Global EV Adhesives Market Forecast

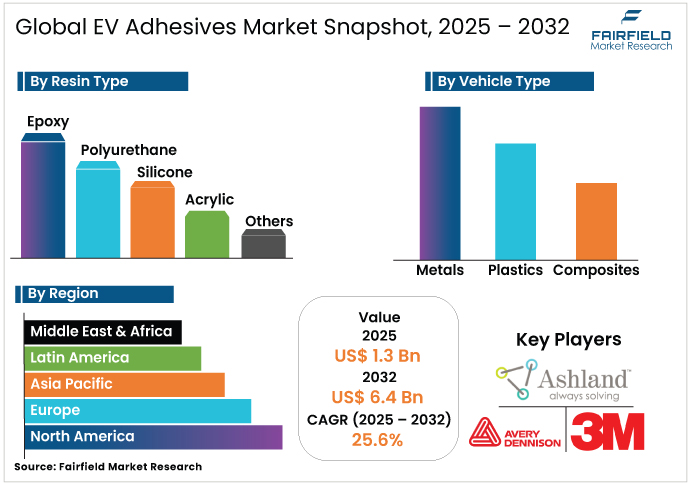

- The EV Adhesives Market is valued at USD 1.7 Bn in 2026 and is projected to reach USD 5.8 Bn, growing at a CAGR of 19% by 2033.

- This growth is driven by the rising adoption of electric vehicles, increasing focus on lightweight assembly, and expanding use of adhesives in battery packs, BIW structures, and thermal management systems. Innovations like Henkel’s AI-powered virtual adhesives and debondable bonding technologies are supporting faster development and circular design goals.

EV Adhesives Market Summary: Insights & Trends

- Asia Pacific leads with 42% market share, driven by China’s massive EV production scale, battery innovation, and cost-effective vehicle models, outpacing all other regions in adhesive demand.

- Battery Pack & Thermal Interface Bonding dominates with 34% share, fueled by the shift toward fast-charging systems, compact Cell-to-Pack battery architecture, and thermal management needs.

- Polyurethane adhesives capture 26% of the market in 2025, owing to their superior bonding strength, flexibility, and compatibility with multiple EV components, including batteries and exteriors.

- Electric cars account for nearly 64% of adhesive consumption, as global EV sales reached 17 million units in 2024, led by China, Europe, and the U.S.

- Liquid adhesives hold the highest share, 57% due to their ease of application, strong structural performance, and adaptability across battery, body, and powertrain segments.

- North America captures a 21% share, supported by IRA-backed policy incentives, U.S. battery production expansion, and rising consumer adoption of electric vehicles.

A Look Back and a Look Forward - Comparative Analysis

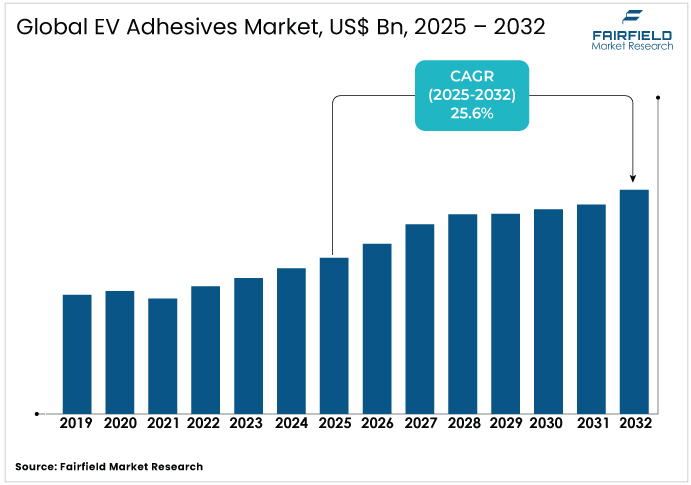

Between 2019 and 2024, the global electric vehicle adhesives market recorded a strong growth rate of 20.5%, supported by surging EV adoption, evolving automotive design, and growing sustainability mandates. The rising demand for structural integrity, lightweighting, and battery safety accelerated adhesive use across EV body frames, battery packs, and powertrains. EV sales more than doubled in 2021 to 6.6 million units, with global carmakers introducing over 450 EV models and ramping up production. China led the surge, accounting for half of global EV growth, while Europe and the U.S. also saw impressive gains. Adhesive manufacturers responded with innovations in thermal, conductive, and crash-durable bonding solutions tailored for new energy vehicles.

