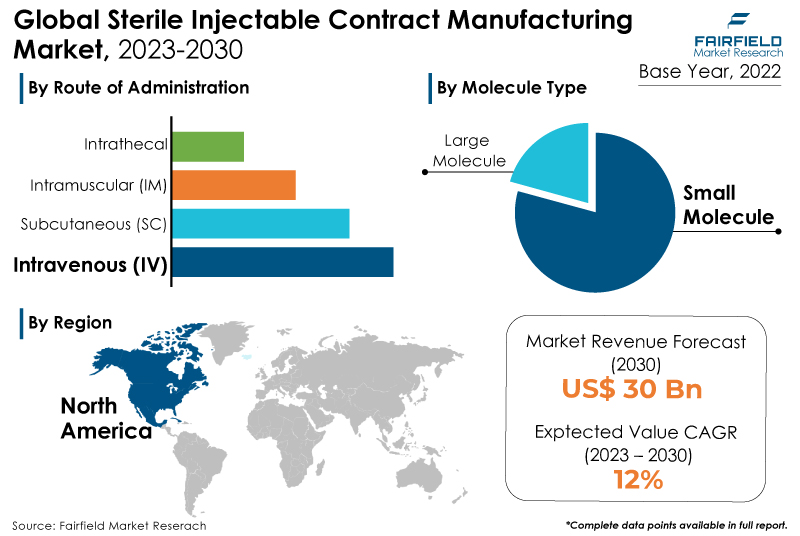

- Global sterile injectable contract manufacturing market size to reach a value of US$30 Bn by 2030-end

- Market revenue to rise high at 12% CAGR during the assessment period, 2023 - 2030

Market Analysis in Brief

The demand for sterile injectables has led to a rise in outsourced agreements between contract manufacturers and original drug sponsors, driving the growth of the sterile injectable contract manufacturing industry. Factors such as rapid drug absorption, reduced risk of drug degradation by gastric secretion, faster drug action, and lower drug concentration support the demand for commercial injectable doses. Pharmaceutical companies focusing on injectable manufacturing are gaining traction by providing development support for large molecule injectable drugs, monoclonal antibody therapies, and drugs treating infectious diseases. Shorter and more cost-effective research and development cycles for generic injectables and advancements in treatment options for rare diseases also contribute to the growth of injectable contract manufacturers globally. Several pharmaceutical giants and established contract manufacturers faced challenges, including delays in the drug development process, risks of non-compliance with on-market products, and disruptions to business continuity.

Additionally, global pharmaceutical companies have downscaled their manufacturing operations in Russia. The rising inflation globally and declining drug approvals in 2022 negatively impacted the pharmaceutical business. This led to a decrease in new molecular entity (NME) approvals and commercial-scale production agreements for contract manufacturers in 2023.

Key Report Findings

- The market for sterile injectable contract manufacturing will demonstrate a massive expansion in revenue between 2023 and 2030

- The small molecule segment captured the largest market share in the sterile injectable contract manufacturing market due to its widespread use, established production processes, and higher demand for large-scale manufacturing.

- The intravenous (IV) mode of application held a dominating market share in the sterile injectable contract manufacturing market due to its widespread use in critical and time-sensitive medical conditions and its efficiency in delivering rapid and precise treatments.

- North America will continue to lead its way, whereas Asia Pacific's sterile injectable contract manufacturing market will experience the strongest growth till 2030.

Growth Drivers

Growing Pipeline and Approvals of Injectables

The growing pipeline and approvals of injectables are major drivers of the sterile injectable contract manufacturing industry. Pharmaceutical companies worldwide are increasingly focusing on developing injectable drugs due to their numerous advantages, such as faster onset of action, precise dosing, and improved patient compliance. As a result, the global pipeline of injectable drugs has expanded significantly, with a wide range of therapeutic areas, including oncology, diabetes, and autoimmune diseases, contributing to the growth of the injectables market.

Faster drug approvals have encouraged pharmaceutical companies to outsource their manufacturing needs to specialised contract manufacturing organisations that can efficiently produce sterile injectable drugs while ensuring compliance with regulatory requirements.

Moreover, advancements in biotechnology and novel drug delivery technologies have further fueled the growth of injectable drugs. Developing complex biologics and targeted therapies often requires specialised manufacturing capabilities that CMOs can offer. Contract manufacturing organisations equipped with state-of-the-art facilities and expertise in handling biologics play a crucial role in meeting the rising demand for injectable drugs, further driving the sterile injectable contract manufacturing market.

In conclusion, the increasing pipeline and approvals of injectables have created a robust demand for sterile injectable manufacturing services. As pharmaceutical companies seek efficient and reliable partners to produce their injectable drugs, contract manufacturing organisations are poised to play a pivotal role in meeting this demand and driving the growth of the sterile injectable contract manufacturing market.

Increasing Demand For Cell & Gene Therapies

The growing demand for cell therapies is a major driving force behind the growth of the sterile injectable contract manufacturing market. Cell and gene therapies have emerged as revolutionary treatment options for various genetic and chronic diseases, offering the potential for personalised and curative treatments. As the pipeline of these innovative therapies expands, there is a growing need for specialised manufacturing capabilities to produce sterile injectable products that adhere to strict regulatory requirements. Because of the intricacy of cell and gene treatments, specialised production methods and strong quality control procedures are required.

Contract manufacturing organisations with expertise in sterile injectable manufacturing and specialised facilities are well-positioned to cater to the unique manufacturing requirements of cell and gene therapies. Pharmaceutical and biotechnology companies increasingly rely on these CMOs to access cutting-edge manufacturing capabilities and expedite the development of cell therapies.

Furthermore, the rapid advancements in biotechnology and gene editing techniques have significantly accelerated the development of novel cell and gene therapies. As more breakthrough therapies move through clinical trials and gain regulatory approvals, the demand for manufacturing services to support commercial-scale production is expected to surge. In order to fill this gap and address the rising demand for cell and gene treatments on a worldwide scale, sterile injectable CMOs are essential.

In conclusion, the market for sterile injectable contract manufacturing is expanding as a result of the growing need for cell and gene treatments. Contract manufacturing companies with specialised capabilities will play a crucial role in meeting the manufacturing needs for sterile injectable products as the pharmaceutical industry continues to invest in innovative therapies, helping to advance cell and gene therapies and revolutionising the field of modern medicine.

Overview of Key Segments

Small Molecule Category Leads its Way

For several compelling reasons, the small molecule segment has captured the largest market share in the sterile injectable contract manufacturing market. Firstly, small molecule drugs are the most widely used and established class of pharmaceutical products, covering a broad range of therapeutic areas. Their well-known pharmacological properties and simple chemical structures make them more amenable to large-scale manufacturing and regulatory approval. As a result, there is a substantial demand for contract manufacturing services for small molecule injectables to support the production of essential drugs for various medical conditions.

Secondly, small molecule drugs typically require higher production volumes than biologics or cell and gene therapies, which often have limited patient populations due to their personalised nature. The larger patient base for small molecule injectables translates to higher manufacturing volumes, driving the demand for CMOs with the capacity to handle large-scale production efficiently. This focus on economies of scale further strengthens the small molecule segment's dominance in the contract manufacturing market.

Moreover, the production processes for small molecule injectables are well-established and have been optimised over time, leading to greater efficiency and cost-effectiveness. The standardised manufacturing processes for small molecule drugs allow CMOs to achieve consistent quality and reliable outcomes in large-scale production. Pharmaceutical companies seeking reliable and cost-efficient manufacturing solutions for their small molecule injectable products are more inclined to partner with experienced CMOs in this segment.

To conclude, the small molecule segment holds the largest market share in the sterile injectable contract manufacturing market due to the widespread use and established nature of small molecule drugs. The need for large-scale manufacturing and well-optimised production processes makes small molecule injectables a key focus for contract manufacturing organisations. As the demand for essential drugs rises, the small molecule segment is expected to maintain its dominant position in the contract manufacturing market for sterile injectables.

IV Administration Route Remains Preferred

The intravenous (IV) route of adminsitration continues to capture the largest market share in the sterile injectable contract manufacturing market for several reasons. Firstly, intravenous administration offers several advantages, including rapid onset of action and precise dosing, making it the preferred mode of delivery for many critical and time-sensitive medical conditions.

IV injectables are commonly used in hospitals and healthcare settings for various treatments, such as antibiotics, pain management, and chemotherapy. The significant demand for IV drugs in these settings drives contract manufacturing organisations to produce sterile injectables in large quantities to meet the healthcare industry's requirements.

Secondly, the IV route provides a direct and efficient delivery pathway, ensuring the drug enters the bloodstream and reaches its target quickly. This mode of administration is particularly crucial for emergency treatments and critical care situations, where rapid and effective drug delivery can be life-saving. As a result, pharmaceutical companies developing intravenous drugs often seek reliable and experienced CMOs to manufacture these essential injectables with a focus on quality and safety.

Moreover, IV drugs are frequently used for chronic conditions that require long-term treatment, such as diabetes or cancer. This chronic usage of IV drugs generates a continuous demand for manufacturing and supply, leading pharmaceutical companies to partner with CMOs with a proven track record in large-scale production and supply chain management.

The IV mode of application captures the largest revenue share of the sterile injectable contract manufacturing market due to its critical role in delivering rapid and precise treatments, particularly in emergency and hospital settings. The ongoing demand for IV injectables in the treatment of chronic conditions also contributes to the significant market share of this mode of administration. CMOs specialising in large-scale production and reliable supply chain management are essential partners for pharmaceutical companies seeking to meet the growing demand for intravenous drugs.

Growth Opportunities Across Regions

North America Holds a Commanding Share

For several reasons, North America has captured the largest market share in the Sterile Injectable Contract Manufacturing market. Firstly, the region is home to a well-developed pharmaceutical and biotechnology industry with a strong focus on research and development. North American companies have been at the forefront of innovation in the healthcare sector, leading to significant demand for sterile injectable drugs. This demand has led many regional pharmaceutical companies to outsource their manufacturing needs to specialised CMOs that can offer high-quality and efficient production services.

The regulatory environment in North America is relatively favourable for the sterile injectable contract manufacturing sector. The United States Food and Drug Administration (FDA), and Health Canada have stringent regulations and quality standards for drug manufacturing, ensuring that products meet strict safety and efficacy criteria. Many global pharmaceutical companies prefer to work with contract manufacturers in North America to comply with these regulatory requirements, further strengthening the market's position.

North America's strategic geographical location is vital to the market's growth. The region's proximity to major pharmaceutical markets in the United States and Canada allows for efficient distribution and supply chain management. Additionally, a skilled workforce and advanced manufacturing infrastructure contribute to the region's attractiveness as a hub for sterile injectable contract manufacturing.

Overall, the combination of a strong pharmaceutical industry, favourable regulatory environment, and strategic location has positioned North America as the dominant player in the sterile injectable contract manufacturing market, capturing the largest revenue share in the industry.

Asia Pacific Develops a Lucrative Market

For several compelling reasons, Asia Pacific is anticipated to grow at CAGR in the sterile injectable contract manufacturing market. Firstly, the region's pharmaceutical industry has been experiencing significant growth, driven by a rising population, increasing healthcare spending, and expanding access to healthcare services. As a result, the growing demand for sterile injectable drugs to address various medical conditions creates opportunities for CMOs in the region.

The Asia Pacific region offers cost advantages for pharmaceutical manufacturing. Labor costs are generally lower in countries like India, China, and southeast Asian nations, making them attractive destinations for contract manufacturing services. Additionally, these countries have invested in modern manufacturing facilities and technologies, enabling them to produce high-quality sterile injectables at competitive prices.

Furthermore, several Asian countries have implemented policies and incentives to attract foreign investment and foster the development of their pharmaceutical industries. For example, India's 'Pharma Vision 2020' and China's 'Made in China 2025' initiatives aim to boost the domestic pharmaceutical sector and encourage collaborations with international companies.

Such supportive government policies have encouraged multinational pharmaceutical firms to partner with local, regional CMOs for efficient, cost-effective sterile injectable manufacturing. Overall, the growing pharmaceutical market, cost advantages, and supportive government policies position Asia Pacific for robust growth in the sterile injectable contract manufacturing market.

Challenges Related To Quality Control

Challenges related to quality control present significant restraints to the growth of the sterile injectable contract manufacturing market. Ensuring stringent quality standards is paramount in producing sterile injectable drugs to guarantee patient safety and regulatory compliance. However, maintaining consistent quality control throughout manufacturing can be complex and challenging.

Moreover, sterile injectable drugs often require specialised manufacturing equipment and processes to achieve the required level of sterility. Quality control protocols must be meticulously executed to detect and rectify potential deviations during production, packaging, and distribution. Please address these challenges to avoid costly product rejections and regulatory non-compliance.

Furthermore, the global regulatory landscape is becoming increasingly stringent, with health authorities demanding greater transparency and accountability in manufacturing processes. Compliance with varying regulatory requirements across different countries and regions adds complexity to quality control efforts for global CMOs. Navigating and meeting diverse regulatory expectations often requires significant investments in technology, personnel training, and validation studies.

Smaller CMOs or those needing more robust quality control systems may face hurdles in expanding their market presence due to the increased regulatory scrutiny and requirements for sterile injectable products. In conclusion, the challenges related to quality control pose significant restraints on the sterile injectable contract manufacturing market. Ensuring consistent and robust quality standards throughout the manufacturing process is essential for CMOs to gain and retain the trust of pharmaceutical companies and regulators.

Overcoming these challenges requires continuous investment in advanced technologies, skilled personnel, and streamlined processes to maintain the highest quality and compliance in sterile injectable manufacturing.

Sterile Injectable Contract Manufacturing Market: Competitive Landscape

Some of the leading players at the forefront in the Sterile Injectable Contract Manufacturing market space include Catalent, Inc., Grifols S.A., Aenova Group, Vetter Pharma; Recipharm AB, Baxter, Boehringer Ingelheim, Fresenius Kabi, Unither Pharmaceuticals, Famar, Cipla Ltd., and NextPharma Technologies.

Recent Notable Developments

In July 2023, WuXi STA launched the first high-potency sterile injectable manufacturing line at Wuxi City, China. The new HP injectable manufacturing line, with an annual capacity of 12 million units, further enhances the company’s manufacturing capabilities and capacity for injectable dosage forms – providing greater flexibility to respond to the increasing demand of the high potency pharmaceuticals market.

In February 2023, Switzerland-based contract development and manufacturing organisation (CDMO) CARBOGEN AMCIS opened a new facility in France, dedicated to the custom development and production of sterile injectable drug products. The facility forms two new fully-automated production lines for liquid and freeze-dried drugs, including highly potent compounds and advanced therapies such as antibody-drug conjugates (ADCs).

In November 2022, the Food and Drug Administration (FDA) approved using tremelimumab in combination with durvalumab and platinum-based chemotherapy to treat metastatic non-small cell lung cancer (NSCLC) in adult patients.

In May 2022, the United States Food and Drug Administration approved Eli Lilly's Mounjaro (tripeptide) injection, a novel once-weekly GIP (glucose-dependent insulinotropic polypeptide) and GLP-1 (glucagon-like peptide-1) receptor agonist, intended to enhance glycemic control in adults diagnosed with type 2 diabetes.

Global Sterile Injectable Contract Manufacturing Market is Segmented as Below:

By Molecule Type

- Small Molecule

- Large Molecule

By Therapeutic Application

- Cancer

- Diabetes

- Cardiovascular Diseases

- Central Nervous System Disorders

- Infectious Disorders

- Musculoskeletal

- Others

By Route of Administration

- Subcutaneous (SC)

- Intravenous (IV)

- Intramuscular (IM)

- Intrathecal

- Others

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Egypt

- Nigeria

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Sterile Injectable Contract Manufacturing Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.8. PESTLE Analysis

3. Global Sterile Injectable Contract Manufacturing Market Outlook, 2018 - 2030

3.1. Global Sterile Injectable Contract Manufacturing Market Outlook, by Molecule Type, Value (US$ Bn), 2018 - 2030

3.1.1. Key Highlights

3.1.1.1. Small Molecule

3.1.1.2. Large Molecule

3.2. Global Sterile Injectable Contract Manufacturing Market Outlook, by Therapeutic Application, Value (US$ Bn), 2018 - 2030

3.2.1. Key Highlights

3.2.1.1. Cancer

3.2.1.2. Diabetes

3.2.1.3. Cardiovascular Diseases

3.2.1.4. Central Nervous System Disorders

3.2.1.5. Infectious Disorders

3.2.1.6. Musculoskeletal

3.2.1.7. Others

3.3. Global Sterile Injectable Contract Manufacturing Market Outlook, by Route of Administration, Value (US$ Bn), 2018 - 2030

3.3.1. Key Highlights

3.3.1.1. Subcutaneous (SC)

3.3.1.2. Intravenous (IV)

3.3.1.3. Intramuscular (IM)

3.3.1.4. Intrathecal

3.3.1.5. Others

3.4. Global Sterile Injectable Contract Manufacturing Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

3.4.1. Key Highlights

3.4.1.1. North America

3.4.1.2. Europe

3.4.1.3. Asia Pacific

3.4.1.4. Latin America

3.4.1.5. Middle East & Africa

4. North America Sterile Injectable Contract Manufacturing Market Outlook, 2018 - 2030

4.1. North America Sterile Injectable Contract Manufacturing Market Outlook, by Molecule Type, Value (US$ Bn), 2018 - 2030

4.1.1. Key Highlights

4.1.1.1. Small Molecule

4.1.1.2. Large Molecule

4.2. North America Sterile Injectable Contract Manufacturing Market Outlook, by Therapeutic Application, Value (US$ Bn), 2018 - 2030

4.2.1. Key Highlights

4.2.1.1. Cancer

4.2.1.2. Diabetes

4.2.1.3. Cardiovascular Diseases

4.2.1.4. Central Nervous System Disorders

4.2.1.5. Infectious Disorders

4.2.1.6. Musculoskeletal

4.2.1.7. Others

4.3. North America Sterile Injectable Contract Manufacturing Market Outlook, by Route of Administration, Value (US$ Bn), 2018 - 2030

4.3.1. Key Highlights

4.3.1.1. Subcutaneous (SC)

4.3.1.2. Intravenous (IV)

4.3.1.3. Intramuscular (IM)

4.3.1.4. Intrathecal

4.3.1.5. Others

4.4. North America Sterile Injectable Contract Manufacturing Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

4.4.1. Key Highlights

4.4.1.1. U.S. Sterile Injectable Contract Manufacturing Market by Molecule Type, Value (US$ Bn), 2018 - 2030

4.4.1.2. U.S. Sterile Injectable Contract Manufacturing Market by Therapeutic Application, Value (US$ Bn), 2018 - 2030

4.4.1.3. U.S. Sterile Injectable Contract Manufacturing Market by Route of Administration, Value (US$ Bn), 2018 - 2030

4.4.1.4. Canada Sterile Injectable Contract Manufacturing Market by Molecule Type, Value (US$ Bn), 2018 - 2030

4.4.1.5. Canada Sterile Injectable Contract Manufacturing Market by Therapeutic Application, Value (US$ Bn), 2018 - 2030

4.4.1.6. Canada Sterile Injectable Contract Manufacturing Market by Route of Administration, Value (US$ Bn), 2018 - 2030

4.4.2. BPS Analysis/Market Attractiveness Analysis

5. Europe Sterile Injectable Contract Manufacturing Market Outlook, 2018 - 2030

5.1. Europe Sterile Injectable Contract Manufacturing Market Outlook, by Molecule Type, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Small Molecule

5.1.1.2. Large Molecule

5.2. Europe Sterile Injectable Contract Manufacturing Market Outlook, by Therapeutic Application, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Cancer

5.2.1.2. Diabetes

5.2.1.3. Cardiovascular Diseases

5.2.1.4. Central Nervous System Disorders

5.2.1.5. Infectious Disorders

5.2.1.6. Musculoskeletal

5.2.1.7. Others

5.3. Europe Sterile Injectable Contract Manufacturing Market Outlook, by Route of Administration, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. Subcutaneous (SC)

5.3.1.2. Intravenous (IV)

5.3.1.3. Intramuscular (IM)

5.3.1.4. Intrathecal

5.3.1.5. Others

5.4. Europe Sterile Injectable Contract Manufacturing Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

5.4.1. Key Highlights

5.4.1.1. Germany Sterile Injectable Contract Manufacturing Market by Molecule Type, Value (US$ Bn), 2018 - 2030

5.4.1.2. Germany Sterile Injectable Contract Manufacturing Market by Therapeutic Application, Value (US$ Bn), 2018 - 2030

5.4.1.3. Germany Sterile Injectable Contract Manufacturing Market by Route of Administration, Value (US$ Bn), 2018 - 2030

5.4.1.4. U.K. Sterile Injectable Contract Manufacturing Market by Molecule Type, Value (US$ Bn), 2018 - 2030

5.4.1.5. U.K. Sterile Injectable Contract Manufacturing Market by Therapeutic Application, Value (US$ Bn), 2018 - 2030

5.4.1.6. U.K. Sterile Injectable Contract Manufacturing Market by Route of Administration, Value (US$ Bn), 2018 - 2030

5.4.1.7. France Sterile Injectable Contract Manufacturing Market By Molecule Type, Value (US$ Bn), 2018 - 2030

5.4.1.8. France Sterile Injectable Contract Manufacturing Market By Therapeutic Application, Value (US$ Bn), 2018 - 2030

5.4.1.9. France Sterile Injectable Contract Manufacturing Market By Route of Administration, Value (US$ Bn), 2018 - 2030

5.4.1.10. Italy Sterile Injectable Contract Manufacturing Market By Molecule Type, Value (US$ Bn), 2018 - 2030

5.4.1.11. Italy Sterile Injectable Contract Manufacturing Market By Therapeutic Application, Value (US$ Bn), 2018 - 2030

5.4.1.12. Italy Sterile Injectable Contract Manufacturing Market By Route of Administration, Value (US$ Bn), 2018 - 2030

5.4.1.13. Turkey Sterile Injectable Contract Manufacturing Market By Molecule Type, Value (US$ Bn), 2018 - 2030

5.4.1.14. Turkey Sterile Injectable Contract Manufacturing Market By Therapeutic Application, Value (US$ Bn), 2018 - 2030

5.4.1.15. Turkey Sterile Injectable Contract Manufacturing Market By Route of Administration, Value (US$ Bn), 2018 - 2030

5.4.1.16. Russia Sterile Injectable Contract Manufacturing Market By Molecule Type, Value (US$ Bn), 2018 - 2030

5.4.1.17. Russia Sterile Injectable Contract Manufacturing Market By Therapeutic Application, Value (US$ Bn), 2018 - 2030

5.4.1.18. Russia Sterile Injectable Contract Manufacturing Market By Route of Administration, Value (US$ Bn), 2018 - 2030

5.4.1.19. Rest Of Europe Sterile Injectable Contract Manufacturing Market By Molecule Type, Value (US$ Bn), 2018 - 2030

5.4.1.20. Rest Of Europe Sterile Injectable Contract Manufacturing Market By Therapeutic Application, Value (US$ Bn), 2018 - 2030

5.4.1.21. Rest Of Europe Sterile Injectable Contract Manufacturing Market By Route of Administration, Value (US$ Bn), 2018 - 2030

5.4.2. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Sterile Injectable Contract Manufacturing Market Outlook, 2018 - 2030

6.1. Asia Pacific Sterile Injectable Contract Manufacturing Market Outlook, by Molecule Type, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Small Molecule

6.1.1.2. Large Molecule

6.2. Asia Pacific Sterile Injectable Contract Manufacturing Market Outlook, by Therapeutic Application, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Cancer

6.2.1.2. Diabetes

6.2.1.3. Cardiovascular Diseases

6.2.1.4. Central Nervous System Disorders

6.2.1.5. Infectious Disorders

6.2.1.6. Musculoskeletal

6.2.1.7. Others

6.3. Asia Pacific Sterile Injectable Contract Manufacturing Market Outlook, by Route of Administration, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. Subcutaneous (SC)

6.3.1.2. Intravenous (IV)

6.3.1.3. Intramuscular (IM)

6.3.1.4. Intrathecal

6.3.1.5. Others

6.4. Asia Pacific Sterile Injectable Contract Manufacturing Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.4.1. Key Highlights

6.4.1.1. China Sterile Injectable Contract Manufacturing Market by Molecule Type, Value (US$ Bn), 2018 - 2030

6.4.1.2. China Sterile Injectable Contract Manufacturing Market by Therapeutic Application, Value (US$ Bn), 2018 - 2030

6.4.1.3. China Sterile Injectable Contract Manufacturing Market by Route of Administration, Value (US$ Bn), 2018 - 2030

6.4.1.4. Japan Sterile Injectable Contract Manufacturing Market by Molecule Type, Value (US$ Bn), 2018 - 2030

6.4.1.5. Japan Sterile Injectable Contract Manufacturing Market by Therapeutic Application, Value (US$ Bn), 2018 - 2030

6.4.1.6. Japan Sterile Injectable Contract Manufacturing Market by Route of Administration, Value (US$ Bn), 2018 - 2030

6.4.1.7. South Korea Sterile Injectable Contract Manufacturing Market by Molecule Type, Value (US$ Bn), 2018 - 2030

6.4.1.8. South Korea Sterile Injectable Contract Manufacturing Market by Therapeutic Application, Value (US$ Bn), 2018 - 2030

6.4.1.9. South Korea Sterile Injectable Contract Manufacturing Market by Route of Administration, Value (US$ Bn), 2018 - 2030

6.4.1.10. India Sterile Injectable Contract Manufacturing Market by Molecule Type, Value (US$ Bn), 2018 - 2030

6.4.1.11. India Sterile Injectable Contract Manufacturing Market by Therapeutic Application, Value (US$ Bn), 2018 - 2030

6.4.1.12. India Sterile Injectable Contract Manufacturing Market by Route of Administration, Value (US$ Bn), 2018 - 2030

6.4.1.13. Southeast Asia Sterile Injectable Contract Manufacturing Market by Molecule Type, Value (US$ Bn), 2018 - 2030

6.4.1.14. Southeast Asia Sterile Injectable Contract Manufacturing Market by Therapeutic Application, Value (US$ Bn), 2018 - 2030

6.4.1.15. Southeast Asia Sterile Injectable Contract Manufacturing Market by Route of Administration, Value (US$ Bn), 2018 - 2030

6.4.1.16. Rest of Asia Pacific Sterile Injectable Contract Manufacturing Market by Molecule Type, Value (US$ Bn), 2018 - 2030

6.4.1.17. Rest of Asia Pacific Sterile Injectable Contract Manufacturing Market by Therapeutic Application, Value (US$ Bn), 2018 - 2030

6.4.1.18. Rest of Asia Pacific Sterile Injectable Contract Manufacturing Market by Route of Administration, Value (US$ Bn), 2018 - 2030

6.4.2. BPS Analysis/Market Attractiveness Analysis

7. Latin America Sterile Injectable Contract Manufacturing Market Outlook, 2018 - 2030

7.1. Latin America Sterile Injectable Contract Manufacturing Market Outlook, by Molecule Type, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Small Molecule

7.1.1.2. Large Molecule

7.2. Latin America Sterile Injectable Contract Manufacturing Market Outlook, by Therapeutic Application, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Cancer

7.2.1.2. Diabetes

7.2.1.3. Cardiovascular Diseases

7.2.1.4. Central Nervous System Disorders

7.2.1.5. Infectious Disorders

7.2.1.6. Musculoskeletal

7.2.1.7. Others

7.3. Latin America Sterile Injectable Contract Manufacturing Market Outlook, by Route of Administration, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Subcutaneous (SC)

7.3.1.2. Intravenous (IV)

7.3.1.3. Intramuscular (IM)

7.3.1.4. Intrathecal

7.3.1.5. Others

7.4. Latin America Sterile Injectable Contract Manufacturing Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.4.1. Key Highlights

7.4.1.1. Brazil Sterile Injectable Contract Manufacturing Market by Molecule Type, Value (US$ Bn), 2018 - 2030

7.4.1.2. Brazil Sterile Injectable Contract Manufacturing Market by Therapeutic Application, Value (US$ Bn), 2018 - 2030

7.4.1.3. Brazil Sterile Injectable Contract Manufacturing Market by Route of Administration, Value (US$ Bn), 2018 - 2030

7.4.1.4. Mexico Sterile Injectable Contract Manufacturing Market by Molecule Type, Value (US$ Bn), 2018 - 2030

7.4.1.5. Mexico Sterile Injectable Contract Manufacturing Market by Therapeutic Application, Value (US$ Bn), 2018 - 2030

7.4.1.6. Mexico Sterile Injectable Contract Manufacturing Market by Route of Administration, Value (US$ Bn), 2018 - 2030

7.4.1.7. Argentina Sterile Injectable Contract Manufacturing Market by Molecule Type, Value (US$ Bn), 2018 - 2030

7.4.1.8. Argentina Sterile Injectable Contract Manufacturing Market by Therapeutic Application, Value (US$ Bn), 2018 - 2030

7.4.1.9. Argentina Sterile Injectable Contract Manufacturing Market by Route of Administration, Value (US$ Bn), 2018 - 2030

7.4.1.10. Rest of Latin America Sterile Injectable Contract Manufacturing Market by Molecule Type, Value (US$ Bn), 2018 - 2030

7.4.1.11. Rest of Latin America Sterile Injectable Contract Manufacturing Market by Therapeutic Application, Value (US$ Bn), 2018 - 2030

7.4.1.12. Rest of Latin America Sterile Injectable Contract Manufacturing Market by Route of Administration, Value (US$ Bn), 2018 - 2030

7.4.2. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Sterile Injectable Contract Manufacturing Market Outlook, 2018 - 2030

8.1. Middle East & Africa Sterile Injectable Contract Manufacturing Market Outlook, by Molecule Type, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Small Molecule

8.1.1.2. Large Molecule

8.2. Middle East Sterile Injectable Contract Manufacturing Market Outlook, by Therapeutic Application, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Cancer

8.2.1.2. Diabetes

8.2.1.3. Cardiovascular Diseases

8.2.1.4. Central Nervous System Disorders

8.2.1.5. Infectious Disorders

8.2.1.6. Musculoskeletal

8.2.1.7. Others

8.3. Middle East & Africa Sterile Injectable Contract Manufacturing Market Outlook, by Route of Administration, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. Subcutaneous (SC)

8.3.1.2. Intravenous (IV)

8.3.1.3. Intramuscular (IM)

8.3.1.4. Intrathecal

8.3.1.5. Others

8.4. Middle East & Africa Sterile Injectable Contract Manufacturing Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.4.1. Key Highlights

8.4.1.1. GCC Sterile Injectable Contract Manufacturing Market by Molecule Type, Value (US$ Bn), 2018 - 2030

8.4.1.2. GCC Sterile Injectable Contract Manufacturing Market by Therapeutic Application, Value (US$ Bn), 2018 - 2030

8.4.1.3. GCC Sterile Injectable Contract Manufacturing Market by Route of Administration, Value (US$ Bn), 2018 - 2030

8.4.1.4. South Africa Sterile Injectable Contract Manufacturing Market by Molecule Type, Value (US$ Bn), 2018 - 2030

8.4.1.5. South Africa Sterile Injectable Contract Manufacturing Market by Therapeutic Application, Value (US$ Bn), 2018 - 2030

8.4.1.6. South Africa Sterile Injectable Contract Manufacturing Market by Route of Administration, Value (US$ Bn), 2018 - 2030

8.4.1.7. Egypt Sterile Injectable Contract Manufacturing Market by Molecule Type, Value (US$ Bn), 2018 - 2030

8.4.1.8. Egypt Sterile Injectable Contract Manufacturing Market by Therapeutic Application, Value (US$ Bn), 2018 - 2030

8.4.1.9. Egypt Sterile Injectable Contract Manufacturing Market by Route of Administration, Value (US$ Bn), 2018 - 2030

8.4.1.10. Nigeria Sterile Injectable Contract Manufacturing Market by Molecule Type, Value (US$ Bn), 2018 - 2030

8.4.1.11. Nigeria Sterile Injectable Contract Manufacturing Market by Therapeutic Application, Value (US$ Bn), 2018 - 2030

8.4.1.12. Nigeria Sterile Injectable Contract Manufacturing Market by Route of Administration, Value (US$ Bn), 2018 - 2030

8.4.1.13. Rest of Middle East & Africa Sterile Injectable Contract Manufacturing Market by Molecule Type, Value (US$ Bn), 2018 - 2030

8.4.1.14. Rest of Middle East & Africa Sterile Injectable Contract Manufacturing Market by Therapeutic Application, Value (US$ Bn), 2018 - 2030

8.4.1.15. Rest of Middle East & Africa Sterile Injectable Contract Manufacturing Market by Route of Administration, Value (US$ Bn), 2018 - 2030

8.4.2. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Manufacturer vs Application Heatmap

9.2. Company Market Share Analysis, 2022

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Baxter

9.4.1.1. Company Overview

9.4.1.2. Molecule Type Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Development

9.4.2. Catalent, Inc.

9.4.2.1. Company Overview

9.4.2.2. Molecule Type Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Development

9.4.3. Boehringer Ingelheim

9.4.3.1. Company Overview

9.4.3.2. Molecule Type Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Development

9.4.4. Recipharm AB

9.4.4.1. Company Overview

9.4.4.2. Molecule Type Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Development

9.4.5. Aenova Group

9.4.5.1. Company Overview

9.4.5.2. Molecule Type Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Development

9.4.6. Fresenius Kabi

9.4.6.1. Company Overview

9.4.6.2. Molecule Type Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Development

9.4.7. Famar

9.4.7.1. Company Overview

9.4.7.2. Molecule Type Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Development

9.4.8. Grifols S.A

9.4.8.1. Company Overview

9.4.8.2. Molecule Type Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Development

9.4.9. Cipla Ltd.

9.4.9.1. Company Overview

9.4.9.2. Molecule Type Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Development

9.4.10. NextPharma Technologies

9.4.10.1. Company Overview

9.4.10.2. Molecule Type Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Development

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Molecule Type Coverage |

|

|

Therapeutic Application Coverage |

|

|

Route of administration Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |