Automotive Lighting Market Growth and Industry Forecast

- The Automotive Lighting Market is valued at USD 27.2 Bn in 2026 and is projected to reach USD 41.7 Bn, growing at a CAGR of 6% by 2033.

Automotive Lighting Market Summary: Key Insights & Trends

- Passenger cars dominate the automotive lighting market with a 65% share in 2024, driven by high production volumes and LED adoption in over 75% of new models.

- Electric Vehicles are the fastest-growing segment, expanding at a 12.2% CAGR through 2032 with advanced LED and OLED integration.

- Exterior Lighting leads applications with 72% market share, supported by safety regulations that cut nighttime accidents by 20%.

- LED technology retains dominance at 68% share in 2024, while OLED grows fastest at 9.4% CAGR in premium vehicles.

- OEMs account for 79% share, though the aftermarket grows at 8% CAGR via LED retrofits and customization trends.

- Asia Pacific holds ~48.5% share, with China at the forefront as EV production surges past 10 million units by 2025, driving strong demand for advanced automotive lighting solutions across the region.

- Rising EV penetration expected to reach 381 million units by 2032, fueling demand for adaptive and sensor-integrated lighting systems.

- IoT and 5G integration create a US$ 15 Bn opportunity by 2032 through smart, sensor-embedded lighting for autonomous vehicles.

A Look Back and a Look Forward - Comparative Analysis

The automotive lighting market experienced a turbulent journey during 2019–2024, shaped by sharp downturns and gradual recovery. In 2019, the industry was valued at US$ 29.8 billion, supported by steady passenger vehicle demand and the accelerating shift toward LED technologies in Asia Pacific. The outbreak of COVID-19 in 2020 disrupted global supply chains and halted manufacturing operations. With consumer spending on automobiles declining, the market value dropped by nearly 20%, creating widespread challenges for lighting component suppliers worldwide.

Recovery began to take hold in 2021, driven by pent-up vehicle demand and government incentives for electric mobility. By 2024, the market had climbed back to approximately US$ 34.5 billion, recording a modest CAGR of about 3.0% over the five years. Persistent issues such as semiconductor shortages and raw material constraints tested industry resilience, yet innovations in adaptive lighting, a sharper focus on cost efficiency, and the move toward regional sourcing strategies helped the sector stabilize and prepare for future disruptions.

Looking ahead to 2025–2032, the automotive lighting market is poised for accelerated growth, driven by the rapid electrification of vehicles and continuous advancements in smart lighting technologies. The integration of OLED and laser technologies will dominate, offering superior energy efficiency and design flexibility, particularly in premium and electric vehicle segments. Emerging markets in Asia Pacific will drive volume growth through increased vehicle production, while stringent safety regulations in Europe and North America will mandate advanced features such as adaptive headlights. Sustainability trends, including recyclable materials in lighting components, will further propel the market, alongside the rise of autonomous vehicles requiring enhanced sensor-integrated lights.

Key Growth Drivers

- LED Technology Adoption Driving Energy Efficiency and Market Growth in Automotive Lighting

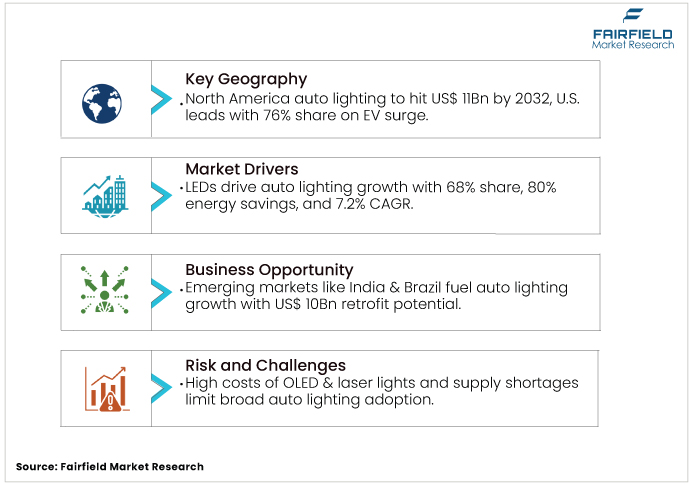

The automotive lighting market is significantly driven by the widespread adoption of LED lighting, which accounted for over 68% of the market share in 2024 and is expected to grow at a CAGR of 7.2% through 2032. LEDs offer up to 80% energy savings compared to halogen bulbs, reducing vehicle fuel consumption by 0.5-1 liter per 100 km, according to industry studies. This efficiency aligns with global emission reduction goals, such as the EU's CO2 targets for vehicles, prompting manufacturers such as Toyota and Volkswagen to integrate LEDs in 90% of new models. Furthermore, LEDs' longer lifespan, up to 50,000 hours versus 1,000 for halogens, lowers maintenance costs, justifying their premium pricing. In emerging economies, where vehicle ownership is annually rising by 5-7%, LED adoption is accelerated by government subsidies for energy-efficient components, boosting the overall market.

- Rising Vehicle Production and EV Penetration Boosting Automotive Lighting Demand

Global vehicle production reached 92 million units in 2024, with electric vehicles (EVs) comprising 14% of sales, up from 4% in 2019, directly propelling the automotive lighting demand. EVs require advanced lighting for aerodynamic designs and safety features, with the segment projected to grow at 12.2% CAGR through 2032. Statistics from the International Energy Agency indicate that EV sales could hit 381 million units by 2032, necessitating specialized lighting such as matrix LEDs for adaptive beam control. In China, the world's largest EV market, production incentives have led to a 25% year-over-year increase in lighting demand. This driver is justified by the need for enhanced visibility in autonomous and connected vehicles, where lighting integrates with sensors, contributing to a 15% reduction in nighttime accidents as per NHTSA data, thus sustaining market growth.

- Stringent Safety Regulations and Consumer Demand Fuelling Advanced Automotive Lighting Features

Regulatory bodies such as the NHTSA and Euro NCAP mandate advanced lighting for vehicle safety ratings, driving the industry with requirements for daytime running lights and adaptive systems that reduce glare by 70%. In 2024, over 80% of new vehicles in Europe featured such technologies, supported by regulations aiming for zero road fatalities by 2050. Consumer surveys show 65% of buyers prioritizing safety features, leading to a 10% premium willingness for smart lights. Justifications include a 20% drop in collision rates with LED headlights, as reported by IIHS, encouraging OEMs to innovate. This driver is amplified in urban areas with high traffic density, where ambient lighting improves pedestrian detection, positioning the automotive lighting market for sustained expansion.

Key Growth Restraints

- Premium OLED and Laser Lights Face Limited Adoption Due to High Costs

The market faces restraints from the elevated costs of technologies such as OLED and laser lights, which can be 2-3 times more expensive than halogen alternatives, deterring adoption in budget segments. In developing regions, where average vehicle prices are under US$ 15,000, this adds 5-10% to manufacturing costs, limiting penetration to premium models. Supply chain issues for rare earth materials further inflate prices by 15-20%, as seen in 2024 shortages, impacting profitability for suppliers and slowing market growth despite long-term benefits.

- Semiconductor Shortages Create Delays in Vehicle Production and Lighting Supply

Geopolitical tensions and post-COVID effects have caused persistent supply chain disruptions in the automotive lighting market, with semiconductor shortages delaying production by 10-15% in 2024. Key materials such as gallium for LEDs face volatility, increasing costs by around 25%, as evidenced by global trade data. This restraint affects timely deliveries to OEMs, leading to vehicle backlogs and reduced market expansion, particularly in high-volume regions such as Asia Pacific where just-in-time manufacturing is prevalent.

Automotive Lighting Market Trends and Opportunities

- Urbanization in India, Brazil Creates Growth Potential for Affordable Vehicle Lighting

The automotive lighting market presents opportunities in emerging economies such as India and Brazil, where urbanization is driving a 7-8% annual increase in vehicle demand. With urban population expected to reach 60% by 2030, per UN data, there's potential for affordable LED retrofits in aftermarket segments. Investments in infrastructure, such as smart cities, justify integrating connected lighting, potentially capturing around 20% market share. Companies can leverage this by partnering with local manufacturers, tapping into a US$ 10 billion opportunity through customized, cost-effective solutions for two-wheelers and commercial vehicles.

- IoT and 5G Integration Unlock Opportunities for Next-Gen Smart Vehicle Lighting

Advancements in IoT and 5G enable smart lighting, offering features such as vehicle-to-vehicle communication for hazard alerts, projected to grow at a significant CAGR. With autonomous vehicles expected to number 24 million by 2032, opportunities arise for sensor-embedded lights, enhancing safety by 30%. Justifications include consumer demand for personalization, with 70% of millennials favoring app-controlled ambient lights. This opens avenues for R&D collaborations, positioning the market for a US$15 billion boost through innovative ecosystems.

Segment-wise Trends & Analysis

- Automotive Lighting Demand Supported by Passenger Cars and Electric Vehicle Adoption

Passenger cars account for a leading position approximately for a 65% share in 2024, driven by high production volumes exceeding 60 million units globally. Their dominance stems from consumer demand for aesthetic and safety enhancements, with LEDs integrated in 75% of new models. Electric Vehicles (EVs) emerge as the fastest-growing segment, projected at a 12.2% CAGR through 2032, fueled by the need for energy-efficient lights that extend battery range by 5-10%. Light Commercial Vehicles follow with steady growth due to logistics expansion, while heavy commercial vehicles lag but benefit from regulatory mandates for durable exterior lighting.

- Rising Demand for Advanced Exterior and Interior Vehicle Lighting Applications

Exterior Lighting leads the market with over 72% share, valued at around US$ 26 billion in 2024, primarily due to safety regulations requiring advanced headlights and taillights. Features such as adaptive beams reduce accidents by 20%, boosting adoption in premium vehicles. Interior Lighting is the fastest-growing, at 7.9% CAGR, driven by trends in ambient and customizable LEDs enhancing passenger comfort, especially in EVs, where it integrates with infotainment. This growth is justified by rising luxury vehicle sales, with 50% of consumers prioritizing interior aesthetics, positioning the segment for significant expansion in the Automotive Lighting Market.

- LED Technology Retains Leadership While OLED Adoption Rises in Premium Models

LED technology dominates, capturing 68% share in 2024, thanks to its efficiency and versatility in applications such as matrix headlights. Its leadership is supported by a 50% cost reduction over five years, making it standard in 80% of new vehicles. OLED emerges as the fastest-growing at 9.4% CAGR, offering flexible, thin designs for innovative taillights and interiors, with adoption in luxury brands such as BMW. Laser technology grows steadily for high-beam applications, while halogen and xenon decline. These trends highlight the market's evolution toward sustainable, high-performance solutions.

- OEMs Drive Majority Share While Aftermarket Expands Through Vehicle Customization

Original Equipment Manufacturers (OEMs) lead the automotive lighting market, accounting for 79% share, integrated into new vehicle production amid rising global output. Their dominance ensures quality and compliance, with partnerships such as Valeo and Ford driving innovations. Aftermarket is the fastest-growing at 8% CAGR, propelled by vehicle customization and retrofits, especially LEDs replacing halogens in older fleets. E-commerce platforms boost accessibility, with consumers spending 15% more on upgrades.

Regional Trends & Analysis

- North America Market Driven by EV Adoption, Safety Rules and Innovation

North America's market is projected to reach US$ 11 billion by 2032, with the U.S. leading at 76% share due to high EV adoption and safety standards. U.S. trends include a shift to adaptive LED systems, mandated by NHTSA for better visibility, reducing crashes by 15%. Drivers such as Tesla's influence have accelerated laser lighting integration, with EV sales hitting 1.6 million in 2024. Stringent emissions rules favor energy-efficient lights, while consumer demand for smart features in SUVs, comprising 50% of sales, fuels growth. Supply chain localization post-COVID enhances resilience, positioning the U.S. as a hub for innovation.

- Europe Market Expansion Driven by Zero Emission Goals and Premium Lighting Adoption

Europe's automotive lighting market, valued at US$ 12 billion in 2025, is led by Germany, France, and the UK, driven by EU regulations for zero-emission vehicles by 2032. Germany holds ~30% share, propelled by OEMs such as BMW adopting OLED for premium models, justified by a 10% export growth. France emphasizes safety with adaptive lights, reducing fatalities by 20%, while the UK's post-Brexit incentives boost EV lighting demand. Key drivers include sustainability goals and R&D investments, with the region achieving 8% CAGR through innovation in connected systems.

- Asia Pacific Market Strengthened by China EV Production and Rising Urban Demand

Asia Pacific dominates with around 50% global share, led by China, India, and Japan, projected to grow at 7.8% CAGR. China's market, at US$ 9 billion in 2025, is driven by EV production exceeding ~10 million units, mandating advanced LEDs for efficiency. India's growth stems from urbanization and two-wheeler demand, with government subsidies for safety lights. Japan leads in technology with laser innovations from Toyota, justified by export demands.

Competitive Landscape Analysis

The automotive lighting market is competitive, with key players focusing on R&D for LED and smart technologies, strategic partnerships for EV integration, and sustainability through recyclable materials. Companies such as Valeo and HELLA emphasize acquisitions to expand portfolios, while OSRAM invests in OLED for design flexibility.

Key Market Companies

- Robert Bosch GmbH

- Hella GmbH & Co. KGaA

- Magneti Marelli / Marelli Holdings Co., Ltd.

- Valeo SA

- Stanley Electric Co., Ltd.

- Koito Manufacturing Co., Ltd.

- ZKW Group (part of ZF)

- Continental AG (lighting division)

- Lumileds (Philips / Apollo Global)

- Osram GmbH (LEDing division / ams OSRAM)

- Nissan Motor Co., Ltd. (in house lighting tech)

- Samsung LED / Samsung Electronics

- LG Innotek / LG Electronics

- DENSO Corporation

- Autoliv Inc.

Recent Developments:

- In March 2025, Valeo formed a strategic partnership with TactoTek to develop advanced interior and exterior lighting applications using In-Mold Structural Electronics. During the same month, Valeo's EvenLED technology also won a Road Safety Innovation Award for vehicle signaling systems

- In July 2025, ams OSRAM and Marelli introduced the micro-LED “EVIYOS™ HD25” headlights on NIO ET9, enabling 25,600-pixel adaptive beams with road-surface projection, improved driver assistance, and enhanced energy efficiency for premium EV applications.

- In July 2025, FORVIA HELLA developed intelligent, OTA-upgradable headlamps for NIO’s ONVO L90, integrating a hardware-software ecosystem with low-power efficiency, advanced safety features, and personalized lighting functions aligned with next-gen EV user experience.

Global Automotive Lighting Market Segmentation-

By Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Technology

- LED

- Halogen

- Xenon

By Product Type

- Interior

- Ambient Lamp

- Reading Lamp

- Backlighting

- Others

- Exterior

- Headlamps

- Tail lamps

- Brake lamps

- Signal Lamp

- Exterior decoration lamp

- Exterior Illumination Function Lamp

- Others

By Sales Channel

- OEM

- Aftermarket

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Executive Summary

- Global Automotive Lighting Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global Automotive Lighting Market Outlook, 2020 - 2033

- Global Automotive Lighting Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Global Automotive Lighting Market Outlook, by Technology, Value (US$ Bn), 2020-2033

- LED

- Halogen

- Xenon

- Global Automotive Lighting Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Interior

- Ambient Lamp

- Reading Lamp

- Backlighting

- Others

- Exterior

- Headlamps

- Tail lamps

- Brake lamps

- Signal Lamp

- Global Automotive Lighting Market Outlook, by Sales Channel, Value (US$ Bn), 2020-2033

- OEM

- Aftermarket

- Global Automotive Lighting Market Outlook, by Region, Value (US$ Bn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global Automotive Lighting Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- North America Automotive Lighting Market Outlook, 2020 - 2033

- North America Automotive Lighting Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- North America Automotive Lighting Market Outlook, by Technology, Value (US$ Bn), 2020-2033

- LED

- Halogen

- Xenon

- North America Automotive Lighting Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Interior

- Ambient Lamp

- Reading Lamp

- Backlighting

- Others

- Exterior

- Headlamps

- Tail lamps

- Brake lamps

- Signal Lamp

- North America Automotive Lighting Market Outlook, by Sales Channel, Value (US$ Bn), 2020-2033

- OEM

- Aftermarket

- North America Automotive Lighting Market Outlook, by Country, Value (US$ Bn), 2020-2033

- S. Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- S. Automotive Lighting Market Outlook, by Technology, 2020-2033

- S. Automotive Lighting Market Outlook, by Product Type, 2020-2033

- S. Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- Canada Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- Canada Automotive Lighting Market Outlook, by Technology, 2020-2033

- Canada Automotive Lighting Market Outlook, by Product Type, 2020-2033

- Canada Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America Automotive Lighting Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Europe Automotive Lighting Market Outlook, 2020 - 2033

- Europe Automotive Lighting Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Europe Automotive Lighting Market Outlook, by Technology, Value (US$ Bn), 2020-2033

- LED

- Halogen

- Xenon

- Europe Automotive Lighting Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Interior

- Ambient Lamp

- Reading Lamp

- Backlighting

- Others

- Exterior

- Headlamps

- Tail lamps

- Brake lamps

- Signal Lamp

- Europe Automotive Lighting Market Outlook, by Sales Channel, Value (US$ Bn), 2020-2033

- OEM

- Aftermarket

- Europe Automotive Lighting Market Outlook, by Country, Value (US$ Bn), 2020-2033

- Germany Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- Germany Automotive Lighting Market Outlook, by Technology, 2020-2033

- Germany Automotive Lighting Market Outlook, by Product Type, 2020-2033

- Germany Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- Italy Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- Italy Automotive Lighting Market Outlook, by Technology, 2020-2033

- Italy Automotive Lighting Market Outlook, by Product Type, 2020-2033

- Italy Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- France Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- France Automotive Lighting Market Outlook, by Technology, 2020-2033

- France Automotive Lighting Market Outlook, by Product Type, 2020-2033

- France Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- K. Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- K. Automotive Lighting Market Outlook, by Technology, 2020-2033

- K. Automotive Lighting Market Outlook, by Product Type, 2020-2033

- K. Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- Spain Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- Spain Automotive Lighting Market Outlook, by Technology, 2020-2033

- Spain Automotive Lighting Market Outlook, by Product Type, 2020-2033

- Spain Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- Russia Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- Russia Automotive Lighting Market Outlook, by Technology, 2020-2033

- Russia Automotive Lighting Market Outlook, by Product Type, 2020-2033

- Russia Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- Rest of Europe Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- Rest of Europe Automotive Lighting Market Outlook, by Technology, 2020-2033

- Rest of Europe Automotive Lighting Market Outlook, by Product Type, 2020-2033

- Rest of Europe Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe Automotive Lighting Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Asia Pacific Automotive Lighting Market Outlook, 2020 - 2033

- Asia Pacific Automotive Lighting Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Asia Pacific Automotive Lighting Market Outlook, by Technology, Value (US$ Bn), 2020-2033

- LED

- Halogen

- Xenon

- Asia Pacific Automotive Lighting Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Interior

- Ambient Lamp

- Reading Lamp

- Backlighting

- Others

- Exterior

- Headlamps

- Tail lamps

- Brake lamps

- Signal Lamp

- Asia Pacific Automotive Lighting Market Outlook, by Sales Channel, Value (US$ Bn), 2020-2033

- OEM

- Aftermarket

- Asia Pacific Automotive Lighting Market Outlook, by Country, Value (US$ Bn), 2020-2033

- China Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- China Automotive Lighting Market Outlook, by Technology, 2020-2033

- China Automotive Lighting Market Outlook, by Product Type, 2020-2033

- China Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- Japan Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- Japan Automotive Lighting Market Outlook, by Technology, 2020-2033

- Japan Automotive Lighting Market Outlook, by Product Type, 2020-2033

- Japan Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- South Korea Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- South Korea Automotive Lighting Market Outlook, by Technology, 2020-2033

- South Korea Automotive Lighting Market Outlook, by Product Type, 2020-2033

- South Korea Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- India Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- India Automotive Lighting Market Outlook, by Technology, 2020-2033

- India Automotive Lighting Market Outlook, by Product Type, 2020-2033

- India Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- Southeast Asia Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- Southeast Asia Automotive Lighting Market Outlook, by Technology, 2020-2033

- Southeast Asia Automotive Lighting Market Outlook, by Product Type, 2020-2033

- Southeast Asia Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- Rest of SAO Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- Rest of SAO Automotive Lighting Market Outlook, by Technology, 2020-2033

- Rest of SAO Automotive Lighting Market Outlook, by Product Type, 2020-2033

- Rest of SAO Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific Automotive Lighting Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Latin America Automotive Lighting Market Outlook, 2020 - 2033

- Latin America Automotive Lighting Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Latin America Automotive Lighting Market Outlook, by Technology, Value (US$ Bn), 2020-2033

- LED

- Halogen

- Xenon

- Latin America Automotive Lighting Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Interior

- Ambient Lamp

- Reading Lamp

- Backlighting

- Others

- Exterior

- Headlamps

- Tail lamps

- Brake lamps

- Signal Lamp

- Latin America Automotive Lighting Market Outlook, by Sales Channel, Value (US$ Bn), 2020-2033

- OEM

- Aftermarket

- Latin America Automotive Lighting Market Outlook, by Country, Value (US$ Bn), 2020-2033

- Brazil Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- Brazil Automotive Lighting Market Outlook, by Technology, 2020-2033

- Brazil Automotive Lighting Market Outlook, by Product Type, 2020-2033

- Brazil Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- Mexico Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- Mexico Automotive Lighting Market Outlook, by Technology, 2020-2033

- Mexico Automotive Lighting Market Outlook, by Product Type, 2020-2033

- Mexico Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- Argentina Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- Argentina Automotive Lighting Market Outlook, by Technology, 2020-2033

- Argentina Automotive Lighting Market Outlook, by Product Type, 2020-2033

- Argentina Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- Rest of LATAM Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- Rest of LATAM Automotive Lighting Market Outlook, by Technology, 2020-2033

- Rest of LATAM Automotive Lighting Market Outlook, by Product Type, 2020-2033

- Rest of LATAM Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America Automotive Lighting Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Middle East & Africa Automotive Lighting Market Outlook, 2020 - 2033

- Middle East & Africa Automotive Lighting Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Middle East & Africa Automotive Lighting Market Outlook, by Technology, Value (US$ Bn), 2020-2033

- LED

- Halogen

- Xenon

- Middle East & Africa Automotive Lighting Market Outlook, by Product Type, Value (US$ Bn), 2020-2033

- Interior

- Ambient Lamp

- Reading Lamp

- Backlighting

- Others

- Exterior

- Headlamps

- Tail lamps

- Brake lamps

- Signal Lamp

- Middle East & Africa Automotive Lighting Market Outlook, by Sales Channel, Value (US$ Bn), 2020-2033

- OEM

- Aftermarket

- Middle East & Africa Automotive Lighting Market Outlook, by Country, Value (US$ Bn), 2020-2033

- GCC Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- GCC Automotive Lighting Market Outlook, by Technology, 2020-2033

- GCC Automotive Lighting Market Outlook, by Product Type, 2020-2033

- GCC Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- South Africa Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- South Africa Automotive Lighting Market Outlook, by Technology, 2020-2033

- South Africa Automotive Lighting Market Outlook, by Product Type, 2020-2033

- South Africa Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- Egypt Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- Egypt Automotive Lighting Market Outlook, by Technology, 2020-2033

- Egypt Automotive Lighting Market Outlook, by Product Type, 2020-2033

- Egypt Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- Nigeria Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- Nigeria Automotive Lighting Market Outlook, by Technology, 2020-2033

- Nigeria Automotive Lighting Market Outlook, by Product Type, 2020-2033

- Nigeria Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- Rest of Middle East Automotive Lighting Market Outlook, by Vehicle Type, 2020-2033

- Rest of Middle East Automotive Lighting Market Outlook, by Technology, 2020-2033

- Rest of Middle East Automotive Lighting Market Outlook, by Product Type, 2020-2033

- Rest of Middle East Automotive Lighting Market Outlook, by Sales Channel, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa Automotive Lighting Market Outlook, by Vehicle Type, Value (US$ Bn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- Robert Bosch GmbH

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Hella GmbH & Co. KGaA

- Magneti Marelli / Marelli Holdings Co., Ltd.

- Valeo SA

- Stanley Electric Co., Ltd.

- Koito Manufacturing Co., Ltd.

- ZKW Group (part of ZF)

- Continental AG (lighting division)

- Lumileds (Philips / Apollo Global)

- Osram GmbH (LEDing division / ams OSRAM)

- Robert Bosch GmbH

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2024 |

|

2019 - 2024 |

2025 - 2032 |

Value: US$ Billion |

||