Looking ahead, the market is poised to grow at an impressive CAGR of 25.6% during 2025–2032, fueled by exponential EV sales and regulatory pressure for decarbonization. In 2022, over 10 million electric cars were sold, and projections for 2023 indicate 14 million units, with EVs likely to make up 18% of global car sales. Rapid electrification in emerging markets like India and Thailand, combined with industrial incentives in the U.S., EU, and China, will drive adhesive demand. As automakers target recyclability and second-life battery use, high-performance adhesives will remain essential to the next phase of EV innovation and production.

Key Growth Drivers

- Global EV Sales Boom Drives Strong Growth in Adhesive Demand

The explosive growth of EV sales globally is directly boosting the EV adhesives market. With EV sales hitting over 17 million units in 2024 and projected to reach 21 million in 2026, the need for advanced bonding solutions in batteries, bodies, and interiors is accelerating. Major regions such as China, Europe, and the U.S. drive this surge, while OEMs rush to enhance battery range, safety, and lightweighting core areas where adhesives play a critical role. The rapid shift from internal combustion engines is making high-performance adhesives indispensable across EV platforms.

- Battery Innovations Spur Demand for Thermal and Structural Adhesives

As EV battery systems evolve toward higher energy densities and compact configurations, thermal regulation and structural integrity become mission-critical. This has amplified the role of electric vehicle adhesives with thermal management and gap fillers gaining ground. Companies like Bostik and Dow have scaled adhesive technologies to manage battery heat and enhance crash resilience. These solutions not only improve range and performance but also support sustainable battery assembly, addressing both regulatory demands and OEM goals for safer, greener vehicles.

Key Growth Barriers

- Low EV Penetration in Emerging Markets Limits Adhesive Uptake

Despite strong growth in developed regions, adoption of electric vehicles and thus adhesives remains sluggish in emerging economies. In countries like India, Indonesia, and Brazil, EVs account for less than 0.5% of car sales due to affordability challenges and limited model availability. This slow uptake restricts the electric vehicle adhesives market from reaching its full global potential, especially in regions with massive automotive populations. Unless infrastructure and local policy support rapidly improve, these gaps will continue to hamper broader adhesive market expansion.

- High Costs and Formulation Complexity Restrain Market Expansion

Developing adhesives for EVs involves balancing multiple performance metrics thermal conductivity, elasticity, durability, and sustainability. The R&D required to formulate these high-spec adhesives, especially those that must meet battery and safety standards, adds to cost and complexity. Manufacturers face pressure to innovate while keeping prices competitive for OEMs. Raw material volatility and the need for specialized chemistries can deter smaller players from entering the electric vehicle adhesives space, creating a barrier to broader supplier diversification.

Electric Vehicle Market Trends and Opportunities

- Adhesive Manufacturing Localizes to Meet Regional EV Production Demand

Key players are building local production hubs to serve the growing EV demand in Asia and Europe. DuPont’s facility in East China, equipped with MES technology, is one such example, enabling efficient, traceable production of adhesives for EV battery bonding and thermal management. This localization supports just-in-time manufacturing and logistics, meets regional sustainability standards, and strengthens supply chain resilience. The electric vehicle adhesives market is shifting toward regionally responsive production strategies that mirror the EV boom in specific geographies.

- NVH Adhesive Technologies Gain Traction for Quieter EV Interiors

As EVs operate more quietly than ICE vehicles, managing cabin noise has become a critical design priority. Adhesive-backed solutions targeting NVH (Noise, Vibration, Harshness) are gaining traction. The Henkel–4JET Loctite LASER-FIT process is a notable innovation, directly forming acoustic foam inside EV tires for superior sound absorption. This trend toward integrated, lightweight NVH adhesives not only enhances passenger comfort but also reduces production steps and carbon emissions, underscoring how acoustics are redefining the adhesive landscape in EV interiors.

Segments Covered in the Report

- Battery Bonding and Thermal Interface Segment Leads Adhesive Applications

Battery Pack & Thermal Interface Bonding holds a market share of around 34% in the global EV adhesives market, driven by the growing need for thermal stability, safety, and compact battery designs in EVs. As automakers increasingly adopt Cell-to-Pack (CTP) architecture and fast-charging capabilities, the demand for high-performance adhesives that support efficient heat dissipation and mechanical durability has intensified. Manufacturers are focusing on solutions that not only optimize heat transfer but also provide structural strength during high-frequency vibrations and rapid charging cycles.

Leading players have responded with purpose-built innovations. A recent launch by Bostik in collaboration with Polytec PT introduced a two-component polyurethane-based adhesive designed to improve thermal conductivity in tightly packed battery modules. Similarly, Dow’s new high-bonding adhesive developed for SAIC’s MG 4 reinforces the importance of integrating heat management with structural integrity. These advancements highlight how adhesive technologies are becoming critical to the performance and reliability of next-gen EV battery systems.

- Polyurethane Dominates for Strong Bonding and Thermal Insulation Needs

Polyurethane resins hold the largest market share of around 26% in 2025 in the global electric vehicle adhesives market, driven by their versatility in high-performance bonding and thermal management. Manufacturers prefer polyurethane for assembling EV battery packs and panels due to its strong adhesion, moisture resistance, and insulation properties.

Companies like DuPont and Henkel continue to enhance this segment. DuPont’s solutions improve serviceability and insulation, while Henkel’s innovations focus on thermal conductivity and structural strength. These resins also support sustainability goals with solvent-free, energy-efficient curing processes, making them a reliable choice for EV OEMs focused on performance and environmental compliance.

- Electric Cars Account for Highest Share in Adhesive Consumption

Electric cars hold the highest market share of around 64% in 2025 in the global electric vehicle adhesives market, driven by a strong surge in EV adoption across China, Europe, and the United States. The steep growth in electric car sales, reaching nearly 17 million units in 2024, has created immense demand for high-performance adhesives used in battery assembly and structural components.

OEMs are prioritizing materials like thermally conductive and moisture-resistant adhesives to ensure safety, durability, and energy efficiency. Advanced adhesive solutions, especially those introduced by leaders like DuPont and Henkel, cater specifically to electric car configurations, reinforcing this vehicle segment’s market dominance.

- Metal Substrates Lead Due to Strength and Heat Management Requirements

The metal substrates segment holds around 42% market share in 2025 in the electric vehicle adhesives market, driven by the rising demand for high-performance bonding solutions in structural and thermal applications. Electric vehicles rely heavily on metals such as aluminum, high-strength steel, and copper across battery packs, body-in-white (BIW) structures, and motor assemblies. These substrates require adhesives that deliver strong mechanical bonding, corrosion resistance, and effective thermal and electrical conductivity.

The growing use of lightweight aluminum in battery enclosures and thermal management plates, particularly in China and Europe, is fueling demand for adhesives that replace welds and rivets while offering crash durability and design flexibility.

- Liquid Adhesives Command Market with Application and Design Flexibility

Liquid adhesives hold the market share of around 57.9% in 2025, driven by their versatility, ease of application, and strong bonding capabilities across a wide range of EV components. Their dominance is further strengthened as companies such as Henkel continue to innovate with advanced formulations and digital tools. For example, Henkel’s use of AI to simulate adhesive performance helps OEMs cut down development cycles while enhancing bonding accuracy. New liquid-based safety coatings offering thermal stability up to 1400°C and dependable adhesives for easier battery disassembly position liquid adhesives as the preferred choice in battery systems, structural bonding, and thermal management layers.

Regional Analysis

- Strong Policy Support and Innovation Fuel North America’s EV Adhesives Market

North America holds the market share of around 21.5% in 2025, driven by strong policy support, rising EV adoption, and a push for domestic manufacturing.

The U.S. EV market continues to grow steadily, with over 400,000 used EVs sold in 2023, reflecting increasing consumer trust. While price gaps between EVs and ICE vehicles still exist, falling battery prices and industrial policy incentives are helping bridge the divide.

Companies like Avery Dennison are driving innovation with the 2024 launch of advanced Cell Wrapping and Electrode Fixing Tapes, which enhance battery safety and efficiency, aligning with U.S. climate goals and IRA compliance.

- Europe Strengthens Strong EV Penetration Despite Policy Shifts

Europe is expected to account for a market share of around 23.4% in 2025, driven by rapid EV adoption, strong regulatory support, and a maturing market across key countries. In 2023, new electric car registrations in Europe reached 3.2 million, marking a 20% increase from the previous year.

Countries such as Germany, France, and the UK are shaping the region’s momentum through policies that promote cleaner transportation. Despite the gradual removal of subsidies, consumer interest stays strong, especially for larger EVs. This continued shift is boosting the need for high-performance adhesives that enable lightweighting, battery integration, and improved structural integrity.

- Asia Pacific Dominates EV Adhesives Through Regional Scale and Battery Innovation

The Asia Pacific region holds a market share of around 42.3% in 2025, driven by China’s dominance in EV production, battery recycling, and cost leadership. Over 60% of electric cars sold in China were cheaper than ICE vehicles in 2023, making EVs mainstream. India contributed strongly with 1.3 million electric two-wheelers sold, supported by the FAME II policy.

Southeast Asia also witnessed a rising adoption, especially in affordable two- and three-wheelers. Chinese automakers are expanding aggressively across emerging Asia. Countries like Thailand and Indonesia are ramping up battery and EV investments, creating a region-wide push for high-performance adhesive solutions across segments.

Competitive Landscape

The electric vehicle adhesives market shows signs of moderate consolidation, with a few dominant players steering innovation through aggressive product development, sustainability initiatives, and strategic investments. 3M, DuPont, Henkel, Dow, Bostik, and Avery Dennison lead the space with deep R&D capabilities and specialized adhesive technologies for battery systems, structural integrity, and thermal management.

These companies focus heavily on EV battery safety, recyclability, and energy-efficient bonding solutions. Technological advancements, such as AI-generated adhesives and thermal-conductive materials, reflect the evolving demand from EV manufacturers. As automakers shift toward electrification, top adhesive providers continue to strengthen their market position through targeted innovation and capacity expansion.

Key Companies

- 3M Company

- Ashland Inc.

- Avery Dennison Corporation

- Bostik (a subsidiary of Arkema Group)

- Click Bond, Inc.

- DAP Products Inc.

- DHM Adhesives, Inc.

- DuPont de Nemours, Inc.

- Eclectic Products, Inc.

- Evans Adhesive Corporation, Inc.

- Franklin International

- B. Fuller Company

- Henkel AG & Co. KGaA

- Dow Inc.

Recent Industry Developments

- On August 15, 2024, DuPont launched BETAFORCE™, a next-gen adhesive for EV battery assembly featuring primer-less application, elastic bonding for crash safety, and 30% bio-based content. The innovation won the 2024 R&D 100 Award, reflecting its market relevance in performance and sustainability.

- On June 14, 2025, Avery Dennison introduced pressure-sensitive cell wrapping and electrode fixing tapes tailored for EV batteries. These U.S.-made adhesives address safety, durability, and compliance with the Inflation Reduction Act, showcasing strong product innovation in EV battery assembly.

- On April 24, 2025, Henkel launched AI-generated virtual adhesives and thermal safety coatings for EV batteries, alongside dependable adhesives for recycling. These advancements underline the shift toward digital engineering and circularity in battery manufacturing.

- On 18 May 2024, Dow completed a major production expansion for its polyurethane adhesives in Germany, scaling capacity tenfold to meet surging demand for EV battery bonding and gap fillers, while using 100% renewable energy, highlighting both scalability and sustainability.

Global EV Adhesives Market Segmentation-

By Resin Type:

- Epoxy

- Polyurethane

- Silicone

- Acrylic

- Others

By Vehicle Type:

- Electric Cars

- Electric Buses

- Electric Bikes

- Electric Trucks

By Substrate:

- Metals

- Plastics

- Composites

- Others

By Form:

- Liquid

- Film & Tape

- Others

By Application

- Battery Modules & Pack Assembly

- Body Frame & BIW (Body-in-white)

- Powertrain System

- Sensors & Electronic Components

- Glazing, Lighting & Exterior Panels

- Miscellaneous (e.g., interiors, wiring)

By Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

- Executive Summary

- Global EV Adhesives Market Snapshot

- Future Projections

- Key Market Trends

- Regional Snapshot, by Value, 2026

- Analyst Recommendations

- Market Overview

- Market Definitions and Segmentations

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Value Chain Analysis

- COVID-19 Impact Analysis

- Porter's Fiver Forces Analysis

- Impact of Russia-Ukraine Conflict

- PESTLE Analysis

- Regulatory Analysis

- Price Trend Analysis

- Current Prices and Future Projections, 2025-2033

- Price Impact Factors

- Global EV Adhesives Market Outlook, 2020 - 2033

- Global EV Adhesives Market Outlook, by Resin Type, Value (US$ Mn), 2020-2033

- Epoxy

- Polyurethane

- Silicone

- Acrylic

- Others

- Global EV Adhesives Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Electric Cars

- Electric Buses

- Electric Bikes

- Electric Trucks

- Global EV Adhesives Market Outlook, by Substrate, Value (US$ Mn), 2020-2033

- Metals

- Plastics

- Composites

- Others

- Global EV Adhesives Market Outlook, by Form, Value (US$ Mn), 2020-2033

- Liquid

- Film & Tape

- Others

- Global EV Adhesives Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Battery Modules & Pack Assembly

- Body Frame & BIW (Body-in-white)

- Powertrain System

- Sensors & Electronic Components

- Glazing, Lighting & Exterior Panels

- Miscellaneous (e.g., interiors, wiring)

- Global EV Adhesives Market Outlook, by Region, Value (US$ Mn), 2020-2033

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Global EV Adhesives Market Outlook, by Resin Type, Value (US$ Mn), 2020-2033

- North America EV Adhesives Market Outlook, 2020 - 2033

- North America EV Adhesives Market Outlook, by Resin Type, Value (US$ Mn), 2020-2033

- Epoxy

- Polyurethane

- Silicone

- Acrylic

- Others

- North America EV Adhesives Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Electric Cars

- Electric Buses

- Electric Bikes

- Electric Trucks

- North America EV Adhesives Market Outlook, by Substrate, Value (US$ Mn), 2020-2033

- Metals

- Plastics

- Composites

- Others

- North America EV Adhesives Market Outlook, by Form, Value (US$ Mn), 2020-2033

- Liquid

- Film & Tape

- Others

- North America EV Adhesives Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Battery Modules & Pack Assembly

- Body Frame & BIW (Body-in-white)

- Powertrain System

- Sensors & Electronic Components

- Glazing, Lighting & Exterior Panels

- Miscellaneous (e.g., interiors, wiring)

- North America EV Adhesives Market Outlook, by Country, Value (US$ Mn), 2020-2033

- S. EV Adhesives Market Outlook, by Resin Type, 2020-2033

- S. EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- S. EV Adhesives Market Outlook, by Substrate, 2020-2033

- S. EV Adhesives Market Outlook, by Form, 2020-2033

- S. EV Adhesives Market Outlook, by Application, 2020-2033

- Canada EV Adhesives Market Outlook, by Resin Type, 2020-2033

- Canada EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- Canada EV Adhesives Market Outlook, by Substrate, 2020-2033

- Canada EV Adhesives Market Outlook, by Form, 2020-2033

- Canada EV Adhesives Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- North America EV Adhesives Market Outlook, by Resin Type, Value (US$ Mn), 2020-2033

- Europe EV Adhesives Market Outlook, 2020 - 2033

- Europe EV Adhesives Market Outlook, by Resin Type, Value (US$ Mn), 2020-2033

- Epoxy

- Polyurethane

- Silicone

- Acrylic

- Others

- Europe EV Adhesives Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Electric Cars

- Electric Buses

- Electric Bikes

- Electric Trucks

- Europe EV Adhesives Market Outlook, by Substrate, Value (US$ Mn), 2020-2033

- Metals

- Plastics

- Composites

- Others

- Europe EV Adhesives Market Outlook, by Form, Value (US$ Mn), 2020-2033

- Liquid

- Film & Tape

- Others

- Europe EV Adhesives Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Battery Modules & Pack Assembly

- Body Frame & BIW (Body-in-white)

- Powertrain System

- Sensors & Electronic Components

- Glazing, Lighting & Exterior Panels

- Miscellaneous (e.g., interiors, wiring)

- Europe EV Adhesives Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Germany EV Adhesives Market Outlook, by Resin Type, 2020-2033

- Germany EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- Germany EV Adhesives Market Outlook, by Substrate, 2020-2033

- Germany EV Adhesives Market Outlook, by Form, 2020-2033

- Germany EV Adhesives Market Outlook, by Application, 2020-2033

- Italy EV Adhesives Market Outlook, by Resin Type, 2020-2033

- Italy EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- Italy EV Adhesives Market Outlook, by Substrate, 2020-2033

- Italy EV Adhesives Market Outlook, by Form, 2020-2033

- Italy EV Adhesives Market Outlook, by Application, 2020-2033

- France EV Adhesives Market Outlook, by Resin Type, 2020-2033

- France EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- France EV Adhesives Market Outlook, by Substrate, 2020-2033

- France EV Adhesives Market Outlook, by Form, 2020-2033

- France EV Adhesives Market Outlook, by Application, 2020-2033

- K. EV Adhesives Market Outlook, by Resin Type, 2020-2033

- K. EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- K. EV Adhesives Market Outlook, by Substrate, 2020-2033

- K. EV Adhesives Market Outlook, by Form, 2020-2033

- K. EV Adhesives Market Outlook, by Application, 2020-2033

- Spain EV Adhesives Market Outlook, by Resin Type, 2020-2033

- Spain EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- Spain EV Adhesives Market Outlook, by Substrate, 2020-2033

- Spain EV Adhesives Market Outlook, by Form, 2020-2033

- Spain EV Adhesives Market Outlook, by Application, 2020-2033

- Russia EV Adhesives Market Outlook, by Resin Type, 2020-2033

- Russia EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- Russia EV Adhesives Market Outlook, by Substrate, 2020-2033

- Russia EV Adhesives Market Outlook, by Form, 2020-2033

- Russia EV Adhesives Market Outlook, by Application, 2020-2033

- Rest of Europe EV Adhesives Market Outlook, by Resin Type, 2020-2033

- Rest of Europe EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- Rest of Europe EV Adhesives Market Outlook, by Substrate, 2020-2033

- Rest of Europe EV Adhesives Market Outlook, by Form, 2020-2033

- Rest of Europe EV Adhesives Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Europe EV Adhesives Market Outlook, by Resin Type, Value (US$ Mn), 2020-2033

- Asia Pacific EV Adhesives Market Outlook, 2020 - 2033

- Asia Pacific EV Adhesives Market Outlook, by Resin Type, Value (US$ Mn), 2020-2033

- Epoxy

- Polyurethane

- Silicone

- Acrylic

- Others

- Asia Pacific EV Adhesives Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Electric Cars

- Electric Buses

- Electric Bikes

- Electric Trucks

- Asia Pacific EV Adhesives Market Outlook, by Substrate, Value (US$ Mn), 2020-2033

- Metals

- Plastics

- Composites

- Others

- Asia Pacific EV Adhesives Market Outlook, by Form, Value (US$ Mn), 2020-2033

- Liquid

- Film & Tape

- Others

- Asia Pacific EV Adhesives Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Battery Modules & Pack Assembly

- Body Frame & BIW (Body-in-white)

- Powertrain System

- Sensors & Electronic Components

- Glazing, Lighting & Exterior Panels

- Miscellaneous (e.g., interiors, wiring)

- Asia Pacific EV Adhesives Market Outlook, by Country, Value (US$ Mn), 2020-2033

- China EV Adhesives Market Outlook, by Resin Type, 2020-2033

- China EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- China EV Adhesives Market Outlook, by Substrate, 2020-2033

- China EV Adhesives Market Outlook, by Form, 2020-2033

- China EV Adhesives Market Outlook, by Application, 2020-2033

- Japan EV Adhesives Market Outlook, by Resin Type, 2020-2033

- Japan EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- Japan EV Adhesives Market Outlook, by Substrate, 2020-2033

- Japan EV Adhesives Market Outlook, by Form, 2020-2033

- Japan EV Adhesives Market Outlook, by Application, 2020-2033

- South Korea EV Adhesives Market Outlook, by Resin Type, 2020-2033

- South Korea EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- South Korea EV Adhesives Market Outlook, by Substrate, 2020-2033

- South Korea EV Adhesives Market Outlook, by Form, 2020-2033

- South Korea EV Adhesives Market Outlook, by Application, 2020-2033

- India EV Adhesives Market Outlook, by Resin Type, 2020-2033

- India EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- India EV Adhesives Market Outlook, by Substrate, 2020-2033

- India EV Adhesives Market Outlook, by Form, 2020-2033

- India EV Adhesives Market Outlook, by Application, 2020-2033

- Southeast Asia EV Adhesives Market Outlook, by Resin Type, 2020-2033

- Southeast Asia EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- Southeast Asia EV Adhesives Market Outlook, by Substrate, 2020-2033

- Southeast Asia EV Adhesives Market Outlook, by Form, 2020-2033

- Southeast Asia EV Adhesives Market Outlook, by Application, 2020-2033

- Rest of SAO EV Adhesives Market Outlook, by Resin Type, 2020-2033

- Rest of SAO EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- Rest of SAO EV Adhesives Market Outlook, by Substrate, 2020-2033

- Rest of SAO EV Adhesives Market Outlook, by Form, 2020-2033

- Rest of SAO EV Adhesives Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Asia Pacific EV Adhesives Market Outlook, by Resin Type, Value (US$ Mn), 2020-2033

- Latin America EV Adhesives Market Outlook, 2020 - 2033

- Latin America EV Adhesives Market Outlook, by Resin Type, Value (US$ Mn), 2020-2033

- Epoxy

- Polyurethane

- Silicone

- Acrylic

- Others

- Latin America EV Adhesives Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Electric Cars

- Electric Buses

- Electric Bikes

- Electric Trucks

- Latin America EV Adhesives Market Outlook, by Substrate, Value (US$ Mn), 2020-2033

- Metals

- Plastics

- Composites

- Others

- Latin America EV Adhesives Market Outlook, by Form, Value (US$ Mn), 2020-2033

- Liquid

- Film & Tape

- Others

- Latin America EV Adhesives Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Battery Modules & Pack Assembly

- Body Frame & BIW (Body-in-white)

- Powertrain System

- Sensors & Electronic Components

- Glazing, Lighting & Exterior Panels

- Miscellaneous (e.g., interiors, wiring)

- Latin America EV Adhesives Market Outlook, by Country, Value (US$ Mn), 2020-2033

- Brazil EV Adhesives Market Outlook, by Resin Type, 2020-2033

- Brazil EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- Brazil EV Adhesives Market Outlook, by Substrate, 2020-2033

- Brazil EV Adhesives Market Outlook, by Form, 2020-2033

- Brazil EV Adhesives Market Outlook, by Application, 2020-2033

- Mexico EV Adhesives Market Outlook, by Resin Type, 2020-2033

- Mexico EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- Mexico EV Adhesives Market Outlook, by Substrate, 2020-2033

- Mexico EV Adhesives Market Outlook, by Form, 2020-2033

- Mexico EV Adhesives Market Outlook, by Application, 2020-2033

- Argentina EV Adhesives Market Outlook, by Resin Type, 2020-2033

- Argentina EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- Argentina EV Adhesives Market Outlook, by Substrate, 2020-2033

- Argentina EV Adhesives Market Outlook, by Form, 2020-2033

- Argentina EV Adhesives Market Outlook, by Application, 2020-2033

- Rest of LATAM EV Adhesives Market Outlook, by Resin Type, 2020-2033

- Rest of LATAM EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- Rest of LATAM EV Adhesives Market Outlook, by Substrate, 2020-2033

- Rest of LATAM EV Adhesives Market Outlook, by Form, 2020-2033

- Rest of LATAM EV Adhesives Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Latin America EV Adhesives Market Outlook, by Resin Type, Value (US$ Mn), 2020-2033

- Middle East & Africa EV Adhesives Market Outlook, 2020 - 2033

- Middle East & Africa EV Adhesives Market Outlook, by Resin Type, Value (US$ Mn), 2020-2033

- Epoxy

- Polyurethane

- Silicone

- Acrylic

- Others

- Middle East & Africa EV Adhesives Market Outlook, by Vehicle Type, Value (US$ Mn), 2020-2033

- Electric Cars

- Electric Buses

- Electric Bikes

- Electric Trucks

- Middle East & Africa EV Adhesives Market Outlook, by Substrate, Value (US$ Mn), 2020-2033

- Metals

- Plastics

- Composites

- Others

- Middle East & Africa EV Adhesives Market Outlook, by Form, Value (US$ Mn), 2020-2033

- Liquid

- Film & Tape

- Others

- Middle East & Africa EV Adhesives Market Outlook, by Application, Value (US$ Mn), 2020-2033

- Battery Modules & Pack Assembly

- Body Frame & BIW (Body-in-white)

- Powertrain System

- Sensors & Electronic Components

- Glazing, Lighting & Exterior Panels

- Miscellaneous (e.g., interiors, wiring)

- Middle East & Africa EV Adhesives Market Outlook, by Country, Value (US$ Mn), 2020-2033

- GCC EV Adhesives Market Outlook, by Resin Type, 2020-2033

- GCC EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- GCC EV Adhesives Market Outlook, by Substrate, 2020-2033

- GCC EV Adhesives Market Outlook, by Form, 2020-2033

- GCC EV Adhesives Market Outlook, by Application, 2020-2033

- South Africa EV Adhesives Market Outlook, by Resin Type, 2020-2033

- South Africa EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- South Africa EV Adhesives Market Outlook, by Substrate, 2020-2033

- South Africa EV Adhesives Market Outlook, by Form, 2020-2033

- South Africa EV Adhesives Market Outlook, by Application, 2020-2033

- Egypt EV Adhesives Market Outlook, by Resin Type, 2020-2033

- Egypt EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- Egypt EV Adhesives Market Outlook, by Substrate, 2020-2033

- Egypt EV Adhesives Market Outlook, by Form, 2020-2033

- Egypt EV Adhesives Market Outlook, by Application, 2020-2033

- Nigeria EV Adhesives Market Outlook, by Resin Type, 2020-2033

- Nigeria EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- Nigeria EV Adhesives Market Outlook, by Substrate, 2020-2033

- Nigeria EV Adhesives Market Outlook, by Form, 2020-2033

- Nigeria EV Adhesives Market Outlook, by Application, 2020-2033

- Rest of Middle East EV Adhesives Market Outlook, by Resin Type, 2020-2033

- Rest of Middle East EV Adhesives Market Outlook, by Vehicle Type, 2020-2033

- Rest of Middle East EV Adhesives Market Outlook, by Substrate, 2020-2033

- Rest of Middle East EV Adhesives Market Outlook, by Form, 2020-2033

- Rest of Middle East EV Adhesives Market Outlook, by Application, 2020-2033

- BPS Analysis/Market Attractiveness Analysis

- Middle East & Africa EV Adhesives Market Outlook, by Resin Type, Value (US$ Mn), 2020-2033

- Competitive Landscape

- Company Vs Segment Heatmap

- Company Market Share Analysis, 2025

- Competitive Dashboard

- Company Profiles

- 3M Company

- Company Overview

- Product Portfolio

- Financial Overview

- Business Strategies and Developments

- Ashland Inc.

- Avery Dennison Corporation

- Bostik (a subsidiary of Arkema Group)

- Click Bond, Inc.

- DAP Products Inc.

- DHM Adhesives, Inc.

- DuPont de Nemours, Inc.

- Eclectic Products, Inc.

- Evans Adhesive Corporation, Inc.

- 3M Company

- Appendix

- Research Methodology

- Report Assumptions

- Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2025 |

|

2019 - 2024 |

2026 - 2033 |

Value: US$ Billion |

||

|

REPORT FEATURES |

DETAILS |

|

Resin Type Coverage |

|

|

Vehicle Type Coverage |

|

|

Substrate Coverage |

|

|

Form Coverage |

|

|

Application Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2024), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |