Global Warehouse Management System Market Forecast

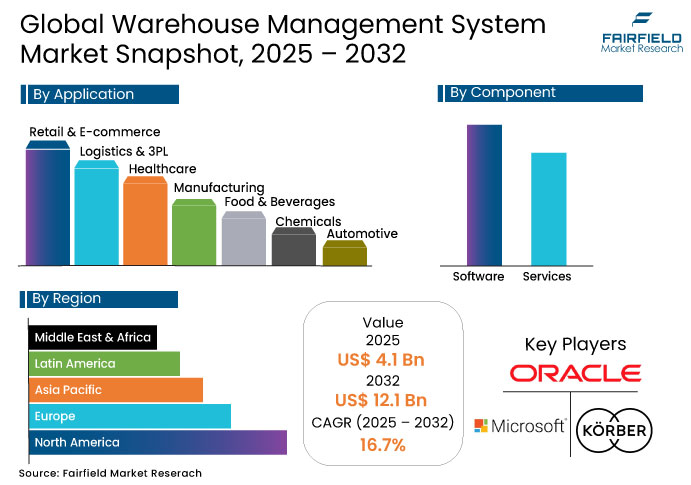

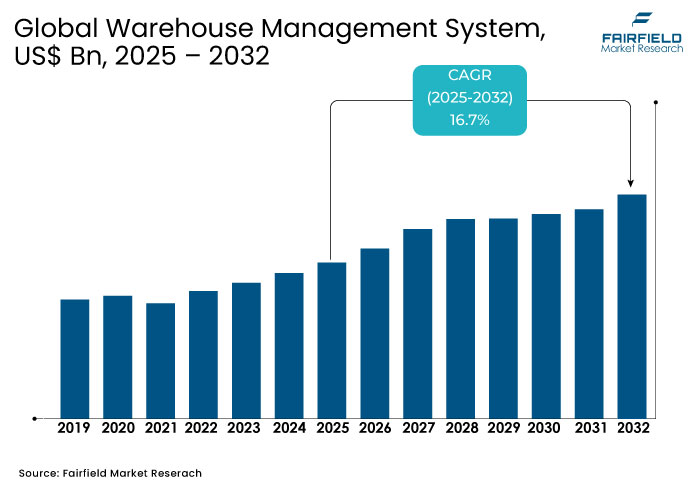

- Global Warehouse Management System (WMS) market is expected to growth from US$ 4.1 Bn in 2025 to US$ 12.1 Bn by 2032. The market with register a significant growth rate of 16.7% during this period.

- The rapid expansion of the e-commerce and omnichannel retail sector is a key growth driver for increasing demand for efficient warehouse management systems.

Warehouse Management System Market Insights

- Software-based WMS platforms are witnessing robust demand as businesses seek advanced inventory management tools to streamline stock accuracy and fulfillment in the fast-growing retail & e-commerce sector.

- Cloud deployment models are gaining traction, especially among 3PL and logistics providers, due to their flexibility, lower upfront cost, and ease of scaling across distributed warehouse networks.

- Labor management functions within WMS are in high demand in the healthcare industry, where accurate tracking of medical inventory and staff scheduling is critical for timely patient care and compliance.

- Manufacturing companies are investing in WMS for billing and yard management, aiming to reduce loading/unloading delays and improve supply chain coordination across inbound and outbound operations.

- Consulting and integration services are expanding rapidly in the automotive industry, where complex global supply chains require tailored WMS solutions for real-time visibility, traceability, and operational efficiency.

A Look Back and a Look Forward - Comparative Analysis

Between 2019 and 2024, the Warehouse Management System market experienced significant momentum driven by the global e-commerce boom, supply chain digitization, and rising demand for real-time inventory tracking. Cloud-based WMS adoption accelerated, particularly among retail and 3PL sectors. Additionally, post-pandemic warehouse automation and remote accessibility needs pushed enterprises to modernize legacy systems with scalable, software-defined solutions.

From 2025 to 2032, the warehouse management system market is poised for transformation as AI, machine learning, and robotics become standard features in intelligent warehousing. Increasing adoption across emerging economies, growing integration with the Internet of Things (IoT), and emphasis on sustainability will redefine warehouse operations. Demand for modular, cloud-native, and highly interoperable platforms will intensify, especially across manufacturing, healthcare, and automotive sectors.

Key Growth Determinants

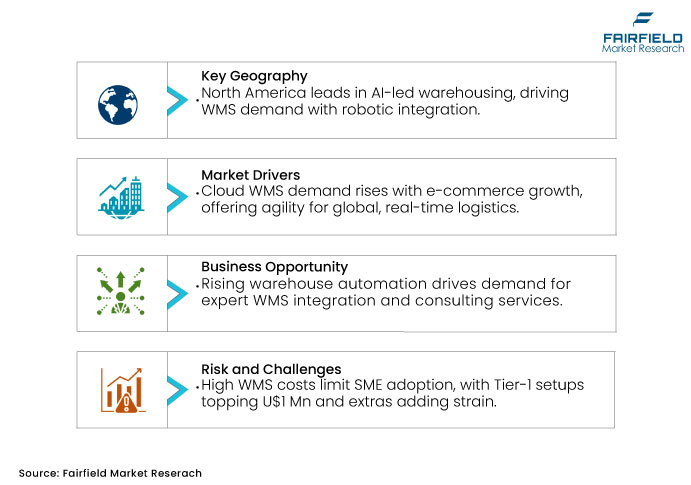

Cloud-based WMS solutions are witnessing growing demand due to increased e-commerce activities and the need for real-time visibility

The growing demand for cloud-based Warehouse Management System solutions is primarily driven by the rapid global expansion of the e-commerce industry, which has transformed supply chain expectations. As companies like Amazon, Alibaba, and Flipkart continue to scale operations, cloud WMS offers the agility to handle fluctuating order volumes, multi-location fulfillment, and omnichannel distribution. For instance, in 2024, Walmart invested in cloud-native logistics platforms to enhance its real-time inventory management capabilities across hundreds of distribution centers.

Additionally, cloud-based WMS provides real-time visibility, essential for reducing errors, improving accuracy, and enabling proactive decision-making. This is particularly crucial as 60% of logistics firms cite visibility as a top supply chain challenge, according to a recent Zebra Technologies report. Cloud solutions also support seamless software updates, AI integration, and remote access, making them ideal for businesses scaling globally. As cyber threats grow, cloud WMS vendors like SAP, Oracle, and Manhattan Associates are increasingly offering advanced security and compliance features, further accelerating adoption across industries.

Key Growth Barriers

High upfront costs and complex integration of WMS with existing enterprise systems restrict adoption among small and mid-sized enterprises

High upfront costs present a significant barrier to WMS adoption, particularly among small and mid-sized enterprises (SMEs). According to CPCON Group, Tier-3 systems start around US$ 100 thousand, while Tier‑1 deployments can exceed US$ 1 million, with additional integration and customization costs often reaching US$ 10-40 thousand. These high initial outlays strain SME IT budgets and slow digital transformation efforts.

Complex integration with existing enterprise systems further hampers WMS uptake. A recent market analysis notes that “high initial setup costs and complex implementation processes remain major barriers, especially for smaller firms with limited IT budgets”. Additionally, automation adoption surveys report integration challenges impact 38–39% of facilities, highlighting that merging WMS with legacy ERP, CRM, or logistics tools requires specialized expertise and adds hidden costs; deterring adoption among resource-constrained SMEs

Warehouse Management System Market Opportunities

Service providers can capitalize on the growing need for system integration and consulting services in automated warehouse setups

As warehouse automation accelerates globally, companies are increasingly seeking professional support for seamless integration of WMS with robotics, ERP systems, and IoT-enabled infrastructure. The growing complexity of modern warehouse environments—driven by e-commerce fulfillment, real-time tracking, and multi-node distribution networks—has created a clear need for expert consulting and system integration services to ensure smooth deployment and operational efficiency.

Service providers can capitalize on this shift by offering end-to-end solutions such as architecture design, software customization, staff training, and post-deployment support. Companies adopting cloud-based WMS platforms and advanced automation tools often lack internal IT resources to manage the transition, turning to specialized firms for support. This growing dependency opens recurring revenue streams for consultants and integrators who can deliver tailored, scalable, and industry-specific WMS solutions.

Segment-wise Overview

- The retail & e-commerce segment is rapidly adopting WMS to streamline order fulfillment and reduce last-mile delivery delays

The retail and e-commerce sector is rapidly transforming warehousing operations due to rising online order volumes and consumer expectations for faster delivery. With last-mile delivery costs accounting for over 50% of total shipping expenses, companies are under pressure to optimize inventory flow and fulfillment speed. Warehouse Management Systems enable retailers to automate picking, sorting, and packing—reducing errors, increasing throughput, and minimizing delivery delays. These systems are now essential for meeting next-day and same-day delivery promises in a cost-efficient manner.

Major players like Walmart and Amazon have heavily invested in WMS-backed automation to manage complex, multi-node fulfillment networks. Walmart’s recent rollout of advanced automated distribution centers and drone-assisted deliveries reflects how deeply integrated WMS solutions are in modern retail logistics. Additionally, omnichannel strategies have pushed brands to maintain accurate real-time inventory across physical stores, warehouses, and online platforms—something only a robust WMS can effectively handle. This widespread adoption positions retail & e-commerce as a key growth driver for the warehouse management system market.

- Software remains the dominant component due to advancements in analytics, inventory optimization, and automation across industries

The software component continues to dominate the global warehouse management system market because ongoing innovations in analytics, inventory optimization, and automation make it indispensable for modern warehousing.

WMS software solutions are now incorporating AI-driven analytics to forecast demand and detect anomalies with over 85% accuracy. Advanced tools like dynamic slotting, labor forecasting, and robotic process orchestration optimize inventory and reduce warehouse inefficiencies by 30–40%. Leading vendors such as Oracle and Manhattan Associates have recently upgraded their platforms to include real-time dashboards and predictive inventory alerts, enabling companies to proactively manage stock levels.

As automation proliferates, software remains at the core of orchestrating integrated systems, such as conveyor belts, scanners, AMRs, and automated sorting units, across industries like retail, manufacturing, and logistics. Cloud-delivered WMS platforms also facilitate rapid deployment, seamless updates, and remote scalability. Businesses increasingly rely on these software solutions to ensure operational agility and resiliency, making the software component the primary growth engine of the global WMS market.

Regional Analysis

- In North America, widespread adoption of robotics and AI in warehousing is accelerating demand for intelligent WMS platforms

North America leads warehouse innovation as companies rapidly integrate robotics and AI to boost efficiency. The region’s AI in warehousing market, accounting for more than 40% of global revenue, drives intelligent WMS adoption to orchestrate complex robotic fleets and real-time analytics. Amazon alone deploys over 750,000 robots and has unveiled tactile AI robot “Vulcan,” reinforcing demand for WMS capable of managing autonomous systems alongside human workflows.

Moreover, autonomous mobile robots (AMRs) are revolutionizing operations, with North America’s AMR market growing over 50% in recent years and expected to more than double by 2030. Leading retailers like Walmart and logistics firms leverage WMS-integrated robotics to reduce labor strain and lift operational capacity. Cloud-connected WMS platforms are essential in managing robotic task allocation, dynamic slotting, and labor forecasting catalyzing adoption by enabling scalable, AI-driven warehouse ecosystems.

- Stringent labor regulations in Europe are pushing logistics firms to adopt WMS for efficient labor and workforce management

Europe’s stringent labor regulations, including mandated break schedules, shift durations, and work-hour caps, are driving logistics companies to implement advanced WMS for workforce compliance and efficiency. With labor costs comprising over 45% of total warehouse expenses, firms are leveraging WMS modules that optimize shift planning, monitor break cycles, and auto-adjust labor allocation. This ensures legal adherence and smooth operations even during seasonal demand peaks.

Leading logistics operators such as DHL and DB Schenker are deploying WMS solutions featuring labor management dashboards to track staff productivity and compliance in real time. These systems reduce overtime and errors, ensuring balanced workloads across teams. In addition, integration with biometric timekeeping and mobile labor apps enhances visibility and accountability; making WMS adoption essential for regulations-driven efficiency and risk mitigation in European warehousing.

- Rapid industrialization and the expansion of manufacturing hubs in Asia Pacific are fueling investments in scalable WMS solutions

Asia Pacific’s boom in manufacturing and logistics is driving unprecedented demand for scalable WMS. With regional warehouse automation spending reaching US$ 15 billion in 2025, largely driven by manufacturing, e-commerce, and FMCG, companies seek WMS platforms that can handle automation technologies like AGVs and AMRs.

Concurrently, industrial corridors and smart industrial park initiatives across China, India, and Southeast Asia are expanding multi-node manufacturing networks. Leading WMS integrators, like enVista, are investing in regional services to support this growth, enabling 24/7 system deployment and support. As labor shortages and rising costs increase, WMS-enabled automation and real-time control become critical, positioning scalable, cloud-ready platforms as strategic enablers of the region’s manufacturing surge.

Competitive Landscape

Leading warehouse management system (WMS) players such as SAP, Oracle, Blue Yonder, and Manhattan Associates are aggressively embedding AI, robotics integration, and cloud-based orchestration into their platforms. Oracle was once again named a 2025 Gartner WMS Leader for its AI-powered real-time inventory and fulfillment capabilities, while SAP incorporated reinforcement learning into its WMS executive framework. These advances set a new bar for intelligent, scalable logistics systems.

Blue Yonder partnered with NVIDIA to infuse predictive intelligence into its WMS offerings, and Körber acquired a robotics startup to support full warehouse automation. Meanwhile, Mantis and Infios expanded their global footprints and earned repeated recognition in Gartner’s Magic Quadrant. This wave of partnerships and acquisitions is reshaping the vendor landscape, driving consolidation and intensifying competition.

Key Market Companies

- Microsoft Corporation

- Körber AG

- Infor Inc.

- Oracle Corporation

- IBM

- SAP SE

- Tecsys

- Manhattan Associates

- PSI Logistics

- EPICOR

- Softeon

- Blue Yonder

- Synergy Ltd

- Made4net

- Unicommerce eSolutions Pvt. Ltd.

- enVista

Expert Opinion

- WMS platforms are becoming strategic assets, not just operational tools, as industries integrate AI, IoT, and robotics to build data-driven, autonomous warehousing systems for future-ready supply chains.

- Cloud-native and modular WMS solutions are gaining preference, offering scalable infrastructure and faster deployment across multi-site networks, especially important for SMEs and fast-growing e-commerce and 3PL operators.

- Rising labor costs and regulatory compliance pressures, particularly in Europe and North America, are pushing firms to adopt WMS with built-in labor management and workforce optimization capabilities.

- Emerging economies in Asia Pacific are accelerating WMS investments, fueled by industrial expansion, digitalization initiatives, and government-backed smart logistics infrastructure in countries like India, China, and Indonesia.

Global Warehouse Management System Market Segmentation-

By Component

- Software

- Services

By Deployment

- On-premise

- Cloud

By Function

- Inventory Management

- Order Management

- Labor Management

- Billing & Yard Management

- Analytics & Optimization

- System Integration & Maintenance

- Consulting Services

By Application

- Retail & E-commerce

- Logistics & 3PL

- Healthcare

- Manufacturing

- Food & Beverages

- Chemicals

- Automotive

- Others (IT & Telecom, Furniture, etc.)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

1. Executive Summary

1.1. Global Warehouse Management System Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Value, 2025

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. COVID-19 Impact Analysis

2.5. Porter's Fiver Forces Analysis

2.6. Impact of Russia-Ukraine Conflict

2.7. PESTLE Analysis

2.8. Regulatory Analysis

2.9. Price Trend Analysis

2.9.1. Current Prices and Future Projections, 2024-2032

2.9.2. Price Impact Factors

3. Global Warehouse Management System Market Outlook, 2019 - 2032

3.1. Global Warehouse Management System Market Outlook, by Component, Value (US$ Bn), 2019 - 2032

3.1.1. Software

3.1.2. Services

3.2. Global Warehouse Management System Market Outlook, by Deployment, Value (US$ Bn), 2019 - 2032

3.2.1. On-premise

3.2.2. Cloud

3.3. Global Warehouse Management System Market Outlook, by Function, Value (US$ Bn), 2019 - 2032

3.3.1. Inventory Management

3.3.2. Order Management

3.3.3. Labor Management

3.3.4. Billing & Yard Management

3.3.5. Analytics & Optimization

3.3.6. System Integration & Maintenance

3.3.7. Consulting Services

3.4. Global Warehouse Management System Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

3.4.1. Retail & E-commerce

3.4.2. Logistics & 3PL

3.4.3. Healthcare

3.4.4. Manufacturing

3.4.5. Food & Beverages

3.4.6. Chemicals

3.4.7. Automotive

3.4.8. Others (IT & Telecom, Furniture, etc.)

3.5. Global Warehouse Management System Market Outlook, by Region, Value (US$ Bn), 2019 - 2032

3.5.1. North America

3.5.2. Europe

3.5.3. Asia Pacific

3.5.4. Latin America

3.5.5. Middle East & Africa

4. North America Warehouse Management System Market Outlook, 2019 - 2032

4.1. North America Warehouse Management System Market Outlook, by Component, Value (US$ Bn), 2019 - 2032

4.1.1. Software

4.1.2. Services

4.2. North America Warehouse Management System Market Outlook, by Deployment, Value (US$ Bn), 2019 - 2032

4.2.1. On-premise

4.2.2. Cloud

4.3. North America Warehouse Management System Market Outlook, by Function, Value (US$ Bn), 2019 - 2032

4.3.1. Inventory Management

4.3.2. Order Management

4.3.3. Labor Management

4.3.4. Billing & Yard Management

4.3.5. Analytics & Optimization

4.3.6. System Integration & Maintenance

4.3.7. Consulting Services

4.4. North America Warehouse Management System Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

4.4.1. Retail & E-commerce

4.4.2. Logistics & 3PL

4.4.3. Healthcare

4.4.4. Manufacturing

4.4.5. Food & Beverages

4.4.6. Chemicals

4.4.7. Automotive

4.4.8. Others (IT & Telecom, Furniture, etc.)

4.5. North America Warehouse Management System Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

4.5.1. U.S. Warehouse Management System Market Outlook, by Component, 2019 - 2032

4.5.2. U.S. Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

4.5.3. U.S. Warehouse Management System Market Outlook, by Function, 2019 - 2032

4.5.4. U.S. Warehouse Management System Market Outlook, by Application, 2019 - 2032

4.5.5. Canada Warehouse Management System Market Outlook, by Component, 2019 - 2032

4.5.6. Canada Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

4.5.7. Canada Warehouse Management System Market Outlook, by Function, 2019 - 2032

4.5.8. Canada Warehouse Management System Market Outlook, by Application, 2019 - 2032

4.6. BPS Analysis/Market Attractiveness Analysis

5. Europe Warehouse Management System Market Outlook, 2019 - 2032

5.1. Europe Warehouse Management System Market Outlook, by Component, Value (US$ Bn), 2019 - 2032

5.1.1. Software

5.1.2. Services

5.2. Europe Warehouse Management System Market Outlook, by Deployment, Value (US$ Bn), 2019 - 2032

5.2.1. On-premise

5.2.2. Cloud

5.3. Europe Warehouse Management System Market Outlook, by Function, Value (US$ Bn), 2019 - 2032

5.3.1. Inventory Management

5.3.2. Order Management

5.3.3. Labor Management

5.3.4. Billing & Yard Management

5.3.5. Analytics & Optimization

5.3.6. System Integration & Maintenance

5.3.7. Consulting Services

5.4. Europe Warehouse Management System Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

5.4.1. Retail & E-commerce

5.4.2. Logistics & 3PL

5.4.3. Healthcare

5.4.4. Manufacturing

5.4.5. Food & Beverages

5.4.6. Chemicals

5.4.7. Automotive

5.4.8. Others (IT & Telecom, Furniture, etc.)

5.5. Europe Warehouse Management System Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

5.5.1. Germany Warehouse Management System Market Outlook, by Component, 2019 - 2032

5.5.2. Germany Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

5.5.3. Germany Warehouse Management System Market Outlook, by Function, 2019 - 2032

5.5.4. Germany Warehouse Management System Market Outlook, by Application, 2019 - 2032

5.5.5. Italy Warehouse Management System Market Outlook, by Component, 2019 - 2032

5.5.6. Italy Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

5.5.7. Italy Warehouse Management System Market Outlook, by Function, 2019 - 2032

5.5.8. Italy Warehouse Management System Market Outlook, by Application, 2019 - 2032

5.5.9. France Warehouse Management System Market Outlook, by Component, 2019 - 2032

5.5.10. France Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

5.5.11. France Warehouse Management System Market Outlook, by Function, 2019 - 2032

5.5.12. France Warehouse Management System Market Outlook, by Application, 2019 - 2032

5.5.13. U.K. Warehouse Management System Market Outlook, by Component, 2019 - 2032

5.5.14. U.K. Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

5.5.15. U.K. Warehouse Management System Market Outlook, by Function, 2019 - 2032

5.5.16. U.K. Warehouse Management System Market Outlook, by Application, 2019 - 2032

5.5.17. Spain Warehouse Management System Market Outlook, by Component, 2019 - 2032

5.5.18. Spain Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

5.5.19. Spain Warehouse Management System Market Outlook, by Function, 2019 - 2032

5.5.20. Spain Warehouse Management System Market Outlook, by Application, 2019 - 2032

5.5.21. Russia Warehouse Management System Market Outlook, by Component, 2019 - 2032

5.5.22. Russia Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

5.5.23. Russia Warehouse Management System Market Outlook, by Function, 2019 - 2032

5.5.24. Russia Warehouse Management System Market Outlook, by Application, 2019 - 2032

5.5.25. Rest of Europe Warehouse Management System Market Outlook, by Component, 2019 - 2032

5.5.26. Rest of Europe Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

5.5.27. Rest of Europe Warehouse Management System Market Outlook, by Function, 2019 - 2032

5.5.28. Rest of Europe Warehouse Management System Market Outlook, by Application, 2019 - 2032

5.6. BPS Analysis/Market Attractiveness Analysis

6. Asia Pacific Warehouse Management System Market Outlook, 2019 - 2032

6.1. Asia Pacific Warehouse Management System Market Outlook, by Component, Value (US$ Bn), 2019 - 2032

6.1.1. Software

6.1.2. Services

6.2. Asia Pacific Warehouse Management System Market Outlook, by Deployment, Value (US$ Bn), 2019 - 2032

6.2.1. On-premise

6.2.2. Cloud

6.3. Asia Pacific Warehouse Management System Market Outlook, by Function, Value (US$ Bn), 2019 - 2032

6.3.1. Inventory Management

6.3.2. Order Management

6.3.3. Labor Management

6.3.4. Billing & Yard Management

6.3.5. Analytics & Optimization

6.3.6. System Integration & Maintenance

6.3.7. Consulting Services

6.4. Asia Pacific Warehouse Management System Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

6.4.1. Retail & E-commerce

6.4.2. Logistics & 3PL

6.4.3. Healthcare

6.4.4. Manufacturing

6.4.5. Food & Beverages

6.4.6. Chemicals

6.4.7. Automotive

6.4.8. Others (IT & Telecom, Furniture, etc.)

6.5. Asia Pacific Warehouse Management System Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

6.5.1. China Warehouse Management System Market Outlook, by Component, 2019 - 2032

6.5.2. China Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

6.5.3. China Warehouse Management System Market Outlook, by Function, 2019 - 2032

6.5.4. China Warehouse Management System Market Outlook, by Application, 2019 - 2032

6.5.5. Japan Warehouse Management System Market Outlook, by Component, 2019 - 2032

6.5.6. Japan Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

6.5.7. Japan Warehouse Management System Market Outlook, by Function, 2019 - 2032

6.5.8. Japan Warehouse Management System Market Outlook, by Application, 2019 - 2032

6.5.9. South Korea Warehouse Management System Market Outlook, by Component, 2019 - 2032

6.5.10. South Korea Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

6.5.11. South Korea Warehouse Management System Market Outlook, by Function, 2019 - 2032

6.5.12. South Korea Warehouse Management System Market Outlook, by Application, 2019 - 2032

6.5.13. India Warehouse Management System Market Outlook, by Component, 2019 - 2032

6.5.14. India Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

6.5.15. India Warehouse Management System Market Outlook, by Function, 2019 - 2032

6.5.16. India Warehouse Management System Market Outlook, by Application, 2019 - 2032

6.5.17. Southeast Asia Warehouse Management System Market Outlook, by Component, 2019 - 2032

6.5.18. Southeast Asia Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

6.5.19. Southeast Asia Warehouse Management System Market Outlook, by Function, 2019 - 2032

6.5.20. Southeast Asia Warehouse Management System Market Outlook, by Application, 2019 - 2032

6.5.21. Rest of SAO Warehouse Management System Market Outlook, by Component, 2019 - 2032

6.5.22. Rest of SAO Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

6.5.23. Rest of SAO Warehouse Management System Market Outlook, by Function, 2019 - 2032

6.5.24. Rest of SAO Warehouse Management System Market Outlook, by Application, 2019 - 2032

6.6. BPS Analysis/Market Attractiveness Analysis

7. Latin America Warehouse Management System Market Outlook, 2019 - 2032

7.1. Latin America Warehouse Management System Market Outlook, by Component, Value (US$ Bn), 2019 - 2032

7.1.1. Software

7.1.2. Services

7.2. Latin America Warehouse Management System Market Outlook, by Deployment, Value (US$ Bn), 2019 - 2032

7.2.1. On-premise

7.2.2. Cloud

7.3. Latin America Warehouse Management System Market Outlook, by Function, Value (US$ Bn), 2019 - 2032

7.3.1. Inventory Management

7.3.2. Order Management

7.3.3. Labor Management

7.3.4. Billing & Yard Management

7.3.5. Analytics & Optimization

7.3.6. System Integration & Maintenance

7.3.7. Consulting Services

7.4. Latin America Warehouse Management System Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

7.4.1. Retail & E-commerce

7.4.2. Logistics & 3PL

7.4.3. Healthcare

7.4.4. Manufacturing

7.4.5. Food & Beverages

7.4.6. Chemicals

7.4.7. Automotive

7.4.8. Others (IT & Telecom, Furniture, etc.)

7.5. Latin America Warehouse Management System Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

7.5.1. Brazil Warehouse Management System Market Outlook, by Component, 2019 - 2032

7.5.2. Brazil Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

7.5.3. Brazil Warehouse Management System Market Outlook, by Function, 2019 - 2032

7.5.4. Brazil Warehouse Management System Market Outlook, by Application, 2019 - 2032

7.5.5. Mexico Warehouse Management System Market Outlook, by Component, 2019 - 2032

7.5.6. Mexico Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

7.5.7. Mexico Warehouse Management System Market Outlook, by Function, 2019 - 2032

7.5.8. Mexico Warehouse Management System Market Outlook, by Application, 2019 - 2032

7.5.9. Argentina Warehouse Management System Market Outlook, by Component, 2019 - 2032

7.5.10. Argentina Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

7.5.11. Argentina Warehouse Management System Market Outlook, by Function, 2019 - 2032

7.5.12. Argentina Warehouse Management System Market Outlook, by Application, 2019 - 2032

7.5.13. Rest of LATAM Warehouse Management System Market Outlook, by Component, 2019 - 2032

7.5.14. Rest of LATAM Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

7.5.15. Rest of LATAM Warehouse Management System Market Outlook, by Function, 2019 - 2032

7.5.16. Rest of LATAM Warehouse Management System Market Outlook, by Application, 2019 - 2032

7.6. BPS Analysis/Market Attractiveness Analysis

8. Middle East & Africa Warehouse Management System Market Outlook, 2019 - 2032

8.1. Middle East & Africa Warehouse Management System Market Outlook, by Component, Value (US$ Bn), 2019 - 2032

8.1.1. Software

8.1.2. Services

8.2. Middle East & Africa Warehouse Management System Market Outlook, by Deployment, Value (US$ Bn), 2019 - 2032

8.2.1. On-premise

8.2.2. Cloud

8.3. Middle East & Africa Warehouse Management System Market Outlook, by Function, Value (US$ Bn), 2019 - 2032

8.3.1. Inventory Management

8.3.2. Order Management

8.3.3. Labor Management

8.3.4. Billing & Yard Management

8.3.5. Analytics & Optimization

8.3.6. System Integration & Maintenance

8.3.7. Consulting Services

8.4. Middle East & Africa Warehouse Management System Market Outlook, by Application, Value (US$ Bn), 2019 - 2032

8.4.1. Retail & E-commerce

8.4.2. Logistics & 3PL

8.4.3. Healthcare

8.4.4. Manufacturing

8.4.5. Food & Beverages

8.4.6. Chemicals

8.4.7. Automotive

8.4.8. Others (IT & Telecom, Furniture, etc.)

8.5. Middle East & Africa Warehouse Management System Market Outlook, by Country, Value (US$ Bn), 2019 - 2032

8.5.1. GCC Warehouse Management System Market Outlook, by Component, 2019 - 2032

8.5.2. GCC Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

8.5.3. GCC Warehouse Management System Market Outlook, by Function, 2019 - 2032

8.5.4. GCC Warehouse Management System Market Outlook, by Application, 2019 - 2032

8.5.5. South Africa Warehouse Management System Market Outlook, by Component, 2019 - 2032

8.5.6. South Africa Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

8.5.7. South Africa Warehouse Management System Market Outlook, by Function, 2019 - 2032

8.5.8. South Africa Warehouse Management System Market Outlook, by Application, 2019 - 2032

8.5.9. Egypt Warehouse Management System Market Outlook, by Component, 2019 - 2032

8.5.10. Egypt Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

8.5.11. Egypt Warehouse Management System Market Outlook, by Function, 2019 - 2032

8.5.12. Egypt Warehouse Management System Market Outlook, by Application, 2019 - 2032

8.5.13. Nigeria Warehouse Management System Market Outlook, by Component, 2019 - 2032

8.5.14. Nigeria Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

8.5.15. Nigeria Warehouse Management System Market Outlook, by Function, 2019 - 2032

8.5.16. Nigeria Warehouse Management System Market Outlook, by Application, 2019 - 2032

8.5.17. Rest of Middle East Warehouse Management System Market Outlook, by Component, 2019 - 2032

8.5.18. Rest of Middle East Warehouse Management System Market Outlook, by Deployment, 2019 - 2032

8.5.19. Rest of Middle East Warehouse Management System Market Outlook, by Function, 2019 - 2032

8.5.20. Rest of Middle East Warehouse Management System Market Outlook, by Application, 2019 - 2032

8.6. BPS Analysis/Market Attractiveness Analysis

9. Competitive Landscape

9.1. Company Vs Segment Heatmap

9.2. Company Market Share Analysis, 2025

9.3. Competitive Dashboard

9.4. Company Profiles

9.4.1. Microsoft Corporation

9.4.1.1. Company Overview

9.4.1.2. Product Portfolio

9.4.1.3. Financial Overview

9.4.1.4. Business Strategies and Developments

9.4.2. Körber AG

9.4.2.1. Company Overview

9.4.2.2. Product Portfolio

9.4.2.3. Financial Overview

9.4.2.4. Business Strategies and Developments

9.4.3. Infor Inc.

9.4.3.1. Company Overview

9.4.3.2. Product Portfolio

9.4.3.3. Financial Overview

9.4.3.4. Business Strategies and Developments

9.4.4. Oracle Corporation

9.4.4.1. Company Overview

9.4.4.2. Product Portfolio

9.4.4.3. Financial Overview

9.4.4.4. Business Strategies and Developments

9.4.5. IBM

9.4.5.1. Company Overview

9.4.5.2. Product Portfolio

9.4.5.3. Financial Overview

9.4.5.4. Business Strategies and Developments

9.4.6. SAP SE

9.4.6.1. Company Overview

9.4.6.2. Product Portfolio

9.4.6.3. Financial Overview

9.4.6.4. Business Strategies and Developments

9.4.7. Tecsys

9.4.7.1. Company Overview

9.4.7.2. Product Portfolio

9.4.7.3. Financial Overview

9.4.7.4. Business Strategies and Developments

9.4.8. Manhattan Associates

9.4.8.1. Company Overview

9.4.8.2. Product Portfolio

9.4.8.3. Financial Overview

9.4.8.4. Business Strategies and Developments

9.4.9. PSI Logistics

9.4.9.1. Company Overview

9.4.9.2. Product Portfolio

9.4.9.3. Financial Overview

9.4.9.4. Business Strategies and Developments

9.4.10. Blue Yonder

9.4.10.1. Company Overview

9.4.10.2. Product Portfolio

9.4.10.3. Financial Overview

9.4.10.4. Business Strategies and Developments

9.4.11. EPICOR

9.4.11.1. Company Overview

9.4.11.2. Product Portfolio

9.4.11.3. Financial Overview

9.4.11.4. Business Strategies and Developments

9.4.12. Softeon

9.4.12.1. Company Overview

9.4.12.2. Product Portfolio

9.4.12.3. Financial Overview

9.4.12.4. Business Strategies and Developments

9.4.13. Synergy Ltd

9.4.13.1. Company Overview

9.4.13.2. Product Portfolio

9.4.13.3. Financial Overview

9.4.13.4. Business Strategies and Developments

9.4.14. Made4net

9.4.14.1. Company Overview

9.4.14.2. Product Portfolio

9.4.14.3. Financial Overview

9.4.14.4. Business Strategies and Developments

9.4.15. Unicommerce eSolutions Pvt. Ltd.

9.4.15.1. Company Overview

9.4.15.2. Product Portfolio

9.4.15.3. Financial Overview

9.4.15.4. Business Strategies and Developments

10. Appendix

10.1. Research Methodology

10.2. Report Assumptions

10.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Chemical Type Coverage |

|

|

End Use Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |