Global Palladium Market Forecast

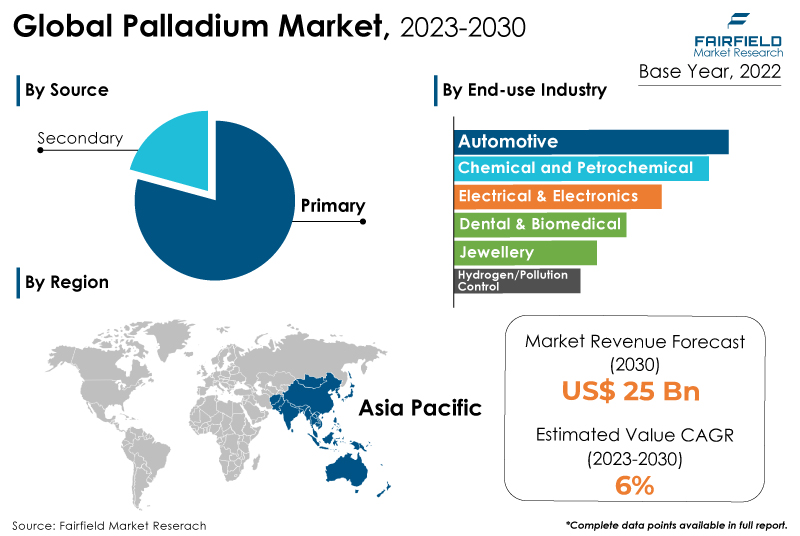

- Global palladium market all set to exhibit a strong 6% CAGR during 2023 - 2030

- Palladium market value to reach nearly US$25 Bn by the end of 2030

Market Analysis in Brief

The palladium market describes the global marketplace where palladium, a precious metal member of the platinum group of elements, is purchased and traded. Palladium is utilised extensively in various industrial applications, especially in the automotive sector, to produce catalytic converters that reduce harmful vehicle emissions. In addition, it is used in jewelry, electronics, and other industries. Dental equipment, chemical processing, and electronics production are just a few examples of industrial uses for palladium. Industrial activity and economic growth may affect the demand for palladium in certain areas. Palladium mining and processing may influence the environment.

Palladium production and availability may be impacted by stronger restrictions or initiatives for responsible sourcing due to rising public pressure and knowledge of environmental issues. The growing emphasis on sustainability and green technologies offers an opportunity for palladium demand to increase. Hydrogen fuel cells, which are gaining popularity as an alternative power source for cars and other applications, depend heavily on palladium.

Key Report Findings

- The global palladium market will expand at a significant rate of 5.7% CAGR between 2023 and 2030.

- The demand for Palladium is rising due to the growing rate of urbanisation.

- Demand for catalytic converters remains higher in the palladium market.

- The automotive category held the highest palladium market revenue share in 2022.

- North America will continue to lead its way, whereas the Asia Pacific Palladium market will experience the strongest growth till 2030.

Growth Drivers

Rising Rate of Urbanisation

The palladium market is likely to grow due to the rate of urbanisation's acceleration. Urbanisation is the process of people moving from rural to urban areas, which results in the growth and development of urban centers and their supporting infrastructure. Numerous effects on palladium demand and consumption may result from this trend.

As urbanisation advances, more people are moving to cities, increasing the need for transportation. The necessity for automobiles with palladium-based catalytic converters to meet government emission regulations to enhance air quality in densely populated places is a common result of this increased vehicle ownership and usage.

Infrastructure development, including roads, bridges, and public transportation networks, is needed quickly. Palladium is an important electronic equipment component and is utilised in buildings, making it a necessary component of urban infrastructure projects. Urbanisation results in increased consumer spending power and the uptake of contemporary technologies. Electronics such as smartphones, computers, and televisions, which are in higher demand in metropolitan areas, consume palladium.

Rising Demand from Automobile Industry

The key factor driving the expansion of the palladium market is the increasing demand for palladium in the automotive sector. To address air pollution and lower greenhouse gas emissions, governments all over the world have been enacting stricter emission limits. Manufacturers must use more palladium in catalytic converters to comply with these standards properly. In the past, catalytic converters for both petrol and diesel engines primarily used platinum as their primary metal.

Automobile manufacturers have been switching from platinum-based catalytic converters to those containing more palladium; however, due to the higher price of platinum and the rising price competitiveness of palladium.

Demand for gasoline-powered cars, which need catalytic converters made of palladium, has increased, especially in developing nations and areas with a lack of infrastructure for electric vehicles. Palladium is increasingly in demand for use in catalytic converters as the global automobile industry expands, particularly in nations like China, and India.

Growth Challenges

Price Volatility

Price fluctuation is one of the reasons limiting the market expansion for palladium. Price volatility describes the swift and notable swings in the price of palladium over brief intervals. Market participants may experience uncertainty due to the high amount of price volatility, which may hinder their ability to plan and make wise decisions.

Price fluctuation may make manufacturers, investors, and other market participants feel apprehensive. Rapid pricing changes can affect firms' ability to forecast expenses and revenues, impacting their investment choices and long-term planning. Market players may find it challenging to protect themselves against price risks due to price volatility effectively. Hedging is a crucial risk management instrument businesses utilise to safeguard themselves from unfavorable price changes. Extreme price changes, however, may render hedging tactics ineffective or more expensive.

Investors may be deterred by price volatility from investing heavily in palladium or entering the market. The risk of investing in assets with high price volatility may be a concern for investors expecting steady and predictable returns.

Russia-Ukraine Geopolitical Tensions Leading to Supply-Demand Imbalance

Russia is one of the key supplier in the global palladium market and plays a critical role regarding the supply of palladium at global level. The ongoing geopolitical conflict between Russia-Ukraine has increased strain on the supply thus keeping the price elevated. Russia’s annual output accounts for more than 35% of the primary palladium supply globally, a revenue worth more than US$6 Bn in exports.

In March 2022, with situation worsening and Western sactions on Russia, the palladium prices spiked to a new record of ~US$100 per gram. Such type of events can hamper the overall supply of palladium, Europe is one of the regions wherein supply has been disrupted. The US is investing in developing its own palladium resources with growing demand for the product.

Overview of Key Segments

Primary Palladium to Experience Strong Demand

The Automotive segment is expected to be the fastest-growing palladium market segment. Palladium is used extensively in electronics and emission control systems in the automotive sector. Some vehicle sensors, including oxygen and exhaust gas sensors, use palladium. These sensors keep track of the exhaust gas composition and supply crucial information to engine management systems for improving fuel economy and emissions reduction.

Palladium is utilised in the automobile sector for ornamental purposes even though it has no direct application to the vehicle function. Palladium is utilised for trim and accents in premium vehicles because of its attractive appearance and lightweight characteristics. Palladium plating is used to protect and increase the lifetime of various automotive parts, including connectors, switches, and contacts, because of its low contact resistance and resistance to corrosion.

Automotive Segment Remains Dominant

The automtive segment will dominate the global market during the forecast period, primarly due to catalytic converters. Catalytic converters are emission control devices fitted in the exhaust systems of vehicles, typically gasoline-powered cars, and palladium is a key component in their construction.

By transforming toxic pollutants into less dangerous chemicals, catalytic converters are essential in lowering harmful emissions from internal combustion engines. Palladium is a critical component of catalytic converters because it helps them fulfill the stringent pollution limits established by regulatory bodies worldwide.

The requirement for palladium in catalytic converters is anticipated to remain high as governments continue to prioritise environmental protection and enact stricter emission standards. Palladium is one of the essential electrode materials used in electrical & electronic components.

Electronic items such as mobile phones, computers, televisions, digital cameras, and other consumer electronics often contain ceramic capacitors with palladium electrodes. Due to their dependability, high capacitance values, and capacity to tolerate challenging working circumstances, they are also utilised in various industrial and automotive applications.

Growth Opportunities Across Regions

China Accounts for the Largest Market Share

Asia Pacific is expected to dominate the palladium market during the forecast period. The uptake of environmentally friendly technology like hydrogen fuel cells and other clean energy options may have opened up new prospects for Asia Pacific palladium demand. Palladium plays a crucial role in creating sustainable and renewable energy sources due to its application in hydrogen fuel cells.

In China, palladium is utilised in various end users such as automotive and industrial processes such as chemical processing, electronics, and oil refining. Economic expansion and industrial activity drive the demand for palladium in these industries. Recycling projects for palladium and other precious metals help keep the supply chain sustainable and may impact the overall availability of palladium in the China.

Palladium Market: Competitive Landscape

Some leading players at the forefront in the palladium market includes Norilsk Nickel, JSC Krastsvetmet, Sibanye-Stillwater, Anglo American Platinum Limited, Impala Platinum Holdings Limited, Glencore Plc, Northam Holdings, and Vale S.A.

Recent Notable Developments

In March 2022, African Rainbow purchased Bokoni Mine to enhance both players' portfolios. The expansion of mining operations and natural developments is also anticipated to be advantageous for both businesses.

The Global Palladium Market is Segmented as Below:

By Source

- Primary

- Secondary

By End-use Industry

- Automotive

- Chemical and Petrochemical

- Electrical & Electronics

- Dental & Biomedical

- Jewellery

- Hydrogen/Pollution Control

- Miscellaneous

By Geographic Coverage

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Turkey

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

1. Executive Summary

1.1. Global Palladium Market Snapshot

1.2. Future Projections

1.3. Key Market Trends

1.4. Regional Snapshot, by Volume, 2022

1.5. Analyst Recommendations

2. Market Overview

2.1. Market Definitions and Segmentations

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Market Opportunities

2.3. Value Chain Analysis

2.4. Porter’s Five Forces Analysis

2.5. Covid-19 Impact Analysis

2.5.1. Supply

2.5.2. Demand

2.6. Impact of Ukraine-Russia Conflict

2.7. Economic Overview

2.7.1. World Economic Projections

2.7.2. PGM Reserves

2.8. PESTLE Analysis

3. Palladium Production and Trade Statistics, 2018 - 2022

3.1. Key Highlights

3.1.1. North America

3.1.2. Europe

3.1.3. Asia Pacific

3.1.4. Latin America

3.1.5. Middle East & Africa

3.2. Trade Statistics

4. Price Trend Analysis, 2018 - 2030

4.1. Key Highlights

4.1.1. Key Factors Affecting the Prices

4.1.2. Price by Source

4.1.3. Price by End-use Industry vs Region

5. Global Palladium Market Outlook, 2018 - 2030

5.1. Global Palladium Market Outlook, by Source, Value (US$ Bn), 2018 - 2030

5.1.1. Key Highlights

5.1.1.1. Primary

5.1.1.2. Secondary

5.2. Global Palladium Market Outlook, by Source, Value (US$ Bn), 2018 - 2030

5.2.1. Key Highlights

5.2.1.1. Automotive

5.2.1.2. Chemical and Petrochemical

5.2.1.3. Electrical & Electronics

5.2.1.4. Dental & Biomedical

5.2.1.5. Jewellery

5.2.1.6. Hydrogen/Pollution Control

5.2.1.7. Misc.

5.3. Global Palladium Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

5.3.1. Key Highlights

5.3.1.1. North America

5.3.1.2. Europe

5.3.1.3. Asia Pacific

5.3.1.4. Latin America

5.3.1.5. Middle East & Africa

6. North America Palladium Market Outlook, 2018 - 2030

6.1. North America Palladium Market Outlook, by Source, Value (US$ Bn), 2018 - 2030

6.1.1. Key Highlights

6.1.1.1. Primary

6.1.1.2. Secondary

6.2. North America Palladium Market Outlook, by Source, Value (US$ Bn), 2018 - 2030

6.2.1. Key Highlights

6.2.1.1. Automotive

6.2.1.2. Chemical and Petrochemical

6.2.1.3. Electrical & Electronics

6.2.1.4. Dental & Biomedical

6.2.1.5. Jewellery

6.2.1.6. Hydrogen/Pollution Control

6.2.1.7. Misc.

6.2.2. Market Attractiveness Analysis

6.3. North America Palladium Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

6.3.1. Key Highlights

6.3.1.1. U.S. Palladium Market by Source, Value (US$ Bn), 2018 - 2030

6.3.1.2. U.S. Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

6.3.1.3. Canada Palladium Market by Source, Value (US$ Bn), 2018 - 2030

6.3.1.4. Canada Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

6.3.2. BPS Analysis/Market Attractiveness Analysis

7. Europe Palladium Market Outlook, 2018 - 2030

7.1. Europe Palladium Market Outlook, by Source, Value (US$ Bn), 2018 - 2030

7.1.1. Key Highlights

7.1.1.1. Primary

7.1.1.2. Secondary

7.2. Europe Palladium Market Outlook, by Source, Value (US$ Bn), 2018 - 2030

7.2.1. Key Highlights

7.2.1.1. Automotive

7.2.1.2. Chemical and Petrochemical

7.2.1.3. Electrical & Electronics

7.2.1.4. Dental & Biomedical

7.2.1.5. Jewellery

7.2.1.6. Hydrogen/Pollution Control

7.2.1.7. Misc.

7.2.2. BPS Analysis/Market Attractiveness Analysis

7.3. Europe Palladium Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

7.3.1. Key Highlights

7.3.1.1. Germany Palladium Market by Source, Value (US$ Bn), 2018 - 2030

7.3.1.2. Germany Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

7.3.1.3. U.K. Palladium Market by Source, Value (US$ Bn), 2018 - 2030

7.3.1.4. U.K. Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

7.3.1.5. France Palladium Market by Source, Value (US$ Bn), 2018 - 2030

7.3.1.6. France Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

7.3.1.7. Italy Palladium Market by Source, Value (US$ Bn), 2018 - 2030

7.3.1.8. Italy Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

7.3.1.9. Turkey Palladium Market by Source, Value (US$ Bn), 2018 - 2030

7.3.1.10. Turkey Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

7.3.1.11. Russia Palladium Market by Source, Value (US$ Bn), 2018 - 2030

7.3.1.12. Russia Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

7.3.1.13. Rest of Europe Palladium Market by Source, Value (US$ Bn), 2018 - 2030

7.3.1.14. Rest of Europe Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

7.3.2. BPS Analysis/Market Attractiveness Analysis

8. Asia Pacific Palladium Market Outlook, 2018 - 2030

8.1. Asia Pacific Palladium Market Outlook, by Source, Value (US$ Bn), 2018 - 2030

8.1.1. Key Highlights

8.1.1.1. Primary

8.1.1.2. Secondary

8.2. Asia Pacific Palladium Market Outlook, by Source, Value (US$ Bn), 2018 - 2030

8.2.1. Key Highlights

8.2.1.1. Automotive

8.2.1.2. Chemical and Petrochemical

8.2.1.3. Electrical & Electronics

8.2.1.4. Dental & Biomedical

8.2.1.5. Jewellery

8.2.1.6. Hydrogen/Pollution Control

8.2.1.7. Misc.

8.2.2. BPS Analysis/Market Attractiveness Analysis

8.3. Asia Pacific Palladium Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

8.3.1. Key Highlights

8.3.1.1. China Palladium Market by Source, Value (US$ Bn), 2018 - 2030

8.3.1.2. China Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

8.3.1.3. Japan Palladium Market by Source, Value (US$ Bn), 2018 - 2030

8.3.1.4. Japan Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

8.3.1.5. South Korea Palladium Market by Source, Value (US$ Bn), 2018 - 2030

8.3.1.6. South Korea Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

8.3.1.7. India Palladium Market by Source, Value (US$ Bn), 2018 - 2030

8.3.1.8. India Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

8.3.1.9. Southeast Asia Palladium Market by Source, Value (US$ Bn), 2018 - 2030

8.3.1.10. Southeast Asia Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

8.3.1.11. Rest of Asia Pacific Palladium Market by Source, Value (US$ Bn), 2018 - 2030

8.3.1.12. Rest of Asia Pacific Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

8.3.2. BPS Analysis/Market Attractiveness Analysis

9. Latin America Palladium Market Outlook, 2018 - 2030

9.1. Latin America Palladium Market Outlook, by Source, Value (US$ Bn), 2018 - 2030

9.1.1. Key Highlights

9.1.1.1. Primary

9.1.1.2. Secondary

9.2. Latin America Palladium Market Outlook, by Source, Value (US$ Bn), 2018 - 2030

9.2.1. Key Highlights

9.2.1.1. Automotive

9.2.1.2. Chemical and Petrochemical

9.2.1.3. Electrical & Electronics

9.2.1.4. Dental & Biomedical

9.2.1.5. Jewellery

9.2.1.6. Hydrogen/Pollution Control

9.2.1.7. Misc.

9.2.2. BPS Analysis/Market Attractiveness Analysis

9.3. Latin America Palladium Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

9.3.1. Key Highlights

9.3.1.1. Brazil Palladium Market by Source, Value (US$ Bn), 2018 - 2030

9.3.1.2. Brazil Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

9.3.1.3. Mexico Palladium Market by Source, Value (US$ Bn), 2018 - 2030

9.3.1.4. Mexico Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

9.3.1.5. Argentina Palladium Market by Source, Value (US$ Bn), 2018 - 2030

9.3.1.6. Argentina Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

9.3.1.7. Rest of Latin America Palladium Market by Source, Value (US$ Bn), 2018 - 2030

9.3.1.8. Rest of Latin America Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

9.3.2. BPS Analysis/Market Attractiveness Analysis

10. Middle East & Africa Palladium Market Outlook, 2018 - 2030

10.1. Middle East & Africa Palladium Market Outlook, by Source, Value (US$ Bn), 2018 - 2030

10.1.1. Key Highlights

10.1.1.1. Primary

10.1.1.2. Secondary

10.2. Middle East & Africa Palladium Market Outlook, by Source, Value (US$ Bn), 2018 - 2030

10.2.1. Key Highlights

10.2.1.1. Automotive

10.2.1.2. Chemical and Petrochemical

10.2.1.3. Electrical & Electronics

10.2.1.4. Dental & Biomedical

10.2.1.5. Jewellery

10.2.1.6. Hydrogen/Pollution Control

10.2.1.7. Misc.

10.2.2. BPS Analysis/Market Attractiveness Analysis

10.3. Middle East & Africa Palladium Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

10.3.1. Key Highlights

10.3.1.1. GCC Palladium Market by Source, Value (US$ Bn), 2018 - 2030

10.3.1.2. GCC Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

10.3.1.3. South Africa Palladium Market by Source, Value (US$ Bn), 2018 - 2030

10.3.1.4. South Africa Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

10.3.1.5. Egypt Palladium Market by Source, Value (US$ Bn), 2018 - 2030

10.3.1.6. Egypt Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

10.3.1.7. Nigeria Palladium Market by Source, Value (US$ Bn), 2018 - 2030

10.3.1.8. Nigeria Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

10.3.1.9. Rest of Middle East & Africa Palladium Market by Source, Value (US$ Bn), 2018 - 2030

10.3.1.10. Rest of Middle East & Africa Palladium Market by End-use Industry, Value (US$ Bn), 2018 - 2030

10.3.2. BPS Analysis/Market Attractiveness Analysis

11. Competitive Landscape

11.1. Source vs Application Heatmap

11.2. Manufacturer vs Source Heatmap

11.3. Company Market Share Analysis, 2022

11.4. Competitive Dashboard

11.5. Company Profiles

11.5.1. Norilsk Nickel

11.5.1.1. Company Overview

11.5.1.2. Product Portfolio

11.5.1.3. Financial Overview

11.5.1.4. Business Strategies and Development

11.5.2. JSC Krastsvetmet

11.5.2.1. Company Overview

11.5.2.2. Product Portfolio

11.5.2.3. Financial Overview

11.5.2.4. Business Strategies and Development

11.5.3. Anglo American Platinum Limited

11.5.3.1. Company Overview

11.5.3.2. Product Portfolio

11.5.3.3. Financial Overview

11.5.3.4. Business Strategies and Development

11.5.4. Sibanye-Stillwater

11.5.4.1. Company Overview

11.5.4.2. Product Portfolio

11.5.4.3. Financial Overview

11.5.4.4. Business Strategies and Development

11.5.5. Impala Platinum Holdings Limited

11.5.5.1. Company Overview

11.5.5.2. Product Portfolio

11.5.5.3. Financial Overview

11.5.5.4. Business Strategies and Development

11.5.6. Glencore Plc

11.5.6.1. Company Overview

11.5.6.2. Product Portfolio

11.5.6.3. Financial Overview

11.5.6.4. Business Strategies and Development

11.5.7. Northam Holdings

11.5.7.1. Company Overview

11.5.7.2. Product Portfolio

11.5.7.3. Financial Overview

11.5.7.4. Business Strategies and Development

11.5.8. Vale S.A.

11.5.8.1. Company Overview

11.5.8.2. Product Portfolio

11.5.8.3. Business Strategies and Development

11.5.9. Sibanye-Stillwater

11.5.9.1. Company Overview

11.5.9.2. Product Portfolio

11.5.9.3. Financial Overview

11.5.9.4. Business Strategies and Development

11.5.10. Southern Palladium Limited

11.5.10.1. Company Overview

11.5.10.2. Product Portfolio

11.5.10.3. Financial Overview

11.5.10.4. Business Strategies and Development

11.5.11. African Rainbow Minerals

11.5.11.1. Company Overview

11.5.11.2. Product Portfolio

11.5.11.3. Financial Overview

11.5.11.4. Business Strategies and Development

11.5.12. Galileo Mining Ltd.

11.5.12.1. Company Overview

11.5.12.2. Product Portfolio

11.5.12.3. Financial Overview

11.5.12.4. Business Strategies and Development

11.5.13. Palladium Recycling

11.5.13.1. Company Overview

11.5.13.2. Product Portfolio

11.5.13.3. Financial Overview

11.5.13.4. Business Strategies and Development

11.5.14. Umicore

11.5.14.1. Company Overview

11.5.14.2. Product Portfolio

11.5.14.3. Financial Overview

11.5.14.4. Business Strategies and Development

11.5.15. Heraeus Group

11.5.15.1. Company Overview

11.5.15.2. Product Portfolio

11.5.15.3. Financial Overview

11.5.15.4. Business Strategies and Development

12. Appendix

12.1. Research Methodology

12.2. Report Assumptions

12.3. Acronyms and Abbreviations

|

BASE YEAR |

HISTORICAL DATA |

FORECAST PERIOD |

UNITS |

|||

|

2022 |

|

2018 - 2022 |

2023 - 2030 |

Value: US$ Million |

||

|

REPORT FEATURES |

DETAILS |

|

Source Coverage |

|

|

End-use Industry Coverage |

|

|

Geographical Coverage |

|

|

Leading Companies |

|

|

Report Highlights |

Key Market Indicators, Macro-micro economic impact analysis, Technological Roadmap, Key Trends, Driver, Restraints, and Future Opportunities & Revenue Pockets, Porter’s 5 Forces Analysis, Historical Trend (2019-2021), Market Estimates and Forecast, Market Dynamics, Industry Trends, Competition Landscape, Category, Region, Country-wise Trends & Analysis, COVID-19 Impact Analysis (Demand and Supply Chain) |